Much of the past decade was dominated by growth stocks thanks to low inflation and loose monetary policy but over the past year there has been a reversal in these fortunes, catching many funds out.

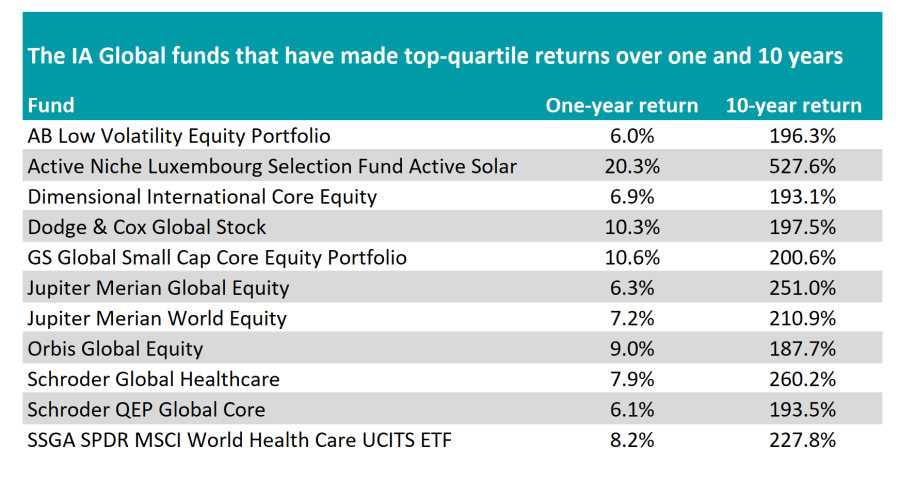

It is a rare breed that have managed to make top-quartile returns over both the past decade and the past 12 months. Of the 224 IA Global funds with a 10-year track record, just 11 have managed the feat.

The best performer on the list is the Active Niche's Luxembourg Selection Fund Active Solar fund managed by Pascal Rochat. The £271m portfolio invests in companies in the solar energy technology sector and has made 527.6% over the past decade.

Renewable energy has been a rising theme over the past decade as people have begun to switch from fossil fuels to more greener means of energy.

Last year, Artemis fund manager Craig Bonthron said solar panels are already producing some of the cheapest energy in the world and, unlike fossil fuels, solar power is only getting cheaper.

“The percentage of solar in the world’s fuel mix may appear small today – it won’t stay that way for long,” he said in a blog to investors.

Source: FE Analytics

Another top theme has been healthcare, which has been a strong trend over the past decade as investors have keyed in on the idea that people are living longer and therefore will require more treatment. Coupled with this is a growing middle class, particularly in emerging countries such as China, which suggests more people can afford healthcare than ever before.

Stonehage Fleming fund manager Gerrit Smit recently told Trustnet that the sector was one area he was allocating to for this year despite a tough 2022.

Backlogs caused by the pandemic are being worked through and companies with good balance sheets should come out of the other side in a strong position, he said.

Funds that have benefited from both the long and short-term trends and achieved a top-quartile return in the IA Global sector over one and 10 years include SSGA SPDR MSCI World Health Care UCITS ETF and Schroder Global Healthcare.

The former is a passive option tracking the MSCI World Health Care 35/20 Capped Index, which is a collection of the world’s largest healthcare stocks. These include the likes of UnitedHealth and Johnson & Johnson in the US as well as European names AstraZeneca and Roche.

Schroder Global Healthcare is an active portfolio, managed by John Bowler since 2004, that has slightly less weighting to the US than its passive rival. Despite this and its 0.93% ongoing charges figure (OCF), it has beaten its passive rival over the past decade, although is slightly behind over one year.

Among more mainstream global equity portfolios, Jupiter Merian Global Equity tops the list. The fund is run by Amadeo Alentorn and the systematic equities team and has made investors 251% over the past decade.

It invests in hundreds of companies, tilting the portfolio between investment styles such as growth, value and momentum ahead of upcoming shifts in the market. The Jupiter Merian World Equity fund is invested in a similar way and also made the list.

Dodge & Cox Global Stock is the first truly active approach on the list. Analysts at Square Mile Research & Consulting said the £3.5bn value fund is “highly regarded in the US” and has been gaining traction in the UK.

The management team look for long-term characteristics but are not “at the mercy” of value investing and will buy growth and momentum stocks where appropriate.

“It is worth noting that due to the longterm nature of the investment approach and significant focus on valuation, the fund's return profile can exhibit periods of heightened volatility versus the wider global equity market. Nevertheless, our view is that over a full market cycle investors should be well rewarded on a riskadjusted basis,” they said.

GS Global Small Cap Core Equity Portfolio also makes the list. Funds that invest further down the market-cap spectrum have performed well over 10 years as these stocks tend to perform better over the long term.

The past decade has been particularly strong as these companies typically require access to capital, which has been abundantly cheap, and rely on growing rather than paying out income – something that has been rewarded in the era of low rates.

Over the past 12 months it has been a top performer, up 10.6%, with much of this coming during the market rally at the start of 2023 as investors have already started to invest with the expectation that the era of high inflation could be coming to an end.