Markets have been a tough place in the past few years, but even more so for investors in the popular Baillie Gifford Managed fund.

This £5.5bn giant has a strong long-term track record, achieving a second-quartile performance over the past five years and first quartile over the decade, but it was once even mightier, with £9.5bn of assets under management at its peak in November 2021.

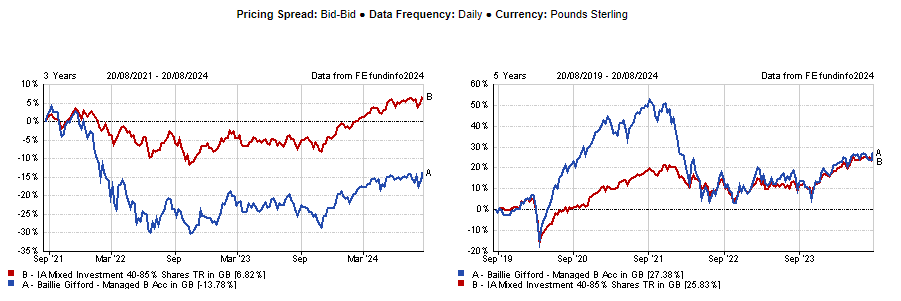

Since then poor performance has brought it down. It is now the worst performer in the IA Mixed Investment 40-85% Shares sector, coming in in the 202nd position out of 202 members over the past three years, when it lost 13.8%.

Manager Steven Hay attributed this to the fund having one of the highest allocations to equities in the peer group. Below, he unpacks how the recent poor returns have happened and explains why he thinks many funds in the market overcomplicate things for themselves.

Performance of fund against sector and index over 3 and 5yrs

Source: FE Analytics

What is your investment process?

We like to keep things simple because investing is complicated enough. Our portfolio is usually comprised of a 75% exposure to equity, 20% to fixed income and 5% cash.

We're looking across the globe to find the best companies that will be able to grow their earnings faster than the market.

How do other funds over-complicate things?

We all know examples in the past where funds have accumulated bets by using derivatives, where trades are expected to match underlying assets, and that hasn't happened. When that is the case, correlations all go to one and the bets are much bigger than people had appreciated.

There are plenty of arguments over how far artificial intelligence is going to go and which companies will be best placed to take advantage of it, but we don't use derivative-based strategies to try and play angles.

Within the fixed income component, people also use hedging, but we only have a small element of currency hedging and interest rate hedging just to keep things balanced.

Why should investors pick this fund?

It is a balanced strategy that’s suitable for people in the accumulation phase of their life who are looking to grow their total return without the racy or risky element that you sometimes get with an all-equity portfolio.

It is also the best way to access the best of Baillie Gifford’s ideas, as multiple regional managers contribute to the portfolio.

Have the best Baillie Gifford ideas disappointed lately?

A lot of the equities that we held did extremely well and our performance was very good during Covid. Then there was some fallout from that, largely led by the interest rate rise and the burst of inflation. That was a fairly big shock and we had a very volatile period.

Operationally, our equities have actually been doing well throughout the period. The problem was largely the valuation reaction to the very significant increase in interest rates.

Why was this fund particularly hit by rising rates?

We currently are overweight stocks at 79% and it is probably fair to say that we have one of the highest equity weightings in the sector. Maybe the types of growth that we look for are more exposed to the interest-rate backdrop. On top of that, some of these themes take time and only come through further in the future.

That said, it has been a difficult period of performance against the peer group, but we are hopeful that we have now turned the corner. We are very excited about the current growth prospects and valuations.

What companies have worked best for the fund in the past year?

Spotify is one that we like and have held through some troubled times. However, it has been quite successful in reducing its cost base and has more than doubled in the past year.

The stock that I’m most excited about is Sweetgreen, a US healthy fast-food chain focusing on the freshness of the ingredients, lack of sugar usage and with lots of plant-based options. It's been very successful and very fast-growing. It was up 82% over the past 12 months.

We have also held Nvidia for the past eight years, but it grew 151% over the past year, so we had to cut it.

How big were the cuts to Nvidia?

We’ve trimmed it twice this year – by 0.4 percentage points in the first quarter from a starting point of 1.9% and then another 0.5 percentage points in the second quarter from a starting point of 1.3%.

These followed strong share price performance, which in the first quarter saw Nvidia approaching the stock limit for the North American team. As of this week, the holding was 1.15%.

Which stocks haven’t worked as well?

Hello Fresh, the German meal delivery company, was a painful one. We felt that post-pandemic, grocery habits were changing and people would start to go to a subscription model for this kind of deliveries, but that's just not happened, it's been more of a discretionary purchase.

The core meal-kit business has been in decline and we haven’t felt the opportunity was great enough to justify holding. We sold while it had lost 70% over the past 12 months.

Another one was the gene sequencing company 10X Genomics, which was down 50% over the past year and we sold at a loss.

For the tech and healthcare part of the portfolio, we know that some businesses will be very successful and some won’t. This one hasn't worked out, so we've exited and moved on to better ideas.

What do you do outside of fund management?

I run a small charity that I set up with my first wife who passed away – she was an ophthalmologist – to enable UK doctors to go to poorer countries and help improve eye care. Other than that, I've got six kids, so not a lot.