Few managers have been able to beat their peers over both 10 years and one year as markets have shifted dramatically in 2022.

Over most of the past decade, the low-growth, low interest rate environment meant equity investors were willing to pay up for fast-growing companies. Meanwhile, bond investors were forced into low-risk equities (sometimes called bond-proxies), boosting quality-growth portfolios.

This year, however, there has been a stark reversal. Interest rates are rising and inflation is rampant, all while economic growth remains stagnant. Oil, mining and financials – all considered ‘value’ stocks – have risen to the top of the leader board.

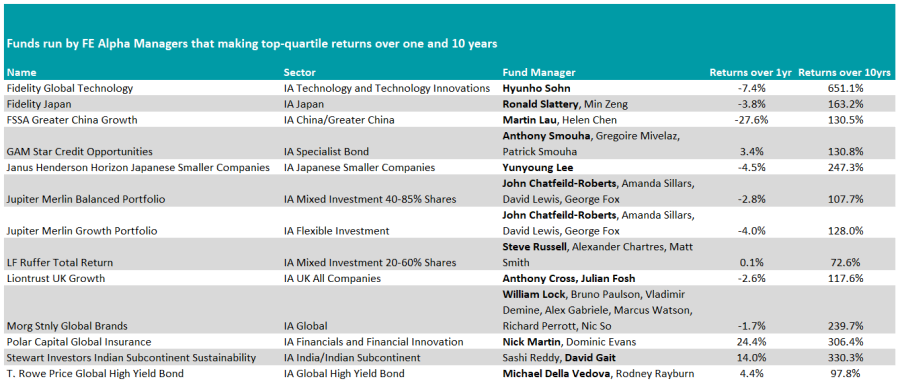

Yet there are some FE fundinfo Alpha Managers – a rating is given to those who have consistently beaten the benchmark index over time – who have performed in both conditions, as the below table shows. Where there are multiple managers running a fund, those with the Alpha rating have been put in bold.

Source: FE Analytics

There are no two funds from the same sector, but there are patterns within the data. For example, capital preservation has been key, with the likes of LF Ruffer Total Return topping in the IA Mixed Investment 20-60% Shares sector over both periods.

The managers take on specific risk but are also keen to divest and move into cash and other traditional havens where appropriate.

Jupiter’s Merlin team have two funds on the list meanwhile, with its Balanced Portfolio and Growth Portfolio in the first quartile of the IA Mixed Investment 40-85% Shares and IA Flexible Investment respectively.

Last year, co-manager David Lewis said the Merlin team aims to pick the right fund managers who “have the ability to defend on the downside and maximise returns given the risk taken in the portfolio”.

The fund-of-funds portfolio diversifies risk and has the option to invest in alternative assets, including investing in gold, cash and bonds, which has helped in 2022.

Turning to funds that invest in equities only, Liontrust UK Growth has been at the top of the IA UK All Companies sector over both timeframes.

The fund invests in companies with a “durable competitive advantage” that can “defy industry competition”.

Over the past decade it has done well from consumer staples and other quality-growth names, while in 2022 it has built up a position in energy, with Shell the largest holding at present.

Elsewhere, Morgan Stanley Global Brands achieved the feat of top-quartile performance over one and 10 years in the IA Global sector. Although it does invest in a range of sectors, the fund is primarily focused on companies that have “dominant market positions”, which leads it to stocks that have well-established brands such as tech firm Microsoft, cigarette maker Philip Morris International and hygiene and health specialist Reckitt Benckiser.

For investors looking to take country-specific risks, FSSA Greater China Growth has been at the top of the IA China/Greater China sector over both the short and long term, while Stewart Investors Indian Subcontinent Sustainability achieved the same among its IA India/Indian Subcontinent peers.

Fidelity Japan led the way in the IA Japan sector, while Janus Henderson Horizon Japanese Smaller Companies came out on top in the IA Japanese Smaller Companies peer group.

FE fundinfo Alpha Managers who run thematic funds also did well with the Fidelity Global Technology and Polar Capital Global Insurance making top-quartile returns over one and 10 years in the IA Technology and Technology Innovations and IA Financials and Financial Innovation sectors respectively.

The latter was the best performer among the group, returning 24.4% this year, while the former has been the best performer over the past decade, more than doubling the returns of anything other fund on the list.

Finally, turning to bonds, investors looking for a fixed income mandate with a wide remit may wish to consider GAM Star Credit Opportunities after it beat its peers in the IA Specialist Bond over both the long and short term.

The only other fund to achieve this feat was T. Rowe Price Global High Yield Bond, which topped the IA Global High Yield Bond sector over both 10 and one-year timeframes.