The past year has been a challenging one for most investors, but perhaps no more so than for multi-asset fund managers who have had to balance equities and bonds – both of which have struggled since interest rates and inflation began to rise.

Funds that were prepared would have had to shift their portfolios away from what has worked for much of the past decade at the right time, making it difficult to be a top performer over both one and 10 years.

Yet there are a gaggle of portfolios that have achieved the feat. Below Trustnet looks at the funds in the four main Investment Association mixed investment sectors to see which came out on top in both the short and long term.

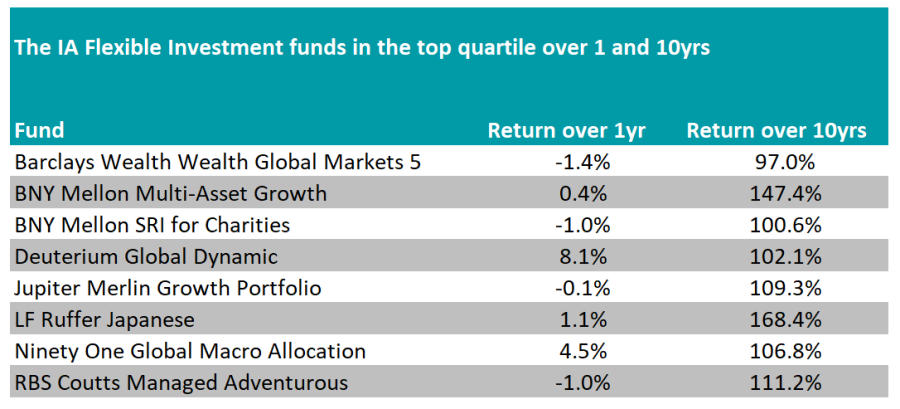

IA Flexible Investment

While all of the others on the list have set guidelines for how much a portfolio can put into equities, funds in the IA Flexible Investment sector can go anywhere.

This results in a peer group that is quite diverse and the below list of funds that made the top quartile over both one and 10 years proves this, with Japanese specialist LF Ruffer Japanese joined by traditional multi-asset funds.

Source: FE Analytics

The largest fund on the list is the £2bn BNY Mellon Multi-Asset Growth fund run by Simon Nichols, FE fundinfo Alpha Manager Bhavin Shah and Paul Flood. They invest almost entirely in equities, although the bond exposure has grown from nothing in March 2020 to around 9% of the portfolio today.

It has made a small positive gain over the past year, while over a decade the fund is up 147.4%, the best return of all flexible funds on the list.

The only other fund with more than £1bn in assets under management (AUM) is Jupiter Merlin Growth Portfolio, managed by Alpha Manager John Chatfeild-Roberts, Amanda Sillars, David Lewis and George Fox.

It is a fund-of-funds, that is predominantly invested in equity portfolios, although there is a 2.1% allocation to gold and 5.5% in cash at present.

Square Mile Investment Consulting & Research analysts gave the Merlin fund an ‘AA’ rating and said the team was “one of the most respected and experienced” in the UK.

“Overall, we hold this team in high regard and consider this a strong offering run by experienced and proven investors, with a good longterm record of managing multiasset fund of funds and who have successfully delivered on the fund's expected outcome since launch,” they said.

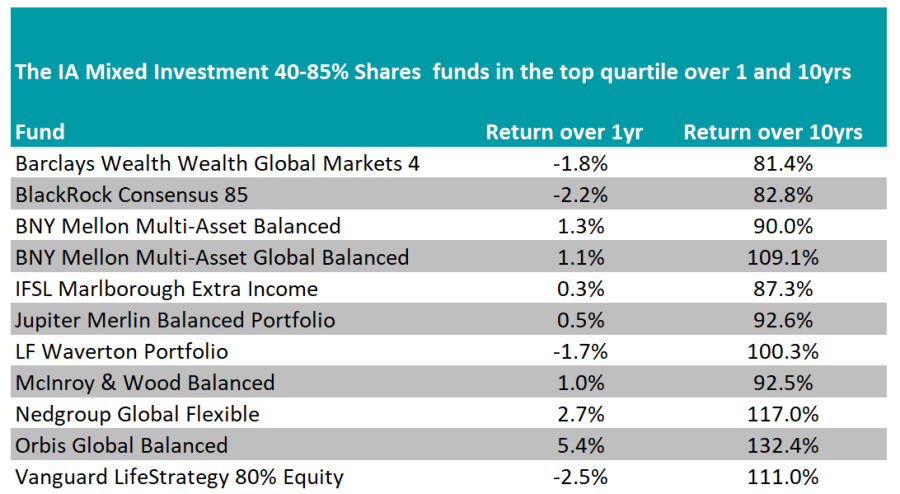

IA Mixed Investment 40-85% Shares

Turning to the most high-risk of the mixed asset funds that have a restriction on how much portfolios can invest in equities, Vanguard LifeStrategy 80% Equity headlines the best performers in the IA Mixed Investment 40-85% Shares sector.

