Private equity and smaller companies are two areas of the closed-ended universe that offer some of the highest growth potential to investors willing to commit their money for the long term.

If you are torn between the two, you may wish to consider Gresham House Strategic, which combines both these strategies in a single trust.

Manager Richard Staveley runs a concentrated portfolio of about 25 positions and takes a hands-on approach to their development. Unlike a typical private equity vehicle, the trust will not own its underlying holdings outright, but instead will take a position sufficient enough to offer influence over issues such as the appointment of board members. This will allow Staveley to suggest those he knows and trusts.

Similarly, he will develop long-term incentive plans for senior managers to ensure their interests are closely aligned with those of shareholders. Such actions are usually carried out in a ‘non-aggressive manner’, working with the current management rather than against it.

At the same time, however, Staveley noted that if things don’t work out, “we talk to other shareholders quite quickly and recommend a way of taking things forward – and they have to listen”.

The manager said two types of private equity are dominant at the moment, with his strategy sitting somewhere in between.

“You have the guys that want to identify unicorns pre-market and then either list them or sell them to another unicorn when they are a bit bigger,” he explained. “And then you have the more traditional private equity guys that look for highly cash-generative businesses in industries that can be consolidated as they are too fragmented.

“We identify companies that private equity or maybe private equity-minded trade buyers may look at and want to acquire.

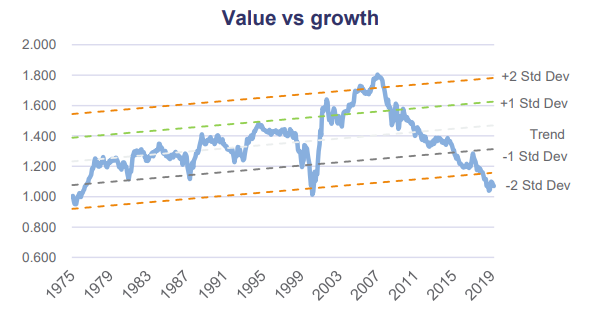

Staveley added: “We have an out-and-out value approach which, you'll be aware from all the coverage of late, has not been in favour.

Source: Gresham House

“But interestingly, that hasn't affected our ability to generate strong returns over the last few years.”

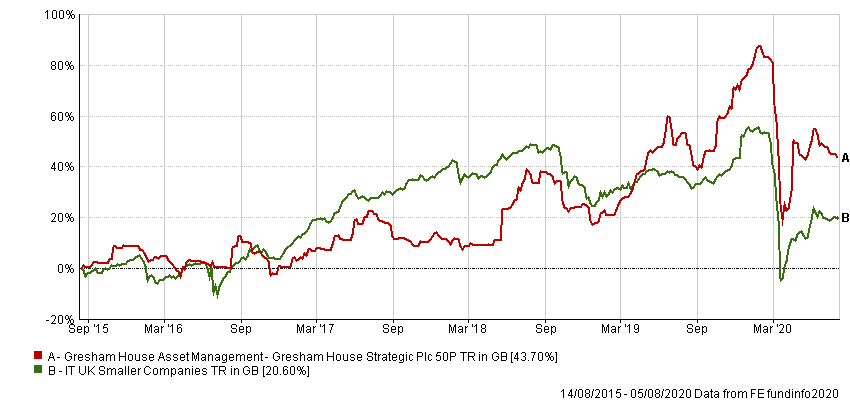

The statistics back this up – data from FE Analytics shows that Gresham House Strategic has made 43.7 per cent since the current management team took charge in August 2015, compared with 20.6 per cent from the IT UK Smaller Companies sector.

Performance of trust vs sector under current management team

Source: FE Analytics

Staveley does not believe it is value investing that is the problem as such, but more the short-cuts relied upon by investors who claim to use this approach.

“We are very focused on free cash-flow generation as the basis for valuation, not book value which is a measure that I think is starting to lose its power,” he said.

“When people look at value versus growth, a lot of the time that is what they're comparing. We focus on businesses whose existing cash flows are undervalued or whose future cash flows and potential for growth-led cash flows are undervalued.

