The rise of artificial intelligence, augmented reality and 5G connectivity are all going to play in favour of semiconductor firm Nvidia, according to Stephen Yiu, who has just added the stock to his LF Blue Whale Growth fund.

Despite being on his radar for some time, Yiu finally pulled the trigger and began building a position in Nvidia in June this year. It now forms part of the fund’s top 10 holdings – which account for more than half of the £1bn portfolio.

Explaining the investment rationale, Yiu said: “We believe Nvidia’s opportunity lies at the confluence of three major secular trends over the next decade – artificial intelligence, augmented reality and 5G – all three of which drive increasingly higher demands on processing power, something Nvidia is well-positioned to supply.

“Five years ago, all of these applications could have been a fantasy - but in the next five years I think you will see some of this materialising in quite major ways, and I think Nvidia will be able to benefit from it dramatically.”

Nvidia is trading on a price-to-earnings ratio of over 95, a multiple which makes it one of the most richly valued stocks in the Blue Whale Growth’s top 10.

Yiu – who prides himself in taking a strict and active approach to valuations – argued that the company is fairly priced despite the high multiple.

Nvidia’s earnings growth trajectory over the next three to five years is more than sustainable to justify the price, in his view.

“You can have Nvidia trading at the same multiple as what it is trading at now but it's free cash flow is going at over 20% plus year on year,” he said. “So it could easily just maintain the same multiple - but it would still be doing better than the market.”

Share price of Nvidia over 5yrs

Source: Google Finance

Although some of the markets that Nvidia is predicted to benefit from in the coming decade may have seemed like a fantasy five years ago, there is growing evidence that some of the markets are rapidly materialising, according to Yiu.

“There’s a lot of high-performance cloud data centres that at the moment that are powered by CPUs [central processing units],” he said.

“But I think what had become quite clear now is there's certain functions that a GPU [graphics processing unit] would perform better, in terms of productivity and in terms of optimization.”

“That's why I think historically it has been using gaming because it's better for graphics, it's better for simulation, it's better for 3D modelling, real time performance - it's not just processing something like an Excel spreadsheet.”

In the past, Nvidia’s GPUs were mostly just coveted by gamers to run graphics-heavy computer games - but Yiu pointed out that the chips have now become “the gold standard” for running apps and processes in the cloud by major cloud service providers like Amazon Web Services, Google Cloud Platform and Microsoft Azure.

One potential concern some investors may have with the new addition is the risks posed by the cyclicality of the semiconductor industry.

Due to the short lifespan of semiconductor items which often become obsolete quickly when new, faster applications are made, when demand is high, there is often short supply for the products – as evidenced most recently by the most recent semiconductor shortage caused by the coronavirus supply shock.

Conversely, when supply exceeds demand, there can be large downswings in the market – as was the case in 2017 when demand for Nvidia’s GPU’s fell off a cliff as cryptocurrency miners stopped buying them after Bitcoin’s price collapsed.

Yiu, however, is not too concerned with the cyclicality of Nvidia’s business.

He said: “For the industry that would still be some elements of cyclicality, but as far as Nvidia is concerned, they are the designer of a chip so we can think of Nvidia being a software company, or maybe that architect of that company.”

He highlighted that Nvidia does not manufacture chips – Taiwan Semiconductor Manufacturing Company (TSMC) does most manufacturing, and therefore bears much of the capital expenditure costs and cyclical risks associated with it.

When it comes to Nvidia, Yiu (pictured) said: “It is all about the IP [intellectual property], the design, how robust it is, how other OEMs [original equipment manufacturers] are going to utilise the design from Nvidia to put it into a chip which then is manufactured by TSMC. If there's any cyclicality is going to sit at the other end of the industry.”

Another concern investors may have is surrounding Nvidia’s $40bn bid to buy UK-founded semiconductor business Arm from Japan’s SoftBank.

UK regulators are considering rejecting Nvidia’s bid to block the merger on the grounds of national security, given the strategic importance of the semiconductor industry.

But Yiu isn’t too worried because he believes the potential merger is not yet reflected in the share price, which currently values Nvidia at a $505bn market capitalisation.

He said: “They [Arm] do have some low power chips which could be used hand-in-hand with the with other parts of other products that Nvidia have, which if it happens that could be quite beneficial.”

Indeed, Arm chief executive officer Simon Segars is in favour of the deal, arguing that the merger with Nvidia is a better outcome than an IPO because the level of investment needed to lead in artificial intelligence.

Yiu – who is in favour of the acquisition - thinks the probability of the deal going through is about two-thirds in favour of it going through, and one-third of it getting blocked, most likely by China.

“China may use this as in a way to voice their opinion that they're not happy with the Western world blocking them,” he said.

Last year the UK government banned the purchase of new Huawei 5G products and pledged to strip its technology from the country’s network on the grounds of national security.

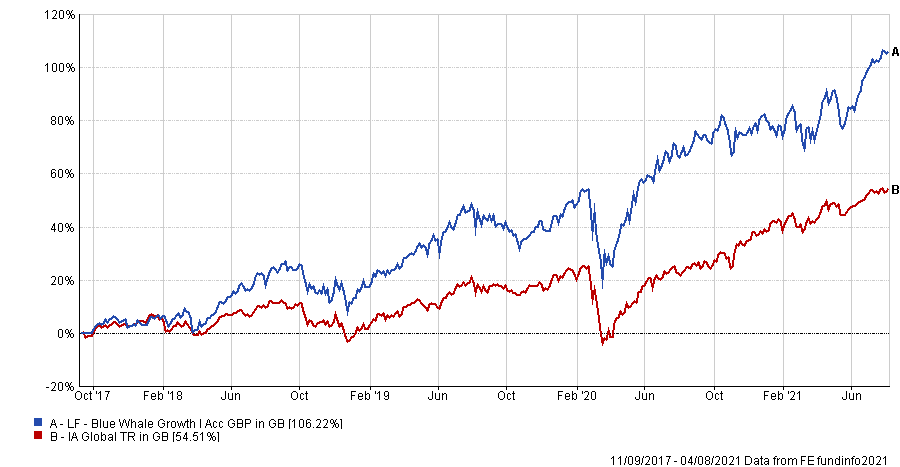

Performance of fund since launch

Source: FE Analytics

Since launch, LF Blue Whale Growth has delivered a 106.2% return, compared with 54.5 % from the average fund in the IA Global sector.

It has an ongoing charges figure (OCF) of 1.14 per cent.