UK equity funds suffered a third consecutive year of outflows in 2023, as investors withdrew a net £1.2bn. Savers pulled money from UK-focused equity funds in eight out of the 12 months of the year, data from Calastone shows.

In the below study looking into the most bought and sold funds of the year, we have focused on funds where investors added or withdrew at least £200m .

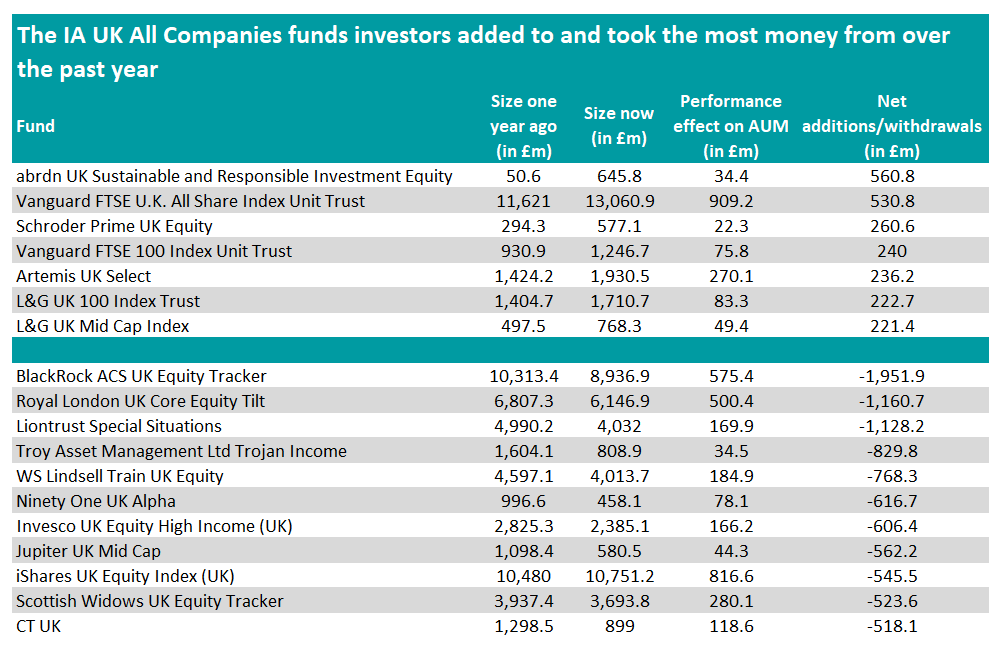

Within the IA UK All Companies sector, 11 funds saw outflows of £200m or more in 2023. Three funds were hit by withdrawals in excess of £1bn, including Liontrust Special Situations, which shed £1.1bn.

While Liontrust Special Situations has struggled in recent times, experts recommended in April 2023 that investors either buy or hold the fund as it could do well in a recessionary environment.

Meanwhile, passive funds BlackRock ACS UK Equity Tracker and Royal London UK Core Equity Tilt lost £2bn and £1.2bn respectively.

Investors also withdrew £768.3m from the largest fund in the IA UK All Companies sector, WS Lindsell Train UK Equity, whose size shrunk by 12% over one year. The fund has underperformed the FTSE All Share in the past three years, not least because the portfolio has no direct exposure to oil and mining companies, which have delivered strong returns.

FE fundinfo Alpha Manager Nick Train also explained that his confidence in the earnings power and undervaluation of some of his key holdings was “misplaced”.

In spite of investors redeeming £545.5m from iShares UK Equity Index (UK), it is the only fund in this shortlist that has been able to still increase its assets under management (AUM), as performance compensated for the outflows. This passive fund tracks the FTSE Custom All Share Net Of Tax Mid Day index and has a tracking error of 1.1 over one year.

Source: FE Analytics

At the other end of the spectrum, seven funds recorded inflows in excess of £200m over the past year, including four trackers.

Of the three actively-managed funds, abrdn UK Sustainable and Responsible Investment Equity was the most popular, attracting £560.8m. It increased its AUM by 1175.5% year on year, with performance contributing an additional £34.4m.

Schroder Prime UK Equity and Artemis UK Select also received more than £200m in the past 12 months.