“Private equity likes that because it can stack cash flow to support a big debt load. But one of the areas that we don't support is leveraging up companies. Our portfolio is very underleveraged and a number of our companies have net cash.”

In order to select appropriate board members, Gresham House has a specific advisory group made up of high-profile names such as Lloyd's of London chairman Bruce Carnegie-Brown and former Centrica chief executive Sir Roy Gardner.

It also employs a former private equity recruitment consultant as a ‘head of talent’. As well as headhunting directors and managers for portfolio holdings, she will also carry out due diligence on employees of existing holdings to ensure their claims stack up.

Staveley said this proved useful after he bought a stake in infrastructure group Infrastrata.

“Infrastrata just bought out of receivership the famous Harland & Wolff Shipyard dockyard in Belfast where the Titanic was built,” he continued. “It bought it for almost nothing and is restarting it and trying to make it a good business again.

“The CEO said he did the same thing for dockyards when he worked in Australia, so we managed to track down the government official that he had a joint venture with on the west coast to get a reference about whether what this guy was saying was true or not.

“What's interesting is that it's one of the largest dry docks in Europe. The previous owners had a pure oil & gas focus and that didn't work out for them. The new CEO of Infrastrata is widening this out to defence, where the government is looking for more competition in the UK versus BAE and Babcock.

“And also the cruise market, which although is not having its best year ever, there is a significant amount of ongoing work required to keep these liners fit for purpose. We're hoping that this strategy for attacking a number of markets at the same time will create a better, more balanced business.”

While the trust’s performance has been strong under the current management team, most small-cap enthusiasts will tell you a standard strategy in this area of the market tends to deliver decent returns over the long term – especially from a starting point of lowly valuations, such as the ones we are seeing at the moment. So why would you take a dramatically different approach such as the one Staveley is advocating?

The manager said that first, most managers in this area of the market are over-indexed to growth, meaning his approach offers some diversification.

Second, he warned that many of the best-performing small-cap funds are now becoming victims of their own success.

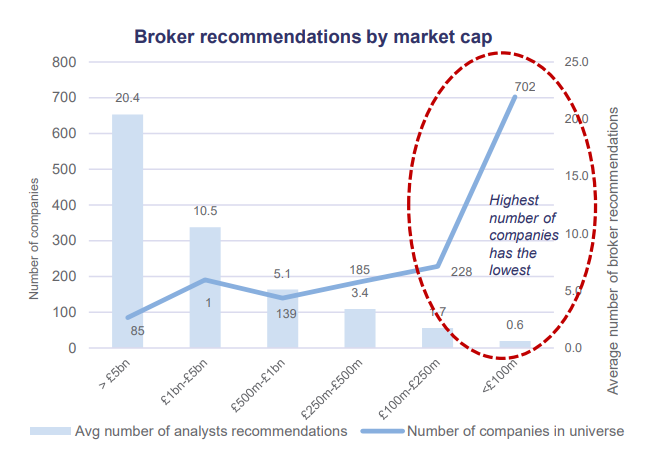

“There are more anomalies than in large-caps because there are fewer eyeballs looking at these small caps,” he explained.

Source: Gresham House

“But during my career, over the last 15 to 20 years, there has been a change in terms of the normal small-cap funds typically moving up the size band.

“This is partly due to the concentration of AUM [assets under management] in a number of fund management houses that have well-invested small-cap teams and is partly a result of the desire for liquidity and the fact All Share managers on the whole have been much higher up the market cap.

“So now there is the sub-£200m space where typically one broker or a maximum of two actually do any work on the company.

“And one of them will be paid by the company to do that,” he finished.

Gresham House Strategic is on a discount of 17.58 per cent compared with 11.73 and 19.5 per cent from its one- and three-year averages.

It has high ongoing charges of 2.94 per cent, according to the AIC, including a performance fee of 1.45 per cent if it returns more than 7 per cent a year. It is not currently geared.