Nvidia has been the poster child of the artificial intelligence frenzy, spearheading the accompanying stock market rally.

The stock fell back last week, however, along with the rest of the ‘Magnificent Seven’ (Alphabet, Amazon, Apple, Meta Platforms, Microsoft and Tesla).

But does this sudden change in fortunes mark a turning point for the graphics processing units (GPU) market leader?

The company is due to reveal its cards on 22 May when it will publish its results for the first quarter of 2024-25. Depending on the figures, this may or may not reassure the market that Nvidia can live up to the high expectations surrounding it.

Over the long term, possible threats to the company’s hegemony might include the emergence of a competitor in the GPU market, such as Advanced Micro Devices (AMD).

Zehrid Osmani, head of the Global Long-Term Unconstrained team at Martin Currie, said: “AMD is seen as an alternative company to Nvidia in the GPU segment and could potentially expand its market share from currently c.5% in data centres to 20% over the longer term.”

So should investors consider taking profits from Nvidia and investing in AMD?

Not so fast, said Chris Ford, co-manager of the Sanlam Global Artificial Intelligence fund. While AMD may well gain market share, it remains a “distant second player” to Nvidia, he said.

One of AMD’s issues is that it is spread thinly across both the GPU and central processing units (CPU) markets, where it trails behind Nvidia and Intel, respectively.

AMD is smaller than Nvidia, which means its research and development capacities are more limited, he continued. AMD is also constrained by the necessity to compete with Intel in the CPU space.

These dynamics have “led to a persistent capability for Nvidia to deliver significantly superior operational performance from their chips compared to AMD”, Ford concluded.

Dom Rizzo, portfolio Manager of the T. Rowe Price Global Technology Equity fund, added that chips from Nvidia and AMD are not interchangeable without “a noticeable degradation in performance”.

AMD is still the new kid in town, yet to gain recognition, he continued. “AMD’s product offering is relatively new to the market, so it has to go through testing. It is at a different stage in terms of adoption and acceptance, so it is difficult to make a direct comparison between the two.”

Nvidia has built a software and services ecosystem on top of its chips, which is something AMD lacks, as it has been focusing on a wider range of products.

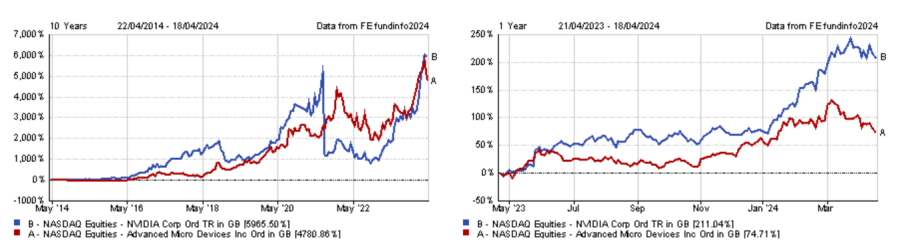

Performance of stocks over 10yrs and 1yr

Source: FE Analytics

For Allan Clarke, investment manager at Aegon Asset Management, the GPU market bears resemblance to the smartphone market in the late 2000s with Apple and Samsung.

While Apple built an entire software ecosystem attached to the iPhone, Samsung didn’t and ran Google’s Android on its phones.

Clarke said: “That made a huge difference to the way the two companies were able to monetise the mobile market: shareholders in Samsung would have done fine since the start of the smartphone era, whereas shareholders in Apple have done very nicely indeed. Apple managed to extract something like 80% of the value of the mobile-era of computing, with other players fighting over the remaining 20%.

“Nvidia will be looking to achieve something similar from this next era of computing. If it achieves that (and it currently is), then AMD will be among a number of players fighting for the remaining 20%.”

In spite of this, Rizzo believes the GPU segment is growing fast enough to accommodate both companies and that capturing 10% of the market share would be enough for AMD to thrive.

“AMD has forecast the market to grow from $45bn to $400bn between now and 2027. If AMD were to secure 10% of the market in 2027 that is still significant room for them to grow,” he said.

Furthermore, once generative AI moves from training large language models – which requires fast computing power, and therefore heavy use of GPUs – the application of these models (inference) will depend less on fast-compute. This could lead to more extensive use of CPUs, which would play to AMD’s strengths, Osmani explained.

However, he disputed this thesis. “We believe that inference is also very data intensive and therefore will still require fast computing power and fast processing microchips. Therefore, the market might come to realise that the significant need for GPUs is sustained for longer than expected, which would favour Nvidia,” he explained.

While Nvidia has no obvious competitors apart from AMD in the GPU market, it could face external threats, such as from application-specific integrated circuit (ASIC) manufacturers.

Ford said: “They’re designed to address a very particular computational problem and deliver a silicone solution that addresses it.

“One of the problems with that approach is that designing and manufacturing chips is extraordinarily expensive. Ideally, you want to design a chip, which you can then manufacture as many times as you possibly can. That means you need to find particular computational tasks that have huge scale attached to them to develop an ASIC, but there really aren't very many of those.

“You could argue that there are more now than there were 10 years ago, but we believe it will remain somewhat limited. However, if there is an element of competition for Nvidia over the course of the next decade, we think it's far more likely to emerge from the ASIC manufacturers than from AMD.”

Clarke also pointed to the likes of Alphabet, Microsoft and Meta as potential threats because they are looking to design their own chips to reduce their reliance on Nvidia – although he thinks they are a long way off from threatening the GPU giant.

He concluded: “Time will tell, but the current rate of development, product advantage and market position for Nvidia looks formidable.”