Income has become an increasingly popular area for investors over the past 12 months as rising interest rates and rampant inflation have caused an influx of new money into assets that can produce dependable payouts.

While there has been a resurgence in bonds and cash options, on the stockmarket an area that has been uplifted is equity income strategies.

Companies that pay dividends tend to be in sectors that have underperformed their peers for much of the past decade, in the era of low rates and low growth, such as oil & gas, financials and mining. Yet these are the firms that have thrived over the past 12 months.

Previously, fast-growing technology and healthcare stocks had led the way, with investors paying handsomely for the potential of future earnings.

With more emphasis on getting a return now rather than in the future, Trustnet looks at the equity income funds that managed to navigate the past decade, as well as forging ahead in the market rotation of the past year.

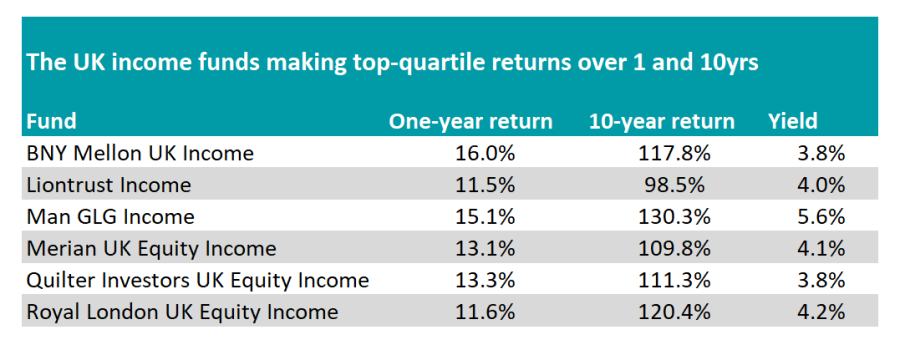

Starting with domestic funds, there were six portfolios that managed to make a top-quartile return in the IA UK Equity Income sector over both one and 10 years.

The largest is FE fundinfo Alpha Manager Henry Dixon’s £1.4bn Man GLG Income fund, which achieved a 15.1% return over 12 months and 130.3% gain over 10 years – the best performer over the period. It also has the highest current yield at 5.6%.

It invests in under-priced companies that trade below their intrinsic value and has typically focused on financials and consumer stocks, although it has also recently built up a large position in oil major Shell. It can also invest in bonds, if this is preferred to the equity.

Analysts at FE Invest rated the fund highly, but said that the portfolio, which is driven by stock-specific events and general sentiment to the UK economy, may underperform over shorter periods.

“It is important to consider the performance of this fund over a minimum period of three years. The recovery process takes time to come to fruition, and then it needs to be acknowledged by the market – therefore, this is a strategy that requires some patience,” they said.

Source: FE Analytics

The top performer over the past year meanwhile has been the £1.3bn BNY Mellon UK Income fund run by Tim Lucas and David Cumming. Previously it was managed by Premier Miton’s Emma Mogford.

Up 16% over the past year, top holdings including oil giants Shell and BP as well as banking groups Barclays and Lloyds have boosted returns.

Other notable funds on the list include Liontrust Income and Royal London UK Equity Income. The former was previously run by veteran Robin Geffen, before Alpha Manager Chris Field took charge in 2022 alongside Dan Ekstein and James O’Connor.

The fund has typically had an overweight to overseas companies – particularly in the US – which has helped it over the long term, although under the new management it is now predominantly invested in UK companies.

Royal London UK Equity Income has also come under new leadership in recent years, with Richard Marwood taking charge in 2021 from retired stockpicker Martin Cholwill. Alpha Manager Niko de Walden is deputy on the fund.

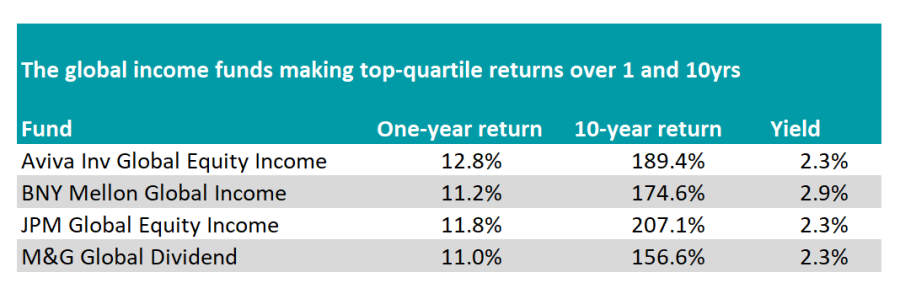

Turning to the IA Global Equity Income sector, a familiar fund group appears, with BNY Mellon Global Income among the list. Formerly managed by Nick Clay and his team before his departure in 2020, the fund is now headed by Jon Bell and Alpha Manager Robert Hay.

The £3.6bn fund has not missed a beat since they took charge and remains a top performer over shorter timeframes, including the past 12 months.

Using a top down (macro) approach with individual stock selection recommended by a team of analysts, the £3.6bn portfolio typically has between 40 and 70 names. Of the funds on the below list, it has the highest yield at 2.9%.

The best long-term performer on the list has been the £576m JPM Global Equity Income fund run by FE fundinfo Alpha Manager Helge Skibeli, Sam Witherow and Michael Rossi.

With a rating of five FE fundinfo Crowns, the fund has had a strong short-term performance as well and over the past year has made 11.8%. It invests using a bottom-up stockpicking approach, looking for companies with a sustainable dividend that can grow in the future.

Source: FE Analytics

Aviva Investors Global Equity Income has been the best performer over one year. Run by Alpha Manager Richard Saldanha, the £216m fund has made 12.8% over 12 months, while it has the second highest 10-year return of 189.4%.

M&G Global Dividend headed by Stuart Rhodes with deputies John Weavers and Chris Youl is the cheapest option of the four with an ongoing charges figure (OCF) of 0.66%

Analysts at Square Mile Investment Consulting & Research gave the portfolio an ‘A’ rating and said the fund is constructed around a “core of solid, reliable dividend paying companies which are supplemented with more cyclically sensitive names”.

Previously in this series we have looked at the IA UK All Companies funds to achieve the feat, as well as those in the IA Global sector.