Fund pickers appear to be split on whether investors should stick with M&G Optimal Income because of the long-term credentials of manager Richard Woolnough, or whether they should be looking for other strategic bond strategies.

M&G Optimal Income fund was previously a titanic-sized fund, climbing to just under £30bn at one point and being the largest fund in the Investment Association universe. Today, however, the UK-domiciled fund stands at just £2.2bn.

M&G did split a large portion of the fund into a Luxembourg-domiciled Sicav, as part of plans to serve European investors after the UK left the EU. There’s around €14.2bn (£12bn) in this Sicav today. However, the UK-domiciled fund has still endured months of consistent outflows; in the past 12 months alone, it has had outflows of £1.5bn.

This has been coupled with recent underperformance. Over the past five years the fund has underperformed the IA Sterling Strategic bond sector, with a total return of 29.91 per cent versus the sector’s 30.45 per cent.

Performance of fund vs sector and index over 5yrs

Source: FE Analytics

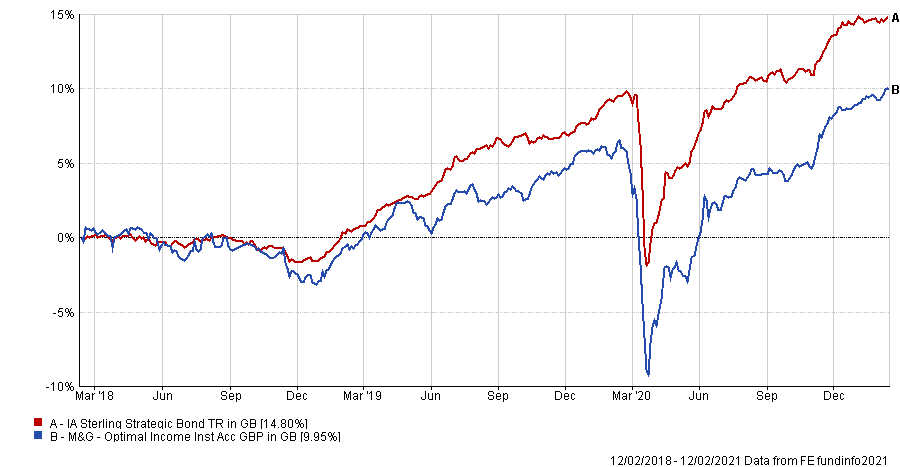

Over three years the fund’s performance has dipped even lower to fourth quartile, making 9.95 per cent compared with the sector’s 14.80 per cent.

Performance of fund vs sector and index over 3yrs

Source: FE Analytics

As investors appear to be voting with their feet combined with the recent performance, Interactive Investor fund analyst Teodor Dilov thinks it might be time for investors to consider other options.

“M&G Optimal Income has attracted a lot of attention recently, mainly due to large outflows and poor performance,” he said.

“Despite its flexibility in terms of both bond issues and ability to invest up to a fifth of the portfolio in equities, along with actively managed duration, the fund failed to achieve its target and underperformed the IA Sterling Strategic Bond sector average over the short and long term.

“In addition, risk-adjusted figures also look average and therefore, investors might want to explore other opportunities in this area.”

But other fund pickers see reasons for sticking with the fund.

Ben Yearsley, co-founder and director of Fairview Investing, defended holding M&G Optimal Income, arguing that investors often make the mistake of allowing a poorer short-term performance to eclipse the long-term outperformance of a manager.

“Richard Woolnough is one of the best bond managers managing money today and it always surprises me when investors question the credentials of longstanding managers who have a short-term period of underperforming,” Yearsley said.

Indeed, looking at the fund’s performance under FE fundinfo Alpha Manager Richard Woolnough shows it has made a total return of 141.81 per cent compared to 82.67 per cent from the average IA Sterling Strategic Bond member.

Performance of fund under manager Richard Woolnough’s tenure

Source: FE Analytics

Yearsley added that Woolnough had proved himself as a manager who can not only navigate a crisis but often make his funds thrive during and afterwards.

“Interestingly the underperformance came in the two-year period leading up to the pandemic and since the market bottom he has outperformed the strategic bond sector,” he said. “He also outperformed convincingly during the global financial crisis: times of stress clearly bring out the best in Richard.

“One of my criticisms of M&G over recent years has been their slowness to respond to changing times as many newer entrants had launched much cheaper alternatives. Thankfully they recently announced reductions in annual charges including to this fund.”

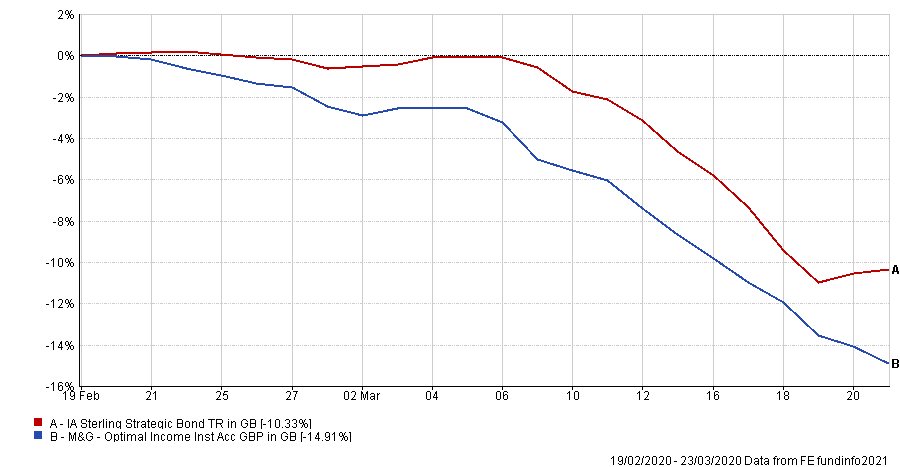

Looking closer at how M&G Optimal Income performed during the coronavirus crisis shows the fund did fall further than the wider sector during the initial sell-off.

Performance of fund vs sector 19 February 2020 to 23 March 2020

Source: FE Analytics

But this was because the fund was underweight duration, which AJ Bell analyst Laith Khalaf said hurt the fund when central banks unleashed their coronavirus support stimulus.

But despite this, Khalaf also thinks that the fund can still bring value to portfolios, particularly in today’s record low interest rate environment.

He said: “Given where interest rates sit, it’s hard to be particularly enamoured with the prospects for bond returns. But if you are invested in this area, Richard Woolnough is a safe pair of hands.

“The fund fell significantly behind its peers in 2020 because it is underweight duration and, as the pandemic hit and central banks responded with even looser monetary policy, longer duration strategies prospered.

“In a topsy turvy monetary world, where central banks in Europe and Japan have entered into the realm of negative nominal interest rates, timing the inevitable reversal of declining yields is fraught with the risk of underperformance, and Woolnough has definitely gone early.

“However the central view that there is little upside left in taking interest rate risk, and plenty of downside, still holds true, and in fact has become more potent as the pandemic has pushed yields lower and central banks are now nearer the zero lower bound.”

He added that while being underweight duration may have hurt the fund during the 2020 crisis it could benefit the fund as the world and global markets move into a recovery.

Khalaf said: “If we do get a recovering global economy this year, and possibly even rising inflation, markets will start to consider when monetary policy will tighten and in that scenario being underweight duration would boost the performance of M&G Optimal Income.”