Schroders’ Jonathan Golan will join Man GLG as a portfolio manager in the credit team, with a new fund planned for the manager in the future.

Golan has almost a decade of experience investing in fixed income and will initially be responsible for managing a corporate bond strategy, as well as a new dynamic bond strategy.

At Schroders, he was the lead manager of the Schroder Sterling Corporate Bond and Schroder Strategic Bond funds. Over one, three and five years, both funds are in the top quartile of their respective sectors.

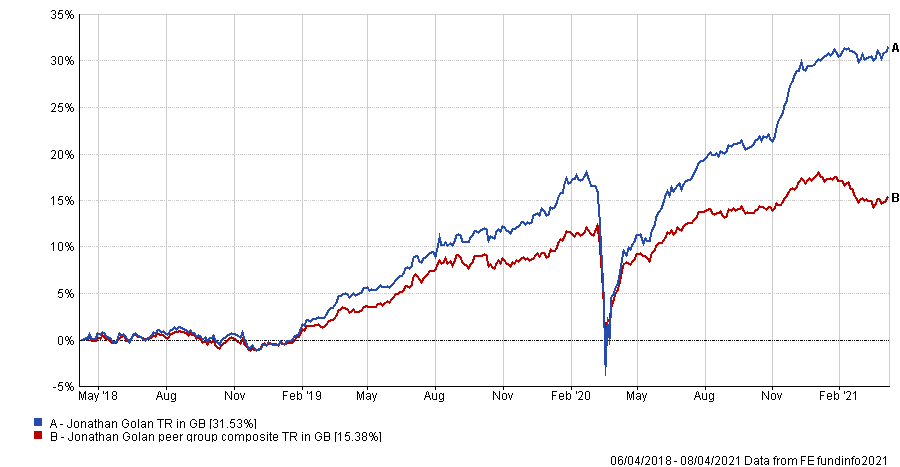

Performance of Golan vs peer group composite over 3yrs

Source: FE Analytics

“I look forward to joining Man GLG to build a series of corporate bond focused strategies, as well as the new dynamic bond strategy,” said Golan.

“My focus will continue to be on rigorous research and bottom-up security selection with the aim of achieving industry leading returns.”

Teun Johnston, chief executive of Man GLG, said: “Jonathan has an established track record of delivering award-winning and top performing sterling bond and income-orientated strategies, which we believe will be well-suited to the needs of our clients in the continued low interest rate environment.

“Expanding our credit team, both in terms of talent and our range of strategies for clients, has been the focus for Man GLG for some time now, and we believe Jonathan will make a fantastic addition – we are delighted to have him join us.”