Dimensional Fund Advisors is the asset management house that had the greatest success in topping the equity fund sectors in 2022, Trustnet research shows, while Baillie Gifford had one of the worst records.

Last year’s volatile markets saw many funds struggle as surging inflation and rising interest rates sparked a change in market leadership, causing many of the industry previously strongest funds falling to the bottom of their sectors.

Virtually all assets aside from commodities ended 2022 with a loss but some funds were able to hold up better than other and this article looks for the asset management groups that had the biggest proportion of their equity funds in the top quartile of their respective sectors.

This article focuses on the fund groups with five or more equity in sectors where quartiles are appropriate but there were several smaller groups with 100% of their line-up in the first quartile last year.

These include Aberforth (Aberforth UK Small Companies), Credo Capital (Credo Global Equity), Dodge & Cox (Dodge & Cox Global Stock, Dodge & Cox US Stock, Dodge & Cox Emerging Markets Stock) and Orbis Investments (Orbis Global Equity).

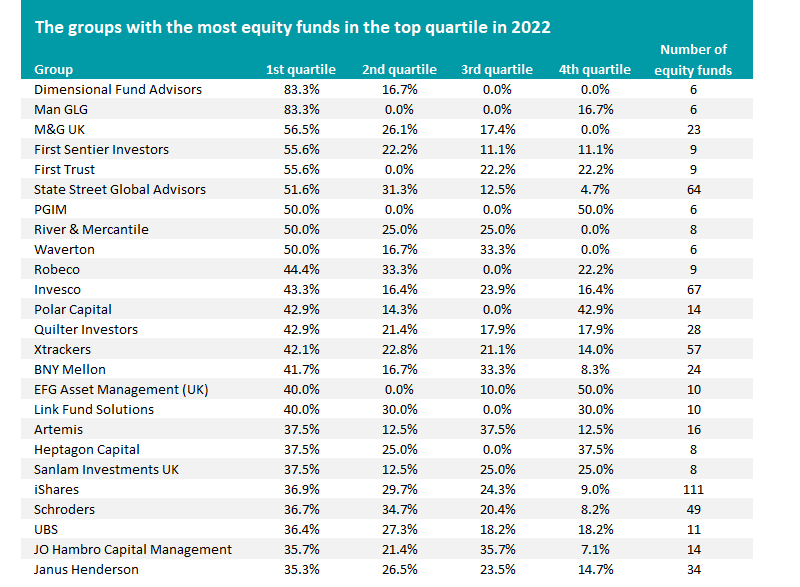

None of the groups with five or more equity funds had a clean sweep in the top-quartile last year, but the best result came from Dimensional Fund Advisors with 83.3% making the grade.

Dimensional is known for its evidence-based investment approach that uses academic research and market data to construct diversified, low-cost portfolios targeting specific dimensions of expected returns such as company size, value, profitability and momentum. This approach involves maintaining a long-term perspective while avoiding market timing and individual stock picking.

Source: FinXL

Five of Dimensional’s six equity funds were in the top quartile in 2022: Dimensional Emerging Markets Core Equity, Dimensional International Core Equity, Dimensional International Value, Dimensional UK Small Companies and Dimensional UK Value.

Only Dimensional UK Core Equity ended the year outside of the first quartile and even then, it only slipped into the second quartile.

Man GLG comes next as it as has five out of its six equity in the top quartile: Man Asia (ex Japan) Equity, Man GLG European Alpha Income, Man GLG Income, Man GLG Japan Core Alpha and Man GLG Undervalued Assets.

However, the sixth fund - Man GLG Continental European Growth – was in the bottom quartile of its peer group last year, meaning the firm performed worse than Dimensional overall.

After these two firms, there’s a quite a drop in the proportion of group’s equity funds making top-quartile returns last year as M&G is in third place with just 56.5% of strategies making the cut.

M&G is one of the best-known groups in the business and among its first quartile last year were M&G Dividend, M&G Global Dividend, M&G Global Themes and M&G Japan. What’s more, none of M&G’s equity funds had a bottom-quartile 2022.

The above table shows the 25 top asset management houses ranked by the proportion of their equity strategies in the first quartile. However, there were another 12 that had more than 25% of their line-up at the top of their sectors last year including Royal London, Vanguard, Fidelity, BlackRock and Jupiter.

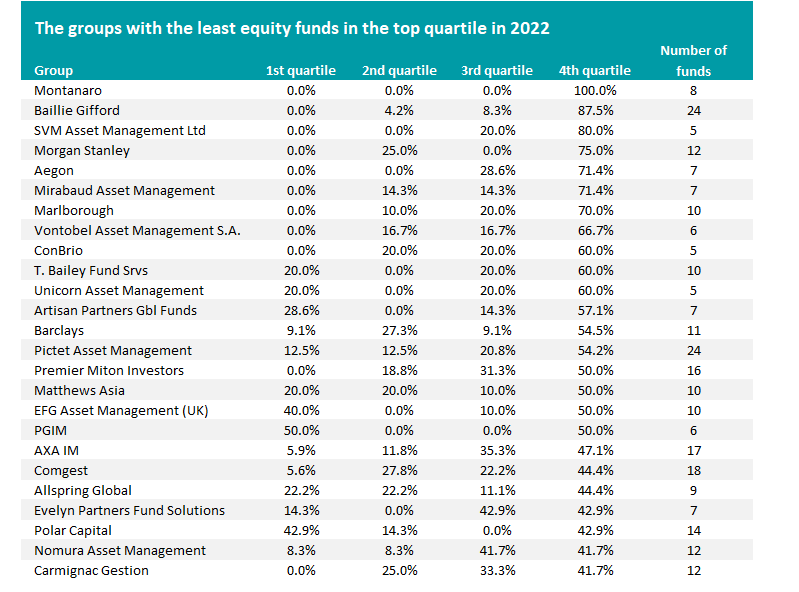

Source: FinXL

Turning things on their heads, the above table shows fund group ranked by the proportion of equity funds in the fourth quartile of their respective Investment Association peer group last year (again, only those with five or more eligible funds).

Montanaro is the only one to have all of its funds at the bottom of their sectors, reflecting the market’s aversion to growth companies and small/mid-cap stocks last year. Montanaro UK Income, Montanaro Better World and Montanaro European Income are the firm’s largest funds.

Baillie Gifford, in second place with 87.5% of its equity funds in the fourth quartile, was one of the bigger stories of 2022. The fund house had enjoyed a strong run ahead of last year as ultra-loose monetary policy favoured its growth approach to investing but its funds dropped from the top of their peers to the bottom when interest rates started to rise.

Among the group’s funds in the bottom quartile last year as well-known offerings such as Baillie Gifford American, Baillie Gifford European, Baillie Gifford Global Discovery, Baillie Gifford Japanese and Baillie Gifford Positive Change.