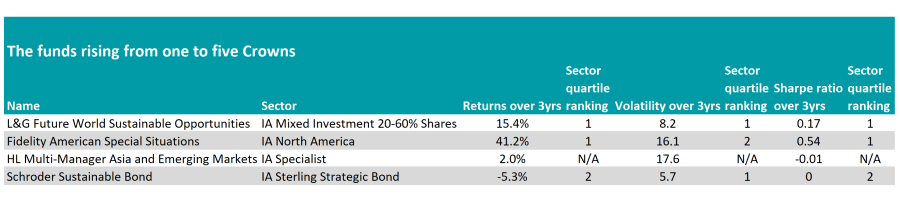

Funds run by Hargreaves Lansdown, Fidelity and Schroders were among those to rocket up the FE fundinfo Crown rating ladder, according to the latest rebalance.

Overall, five funds that had previously held a one-crown rating now hold the maximum of five. The biggest riser is the £808m Fidelity American Special Situations fund run by FE fundinfo Alpha Manager Rosanna Burcheri with Ashish Bhardwaj as deputy.

Over the past three years the fund has made a 41.2% gain, a top-quartile effort in the IA North America sector. It achieved this with top-quartile volatility of 17.5% and a better score for risk-adjusted returns than the majority of its peers (as measured by the Sharpe ratio).

Source: FE Analytics

L&G Future World Sustainable Opportunities from the IA Mixed Investment 20-60% Shares sector also made the list, after making the top quartile for returns, volatility and Sharpe ratio among its peers over three years.

Elsewhere, HL Multi-Manager Asia and Emerging Markets in the IA Specialist sector and Schroder Sustainable Bond in the IA Sterling Strategic Bond sector also made the list.

Overall, there were 351 five-crown rated funds, with the IA Sterling Strategic Bond and IA Infrastructure sectors housing the most relative stand-outs.

Six of the 21 infrastructure funds had five crowns, while there were 21 strategic bond portfolios with the rating, out of a possible 77.

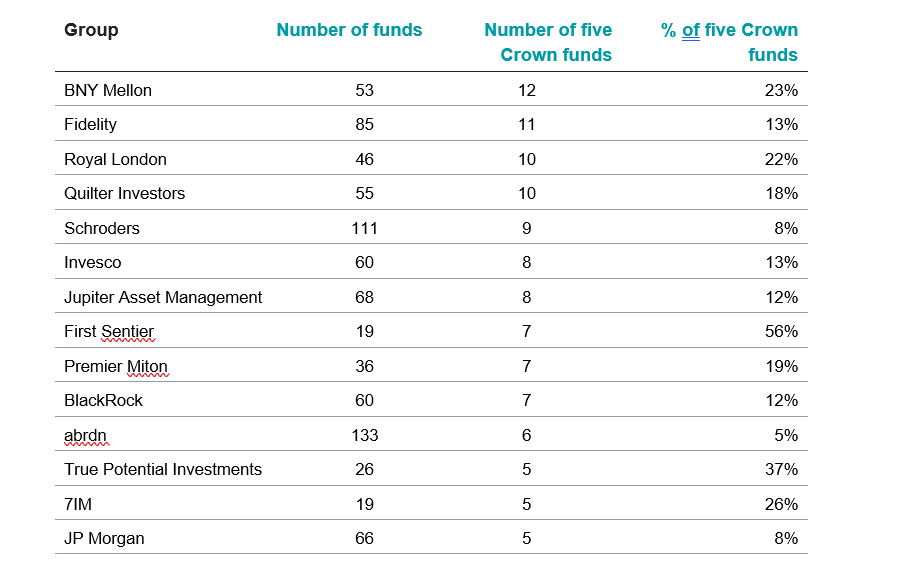

The fund groups with more than five top-rated funds

Source: FE fundinfo

In terms of fund groups, BNY Mellon had the most five-crown rated funds with 12, with the full list of asset managers with five or more listed above. Among these, First Sentier had the highest proportion, with 56% of its funds making the list.

Charles Younes, research manager at FE Investments, said: “What we see from the funds that did well in this most recent rebalance are that they had high exposure to alternatives and therefore benefitted from the diversification here during recent tumultuous markets.

“From the equity funds whose ratings have changed significantly, we can also see that when market cycles move fast as they have done in the past three years, stock selection can fall in and out of favour quite quickly.”

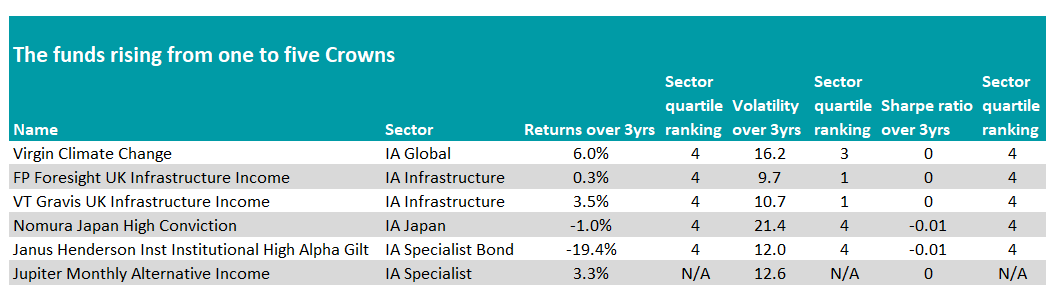

At the other end of the scale, there were six funds that plunged from five crowns to one in the latest rebalance, with the £825m Gravis UK Infrastructure Income the largest among them.

The fund has struggled to make meaningful returns, sitting in the bottom quartile of its sector over three years, although it has been one of the least volatile. It was joined by its peer – the £723m Foresight UK Infrastructure Income fund – which has also struggled.

Source: FE Analytics

Virgin Climate Change, Nomura Japan High Conviction, Janus Henderson Inst Institutional High Alpha Gilt and Jupiter Monthly Alternative Income round out the list.

The crown ratings are calculated by looking over a three-year period at a portfolio’s alpha, volatility and consistency of returns versus a relevant benchmark, as well as the total return.

The top 10% are given a five-crown rating, with the next 15% earnings four crowns. The remainder are split into quartiles, with the next 25% earning a three-crown rating, and so on.

Younes said: “This is the last rebalance that will take into account the extreme market conditions caused by the Covid pandemic.

“As the ratings consider three-year performance this latest rebalance takes into account the Covid sell off, the pandemic rally of growth stocks and now a market rotation with a move in favour of value and a rising interest rate environment.”