The number of underperforming funds in Bestinvest’s semi-annual ‘Spot the Dog’ report hit a record high in the last six months, with assets worth more than £54bn now held in so-called ‘dog funds’.

This rise in underperforming funds follows a more challenging period for markets after the onset of the Covid-19 pandemic earlier this year, with Bestinvest managing director Jason Hollands (pictured) describing it as a “rollercoaster ride” for investors.

“The relative winners have been areas like technology, online stocks and consumer staples companies, but at the other end of the spectrum major sectors like energy and financials have been hit really hard,” he said.

“This has resulted in very wide disparities in performance between fund managers, depending on where their funds were positioned.”

The closely watched report analyses the performance of open-ended funds, applying two filters to identify dog funds.

The first looks for funds that have failed to beat a representative benchmark over three consecutive 12-month periods to highlight consistent underperformance, while the second filters out those that have underperformed the benchmark by 5 per cent or more over the entire three-year period.

The report found 150 dog funds in the period to 30 June, a 65 per cent increase on the 91 dog funds for the three-year period to 31 December 2019.

In addition, the level of asset rose from £43.9bn to £54.4bn, although the higher number of funds means there were more smaller funds this time around with the median fund size set at £133m.

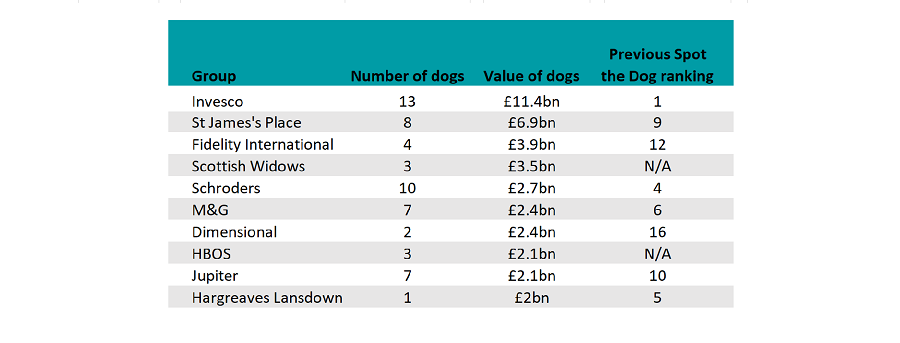

On a group level, the worst offender was Invesco with 13 dog funds with total assets of around £11.4bn, 21 per cent of the total. In second place was St James’s Place with eight dog funds totalling £6.9bn.

Source: Bestinvest

While large fund groups are more likely to have one or two dog funds in their stable, Bestinvest noted that there were several firms that had none at all, including Aviva Investors, Baillie Gifford, BlackRock, Evenlode, Fundsmith, JO Hambro Capital Management, Lindsell Train and Stewart Investors.

The sector with the most dog funds was UK equity income, where 26 per cent were found to underperform, closely followed by global equity income (25 per cent), which Bestinvest said likely reflected dividend cuts and the strong performance of growth stocks.

Of the 86 funds in the in UK equity income sector, 22 funds were judged to be dogs by Bestinvest for underperforming the FTSE All Share, representing £10.2bn in assets.

The worst performer was LF ASI Income Focus, formerly run by Neil Woodford but now overseen by Aberdeen Standard Investments, which was down by 45.48 per cent over three years, compared with a loss of 4.6 per cent for the index.

