Small-caps have the potential to make the biggest gains on the stock market as they have more room to grow than their large-cap peers.

It is this risk/reward dynamic that has enticed investors for years, who have largely been rewarded. Indeed, according to a Trustnet study last week, the only region where larger firms have beaten their smaller rivals is the US.

But getting higher returns, or at least the potential for them, comes with additional risk and the possibility of significant losses. It therefore is imperative for investors to pick the right funds.

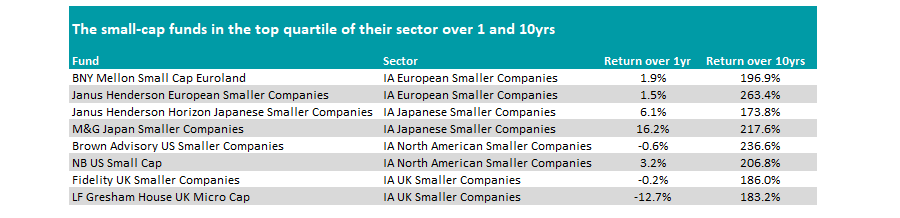

As such, in this article we look at the funds in the Investment Association’s four small-cap sectors – UK Smaller Companies, North American Smaller Companies, European Smaller Companies and Japanese Smaller Companies – that have rewarded investors the most.

To do this, we looked at the portfolios that have made top-quartile returns over both one and 10 years. Previously we have also looked at income funds, UK specialists, broad global strategies and multi-asset ranges.

Starting in the UK, two funds with very different journeys made the list. Fidelity UK Smaller Companies and LF Gresham House UK Micro Cap both have similar returns over the past decade (186% vs 183.2%).

However, the former has had a much better past 12 months, down just 0.2%, while the latter had the best of most of the past decade, up 246.9% in the nine years prior to the past 12 months, but has since lost 12.7%, although this is still a top-quartile return in the volatile sector.

Managed by Jonathan Winton, the £519m Fidelity UK Smaller Companies fund is invested predominantly in industrials, financials and consumer stocks, eschewing the technology and healthcare sectors that can dominate these portfolios.

Analysts at Square Mile Investment Consulting & Research gave it an ‘A’ rating and highlighted that Winton was an “obvious” person to replace Alex Wright, who had previously managed the fund before stepping back to work on other priorities.

“We have been thoroughly pleased with Winton's pragmatism and discipline to the value-orientated process and philosophy, which has been reflected in the fund's performance.

“Additionally, we continue to take comfort from his focus on downside risk and the subsequent protection of capital during times of market distress, which we view as an extremely sensible approach in what has, historically, been a volatile asset class.”

Total return of funds vs sectors over 10yrs

Source: FE Analytics

Conversely, FE fundinfo Alpha Manager Ken Wotton and Brendan Gulston’s LF Gresham House UK Micro Cap fund invests predominantly in AIM stocks. However, to keep volatility low, the managers avoid real estate, mining and oil & gas companies as well as early stage and pre-profit businesses.

Analysts at FE Investments said: “We like the thorough research process that stems from Wotton’s background at private equity firm Livingbridge, where he developed an extensive network of industry specialists and brokers before the investment management division was bought out by Gresham House in late 2018.

“The move has allowed the team to continue managing money as it always has, while benefiting from the resources that a listed company can offer in terms of a bigger team, as well as coverage of companies from their early stages into publicly listed entities.”

Looking further afield, Brown Advisory US Smaller Companies and NB US Small Cap have also achieved first-quartile performance in the US sector over one and 10 years and follow a similar pattern. The former has made a 0.6% loss over 12 months, while the latter has gained 3.2%.

The Brown Advisory fund, managed by Christopher A Berrier, had a stronger nine years prior to the past 12 months, up 241%, but has slipped back more recently. NB US Small Cap meanwhile underperformed the sector average over this time but has thrived in the past year.

Source: FE Analytics

In Europe, Janus Henderson European Smaller Companies and BNY Mellon Small Cap Euroland made the list, although the former has made 66 percentage points more than the latter.

Run by Ollie Beckett and Rory Stokes, the Janus Henderson fund is up 263.4% over the past year and has assets under management of £323m, more than eight times the BNY Mellon fund.

Analysts at FE Investment said Janus Henderson European Smaller Companies is balanced between value and growth – a stark difference to its quality-growth-focused peers.

“Owing to its balanced approach the fund managed to hold up well in every market environment, thus delivering consistent performance across time,” they said.

Finally, in Japan, Janus Henderson Horizon Japanese Smaller Companies and M&G Japan Smaller Companies crack the list. Here the Henderson fund has been beaten by its rival, with the M&G portfolio up 217.6% over 10 years and 16.2% over the past 12 months.

It is managed by Carl Vine, who told Trustnet last year that he thinks Japan is the only market that will deliver double-digit compounded returns this decade.

“It is no longer just a story. Japanese earnings compounded just under 10% per year over the past decade. Not many stock markets consist of companies that can deliver that type of performance – it’s really only the US,” he said.