The £8.8bn portfolio is the second-largest in the popular multi-asset fund range, which invests exclusively in index trackers. The asset allocation is set at 80% equity and 20% bonds, with more than 20% of the portfolio invested in domestic UK stocks.

Analysts at interactive investor, who include the fund in their Super 60 recommendation list, said: “The fund employs a straightforward, diversified and low-cost approach, making it a sound long-term option.”

Source: FE Analytics

The best performer has been the Orbis Global Balanced fund, which has made 5.4% over one year and 132.4% over a decade. Although the fund has an AUM of £137m, the strategy as a whole runs £2.9bn on behalf of investors.

It is currently 77% weighted to equities, with Europe (14%) and the UK (12%) much larger relative regional positions than a traditional equity portfolio. A further 17% is in bonds, with 5% in commodities and 1% in cash.

Familiar fund groups also populate this sector’s list, with Barclays Wealth, Jupiter Merlin and BNY Mellon all making the cut – having also had entrants in the IA Flexible Investment sector above.

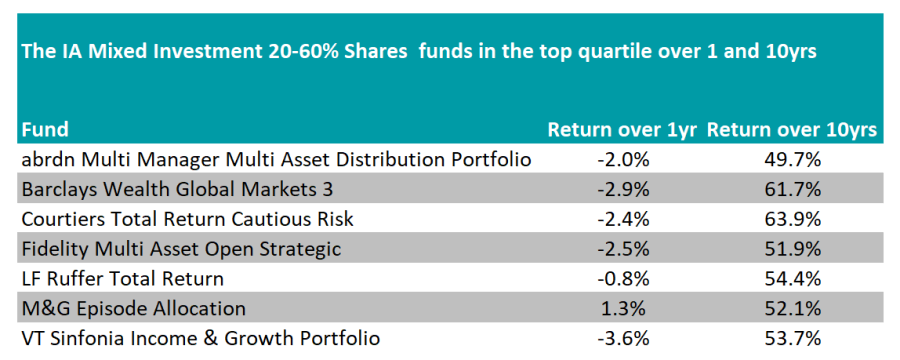

IA Mixed Investment 20-60% Shares

For more defensive investors, names that have protected capital came out on top, with LF Ruffer Total Return among those to make top-quartile returns over one and 10 years in the IA Mixed Investment 20-60% Shares sector.

Run by Alpha Manager Steve Russell, Alexander Chartres and Matt Smith, the £3.4bn fund aims to make a positive return over any 12-month period. Unlike others, it is a fund that invests in individual securities and bonds. Fixed income makes up 78% of the portfolio currently, with short-dated bonds the largest allocation at 35.5%.

Last year, Chartres warned investors not to be fooled by any drops in inflation. “The key word is volatility,” he said. “It's not going to go up and stay up indefinitely. It's going to jump like in World War II and its aftermath, when you had massive state intervention or fiscal activism, significant disruption of labour markets and supply chains, and huge accumulated savings suddenly got spent – you name it, there are a lot of echoes.”

Source: FE Analytics

The best performer over the past year has been M&G Episode Allocation managed by Tony Finding, Stuart Canning and Craig Moran, who use a mix of index trackers and active M&G funds.

Global stocks make up 36.7% of the portfolio, with 27.9% in government bonds, 9.7% in corporate debt and 9% split evenly between property and cash.

IA Mixed Investment 0-35% Shares

In the lowest equity sector, only one fund achieved a top-quartile return over both one and 10 years: Ninety One Diversified Income, which is run by John Stopford and Jason Borbora-Sheen

It aims to generate a 4% income each year, while avoiding the worst of the market falls and invests in range of different sectors. Developed market government bonds are the largest allocation at 41.7%, while emerging market debt is second at 18% of the portfolio.

Analysts at FE Investments said: “The fund provides a strong solution to investors with a clear income target. Due to its mixed asset – but also defensive – approach, we have been impressed by the capacity of the fund to generate this stream of income, irrespective of the directions of equity and bond markets.

“This is a key differentiator to its peers, which have relied too much on equity markets to generate income and capital returns. Therefore we believe it is acceptable to consider the fund as an alternative asset in a portfolio, thanks to the fund’s capacity to generate uncorrelated returns from equity and bond markets.”