UK-based investors ditched bond funds at the fastest pace since the start of the Covid pandemic last month while buying into the US stock market despite its heavy losses, new data from Calastone shows.

April was a turbulent month for investors after US president Donald Trump unveiled (then eventually walked back on) extensive trade tariffs on most countries. This sparked hefty falls in the stock market and rising bond yields.

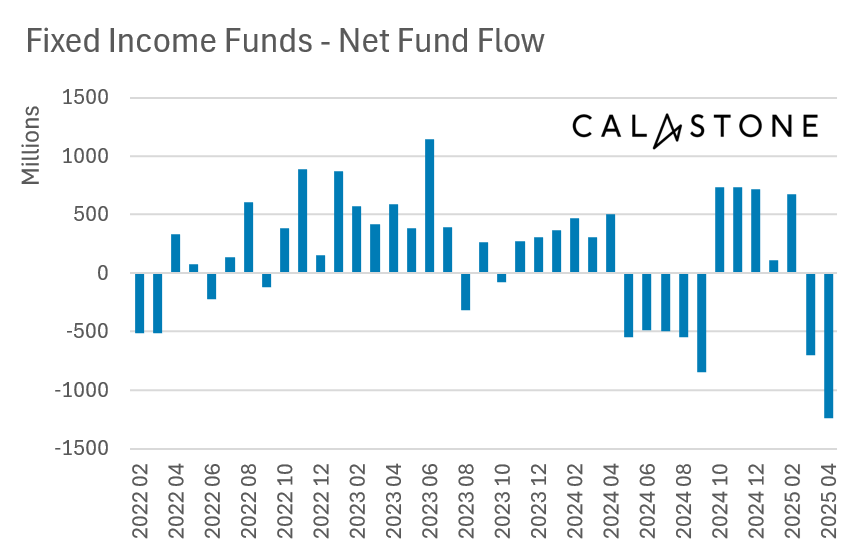

Calastone’s latest Fund Flow Index reveals that investors pulled a net £1.24bn from fixed income funds in April, the second consecutive month of strong selling and the second highest level of outflows in the index’s history.

April’s outflows were focused on government bond funds, which were hit with net redemptions of £621m – the worst on record for this category of funds.

Source: Calastone Fund Flow Index – Apr 2025

Edward Glyn, head of global markets at Calastone, said: “Bond markets have whipsawed as investors try to price the impact on the global economy of ever-changing US policy announcements on trade, as well as threats, both made and rowed back on, to undermine the independence of the US Federal Reserve.

“The US dollar is also under pressure, harming confidence in US government bonds, which form by far the largest share of the global sovereign bond market. The turmoil in US bond markets has in turn pressured yields around the world.”

April’s outflow from bond funds was still some way below the £3.37bn of net redemptions that they suffered in April 2020, when large parts of globe went under unprecedented lockdowns to curb the spread of Covid-19.

However, the outflow in April was 46% higher than the third worst month (September 2024) and followed a “very weak” March, which was the fourth worst month on record for the sector.

Source: Calastone Fund Flow Index – Apr 2025

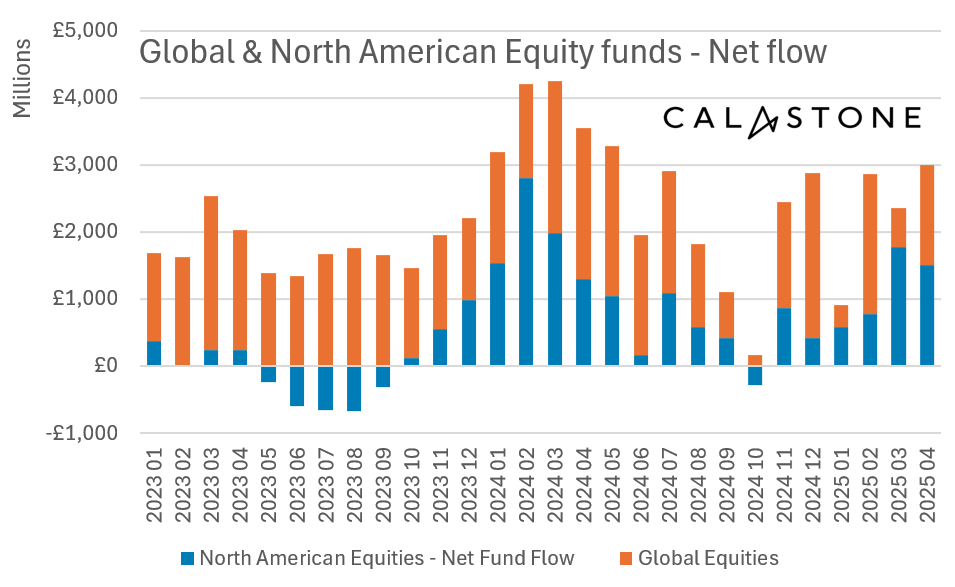

The picture is very different for equity funds, though, which garnered a net £1.52bn inflow in April. This was the fourth consecutive month of net inflows for the category.

Funds investing in North America (mainly the US) were the biggest beneficiaries, with a particular focus on index trackers. A net £1.51bn went into North American equity funds and the buying started in earnest on 8 April, when investors started to speculate that Trump would delay some of the tariffs he announced less than a week before.

Global equity funds, which tend to have a significant weighting to the US, also captured strong inflows, taking in a net £1.48bn last month.

Glyn said: “The interest in US equities in April may simply be a ‘buy the dip’ tactic. Certainly inflows tailed off at the end of the month by which time the US stock market had recovered half the peak-to-trough losses it had suffered between the middle of February and early April.”

However, there was strong selling of emerging market and Asia-Pacific equity funds, with respective net outflows of £591m and £534m. This marks the worst month for emerging markets on Calastone’s record.

“Emerging markets are vulnerable to financial instability and are heavily weighted to China,” Glyn said. “With China singled out for Trump’s harshest tariffs, concerns over economic growth are clearly the reason for investors to draw down their emerging market and Asia fund holdings.”