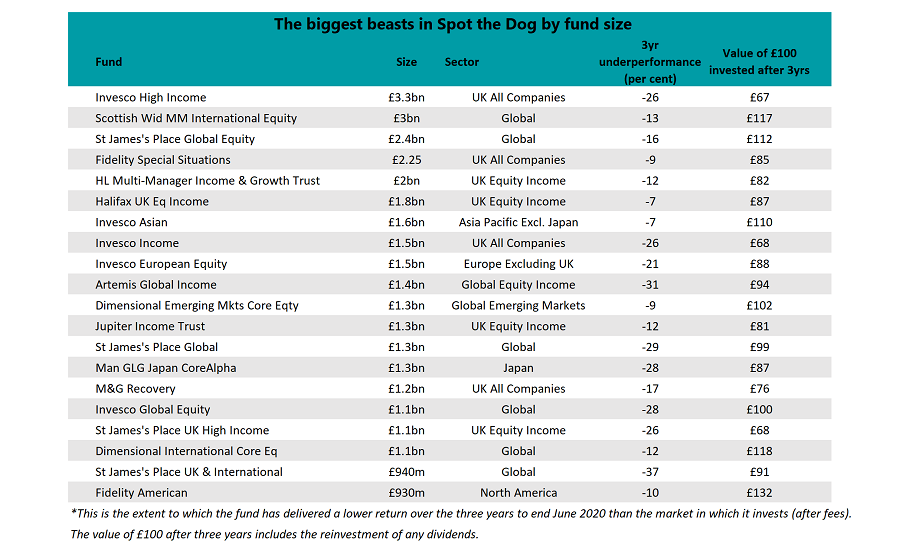

Source: Bestinvest

Some 10 funds from the global equity income sector (totalling £3.3bn) were found to be dogs in the latest Bestinvest report, led by the Legg Mason IF Clearbridge Global Equity Income, with a loss of 12.29 per cent over the three year period compared with a 25.69 per cent gain for the MSCI AC World index.

Bestinvest also found that the number of UK all companies dogs had increased dramatically from 16 at the turn of the year to 29 in June, although this did include a number of smaller strategies.

“The worst performer is the L&G UK Alpha Trust which, despite the ‘macho’ name, has delivered a somewhat Z-grade performance with a portfolio packed full of small companies,” noted Bestinvest.

However, there were a number of large funds included among the underperformers that investors may be more familiar with, such as two multi-billion pound offerings from Invesco – Invesco UK Equity Income and Invesco UK Equity High Income, previously managed by Mark Barnett before his departure earlier this year.

High-profile value strategies such as Alex Wright's £2.2bn Fidelity Special Situations fund,Tom Dobell's £1.2bn M&G Recovery fund and the £443.7m Ninety One UK Special Situations fund also underperformed unsurprisingly as markets continued to favour high-growth companies.

There were no UK smaller companies dog funds in this edition.

In North America – a notoriously difficult region to outperform in given the coverage and efficiency of the market – there were 16 dogs, two fewer than the previous report. These were largely dominated by value or income strategies and less exposed to the high-growth technology companies which have led markets higher.

There were 37 dogs found in the global sector representing 22 per cent of the total and £15.2bn in assets, but again these were made up of value strategies.

Elsewhere, there were fewer European dog funds this time around down to 13 from 16 and just two European smaller companies strategies making the list.

The number of Japanese dog funds doubled from four to eight, which manage a total of £2.7bn. Eight Asia-Pacific dog funds making this year’s list account for £2.3bn of the sector, although the £1.5bn Invesco Asian fund represented a significant share of these assets.

Meanwhile, there were just five dog funds found in the global emerging market equities sector, running some £2.1bn of investor money. However, the largest of these was the £1.3bn Dimensional Emerging Markets Core Equity fund

Source: Bestinvest

“The underperformance of value-focused funds compared to those targeting ‘growth’ and ‘quality’ stocks is a trend that has been playing out for some time now but during 2020 the gap in fortunes between such funds has become quite extreme,” he said.

“No investment trend lasts forever and it just might be the case that as the post-lockdown economic recovery phase gathers pace, we will start to see a turn in fortunes for those parts of the market that have been out-of-favour and the managers who in turn back unloved companies.”

With any dog fund, Hollands said investors should consider whether to stick with them or to move their money elsewhere - but not before finding out why they have underperformed.

“In some cases it may make sense to persevere and stay put, if you believe that the factors that have driven the period of underperformance are temporary and will soon lift,” he concluded. “However, where there is no turnaround is in sight it might be better to move elsewhere.”

For a copy of the report visit http://www.bestinvest.co.uk/spot-the-dog.