Japan needs to undergo a productivity revolution in order to address the legacy systems that are creating a “digital cliff”, according to Joe Bauernfreund, manager of the AVI Japan Opportunity Trust.

“It’s a remarkable situation they have in Japan,” he said. “When it comes to robotics, they are one of the most technologically advanced economies in the world.

“However, when you look at their offices and factories, they are very third world.”

Government departments and businesses still rely on fax machines, which was heavily relied on for reporting Covid-19 statistics in Japan.

This was compounded by the fact businesses were unable to adopt substantial work from home measures as there wasn’t the infrastructure to facilitate it.

Previous governments have warned the country could fall off a digital cliff by 2025, but with shifting corporate culture, changing demographics and a new prime minister, these issues could start to be addressed.

Cash on Japanese balance sheets 2012-19

Source: Bloomberg

The psychological scars of the asset price bubble bursting in the early 1990s has created and will continue to sustain a culture of holding cash and maintaining strong balance sheets.

“The mantra in 1990 was we must have cash for a rainy day,” he said. “So, the whole generation grew up at that corporate level without ever questioning that we must have more cash.”

The safety net of cash means that capital isn’t allocated toward newer digital capabilities.

“The reality of the demographics in Japan mean there aren’t enough people to find jobs for,” said the portfolio manager. “So, they do need to invest in technological enhancement so they can find enough people to do the jobs that are required.

“However, it’s a society that prides itself on keeping people employed and not making people redundant or replaced by computers.”

The issue also lies in the fact that businesses with older executives have not embraced digital transformation, which is perpetuated by a unique culture of advancement that makes it difficult to challenge superiors.

“The culture of Japan means you advance up the career ladder, not based on meritocracy, but based on hierarchy and seniority,” the trust manager explained.

“If you wanted to progress and follow your boss up the ladder, you kept your head down and became a ‘yes’ person. You didn’t question your superiors and you did as you were told.”

Maintaining cash and a failure to replace outdated technologies has therefore been an ethos left largely unchallenged.

The AVI Japan Opportunity Trust manager said: “If shareholders ask for cash you tell them it’s not there and is needed by the company.”

This level of corporate reform will understandably take time as it attempts to change decades of entrenched psychological behaviour.

However, as those demographics change and a new generation begins to take more prominent roles in Japanese business, the culture could start to change.

“The younger generation are more worldly and global,” he explained. “They know that these corporate governance issues are relevant and focusing on shareholders is important.

“It’ll take time for the old guard to go, but slowly but surely there are more independent directors and the challenging of ideas which is filtering down into companies.”

With a new government in place under Yoshihide Suga, Bauernfreund believes that investors will be encouraged by the political and economic stability his appointment offers.

“The fall in markets following the resignation announcement showed that the market doesn’t like that level of uncertainty” he added.

The news that Warren Buffett has also invested in Japanese equities has also fostered greater interest.

“The world-renowned value investor has found value in Japan,” he said. “We’ve subsequently seen interest and the foreign flows have improved towards the Japanese stock market.

“These flows have been negative for years, despite some short-lived periods where those flows have turned positive.

“It’s the valuations where (Japan) stands out,” he added. “They have rock solid balance sheets, haven’t had to raise emergency finance or raise cash from shareholders and there has been very little furloughing of staff – it’s a pretty strong position to be in.”

The manager outlined that the outlook for the fund is extremely optimistic. “Covid and lockdown has had an impact on short-term earnings and sentiment toward shareholder activism.

“Nothing has been derailed but delayed a little bit,” he said. “Our companies continue to generate cash flow and build up their strong balance sheets and are open minded on shareholder improvement.

“The valuation of our portfolio remains remarkably low, and as we see more economic activity within the sector and that’s then reflected in earnings, I think there’s the potential for a tremendous amount of upside.”

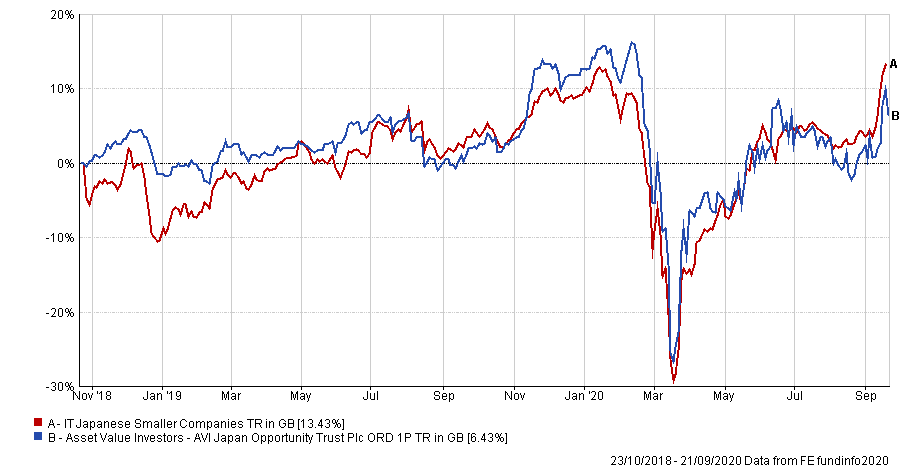

Performance of trust vs sector over 3yrs

Source: FE Analytics

Over three years, the AVI Japan Opportunity Trust has made a total return of 6.43 per cent against a 13.34 per cent gain for the average IT Japanese Smaller Companies peer.

The £124.5m trust is 9 per cent geared and is trading at a 4.4 per cent discount to net asset value (NAV). The management fee is 1 per cent of the trust’s market cap or NAV, whichever is lower.