The Vanguard LifeStrategy range is one of the most popular investment solutions among investors, with a combined £38bn in assets under management among the funds in the Investment Association universe, but last year investors looked elsewhere, according to data from FE Analytics.

Using the multi-asset fund range as a barometer for investor sentiment, people had a greater appetite for risk in 2023, with the equity-heavier versions of the Vanguard LifeStrategy attracting money.

Meanwhile, the bond-heavy funds in the portfolio all shed money. In total, it meant investors pulled a net £400m from the range.

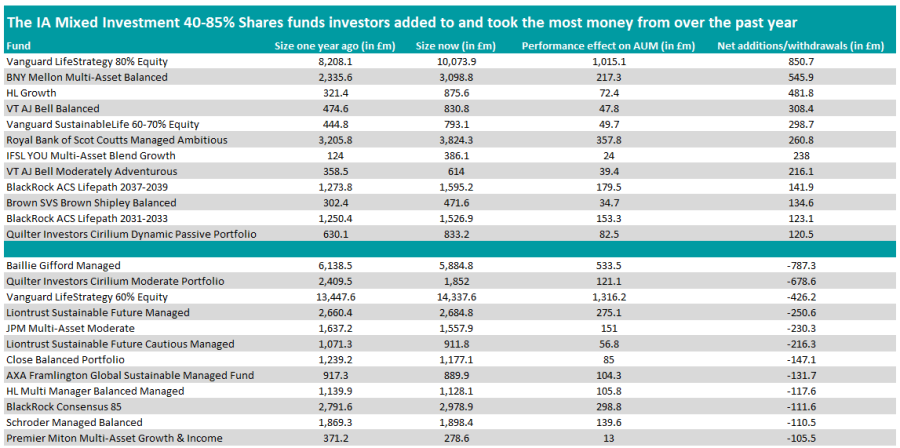

Vanguard LifeStrategy 80% Equity was the most popular of the five versions of the range and also investors’ top choice in the IA Mixed Investment 40-85% Shares sector, as they backed the fund to the tune of £850.7m.

In this sector, stablemate Vanguard SustainableLife 60-70% Equity also received over £100m of inflows over the same period, while BNY Mellon Multi-Asset Balanced was investors’ favourite active fund, receiving £545.9m of inflows.

Investors also backed the Vanguard LifeStrategy 100% in 2023. It was the second most popular fund in the IA Global sector, with the ‘riskiest’ version of Vanguard’s ‘ready-made portfolios’ taking in a net £814.3m from investors.

However, Vanguard LifeStrategy 80% and Vanguard LifeStrategy 100% were the only funds in the range to receive net additions, as investors withdrew significant amounts from the bond-heavier versions, with the whole range bleeding £404.3m in total.

For instance, investors withdrew £426.2m out of Vanguard LifeStrategy 60% Equity, the largest fund in the range.

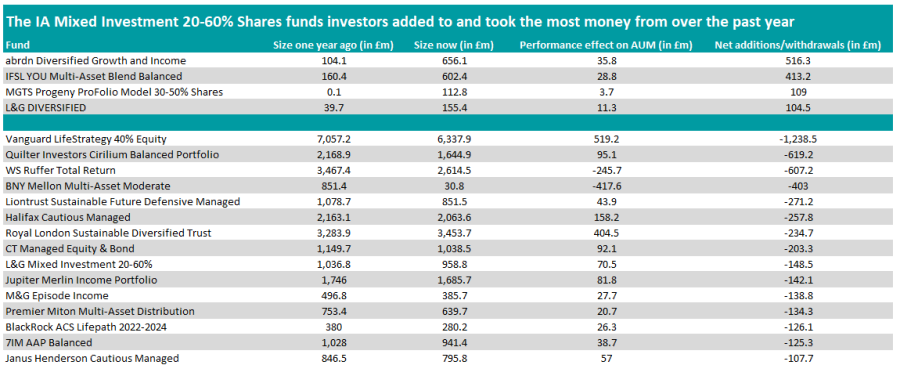

Yet, Vanguard LifeStrategy 40% Equity was the most affected fund, as it shed £1.2bn, making it the most sold portfolio in the IA Mixed Investment 20-60% Shares sector.

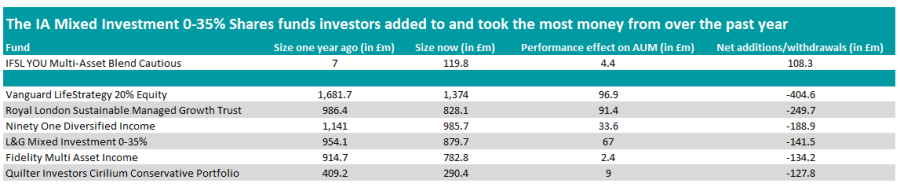

Investors also shunned Vanguard LifeStrategy 20% Equity, taking out £404.6m from the smallest fund in the LifeStrategy range. As a result of those outflows, it was the most sold fund in the IA Mixed Investment 0-35% Shares sector.

Below, we round up the rest of the mixed asset fund flows in each of the major sectors: IA Flexible Investment, IA Mixed Investment 40-85% Shares, IA Mixed Investment 20-60% Shares and IA Mixed Investment 0-35% Shares.

In the IA Mixed Investment 40-85% Shares sector, while Vanguard dominated it was from alone in taking in investors’ cash. In total 12 funds netted more than £100m in inflows last year, as the below table shows.

Source: FE Analytics

In terms of outflows, Baillie Gifford Managed and Quilter Investors Cirilium Moderate Portfolio were the most affected portfolios of the sector, as investors withdrew over £500m out of each of those two funds.#

Turning to IA Mixed Investment 20-60% Shares, there was less optimism, with just four funds gaining £100m from net inflows: abrdn Diversified Growth and Income, IFSL YOU Multi-Asset Blend Balanced, MGTS Progeny ProFolio Model 30-50% Shares and L&G DIVERSIFIED.

Source: FE Analytics

Conversely, 15 funds were hit by outflows of at least £100m in this sector, with investors withdrawing over £500m from both Quilter Investors Cirilium Balanced Portfolio and WS Ruffer Total Return.

In the IA Mixed Investment 0-35% Shares sector there were fewer changes. IFSL YOU Multi-Asset Blend Cautious was the only fund in that sector to receive inflows of at least £100m last year.

Source: FE Analytics

Vanguard LifeStrategy 20% Equity was joined by five other names with more than £100m in outflows, however, including Royal London Sustainable Managed Growth Trust and Ninety One Diversified Income.

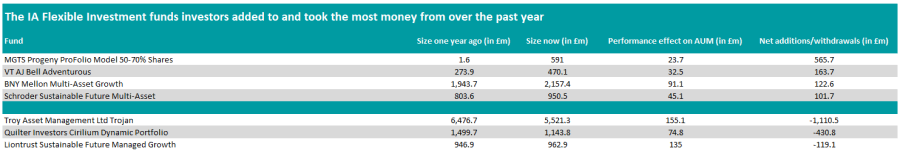

Lastly, with no fund from the LifeStrategy range in the IA Flexible Investment sector, investors’ favourite fund over 2023 was MGTS Progeny ProFolio Model 50-70% Shares, which raked in £565.7m of net new money.

Source: FE Analytics

Only three funds were hit by outflows in excess of £100m, but Troy Asset Management Ltd Trojan was particularly affected, as it shed over £1bn.

Investors also withdrew £430.8 out of Quilter Investors Cirilium Dynamic Portfolio and £119.1 out of Liontrust Sustainable Future Managed Growth.