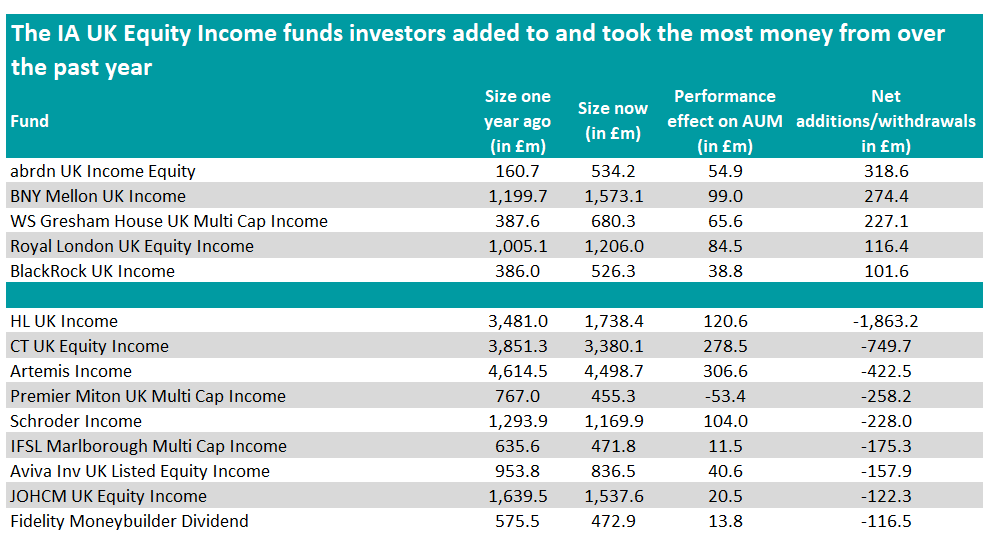

For the IA UK Equity Income sector, we have focused on the portfolios where investors added or withdrew at least £100m.

A fund from abrdn received the most net additions in this sector as well. Over the past year, abrdn UK Income Equity has grown from £160.7m to £534.2m in AUM, with a gain of £54.9m through performance.

Investors also added over £200m to BNY Mellon UK Income and WS Gresham House UK Multi Cap Income and more than £100m to Royal London UK Equity Income and BlackRock UK Income.

Source: FE Analytics

On the other side of the table, investors withdrew almost £2bn from HL UK Income over the past year, while CT UK Equity Income shed £749.7bn. They were the only two funds that lost more than £500m.

Savers also took £422.5m from Artemis Income, the largest fund in the sector. It is still one of the most recommended funds by investment platforms, as it appears on the best-buy lists of AJ Bell, Hargreaves Lansdown and interactive investor.

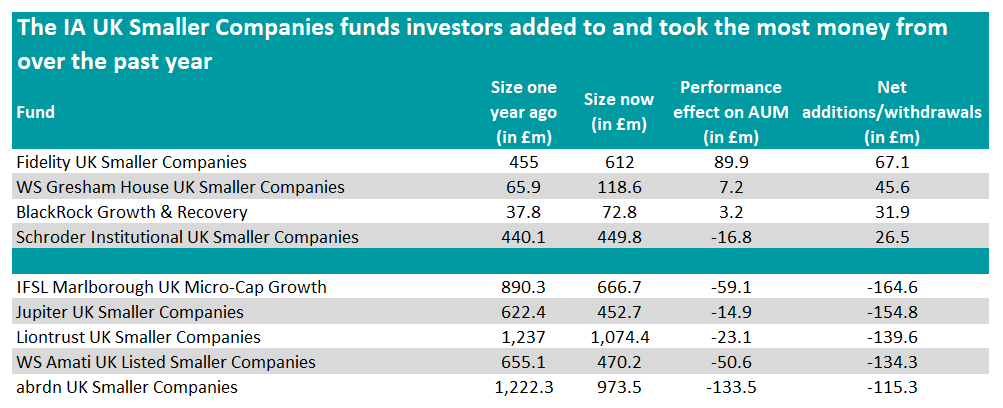

As for the IA UK Smaller Companies sector, we have looked into the funds where investors added at least £20m or withdrew more than £100m.

In total, five funds lost more than £100m over the past 12 months, with IFSL Marlborough UK Micro-Cap Growth shedding the most.

Investors also shunned the largest fund of the sector, Liontrust UK Smaller Companies, removing £139.6m from it.

Source: FE Analytics

Fidelity UK Smaller Companies was investors’ favourite UK small-cap fund, receiving £67.1m of inflows last year.