It has been a disappointing few years for investors who backed star manager Nick Train and his team on the back of stellar returns during the 2010s.

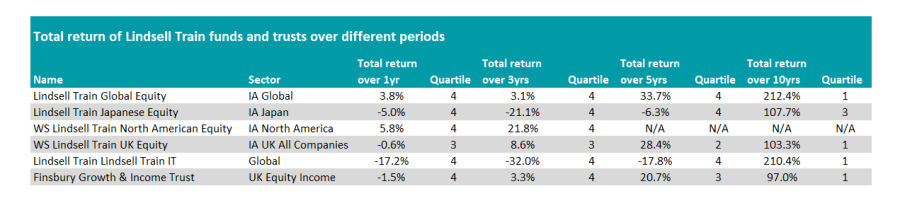

While most of Lindsell Train’s funds remain top-quartile performers over 10 years, every fund and investment trust managed by the firm has failed to beat its peers over three years, with all but one landing in the fourth quartile of their respective sectors, as the below chart shows.

Source: FE Analytics

Train himself admitted he was disappointed in the latest monthly factsheet for Finsbury Growth & Income trust, during which time the trust made a 3.8% gain in net asset value (NAV) terms and 5% on a total return basis – slightly beating the FTSE All Share’s 4.5% gain.

“Despite a rally in December your Company’s NAV underperformed during calendar 2023 and has now underperformed the FTSE All Share Index for three consecutive years,” said Train.

“This is disappointing to me and all my colleagues, because we work hard, we care and are invested in the strategy ourselves.”

He highlighted a couple of reasons his strategy has underperformed in recent years, noting a lack of oil and mining companies as a big detractor to relative returns.

“In addition, I have invested in some companies where my confidence in their earnings power and undervaluation has been misplaced, at least to date. Amongst these, Hargreaves Lansdown has been a big detractor from the returns, as have Burberry and, particularly in 2023, Diageo,” the Finsbury Growth & Income manager noted.

Total return of stocks vs FTSE All Share in 2023

Source: FE Analytics

Despite this, he is not dwelling on the past, instead looking inwards at whether there was more he and his team could be doing.

“What now matters most to shareholders and to me are future returns and that is what I am focused on,” he said. “Is our investment approach still capable of delivering attractive absolute and relative returns and is the portfolio structured in such a way as to offer the possibility of such returns in 2024 and beyond?

“On those points, I can assure investors that our approach remains unchanged and that the structure of the portfolio makes it very likely to continue to perform very differently from the benchmark.”

He noted that portfolio remains highly concentrated, with the top 10 holdings accounting for 86% of the total assets, while allocating to significant investment themes.

The first theme is underpinned by the belief that we are living and investing in a period of accelerating technology change with more products and services becoming digital.

“The software that drives those services becomes more important to their customers. At the same time, the digitisation has created an explosion of data. This has meant that companies that have the tools to aggregate the data and make sense of it have a new growth opportunity,” said Train.

“This has meant that companies that have the tools to aggregate the data and make sense of it have a new growth opportunity.”

Next is the idea that there has been a significant increase in global wealth over past decade, meaning consumers have tended to increasingly spend on luxury and premium products.

The last theme is the notion that the UK stock market holds “a number of world class businesses that offer full participation to these themes of AI, software and luxury and premium-brand consumption”.

“It is around these companies that we have built your portfolio and where we have the highest hopes for future share price gains,” the manager concluded.