Infrastructure, renewable energy, property and private equity trusts are among the investments that could benefit from falling UK interest rates, according to analysts.

Falling interest rates are broadly supportive for equities, but certain investment trust sectors stand to gain more due to their sensitivity to bond yields and discount rates.

Below, analysts from Deutsche Numis, Winterflood Securities, Shore Capital and Peel Hunt identify the trusts they believe are positioned to re-rate as yields decline and sentiment improves.

Infrastructure

Colette Ord, head of real estate, infrastructure and renewable funds research at Deutsche Numis, pointed to infrastructure trusts as a key beneficiary of lower interest rates and singled out International Public Partnerships.

“Lower risk core infrastructure cashflows should perform well, as these are often seen by investors as bond proxies, although we also believe the market often overlooks the ability for infrastructure investment trusts to grow earnings through active management,” she said.

“We like International Public Partnerships, which displays a number of our preferred risk-adjusted return characteristics, along with exposure to some key infrastructure growth trends such as the energy transition.”

Ord added that the trust’s 22% discount to net asset value (NAV) does not reflect the trust’s return potential, while the fully covered 7.7% yield means it could pay a growing dividend for at least a further 20 years.

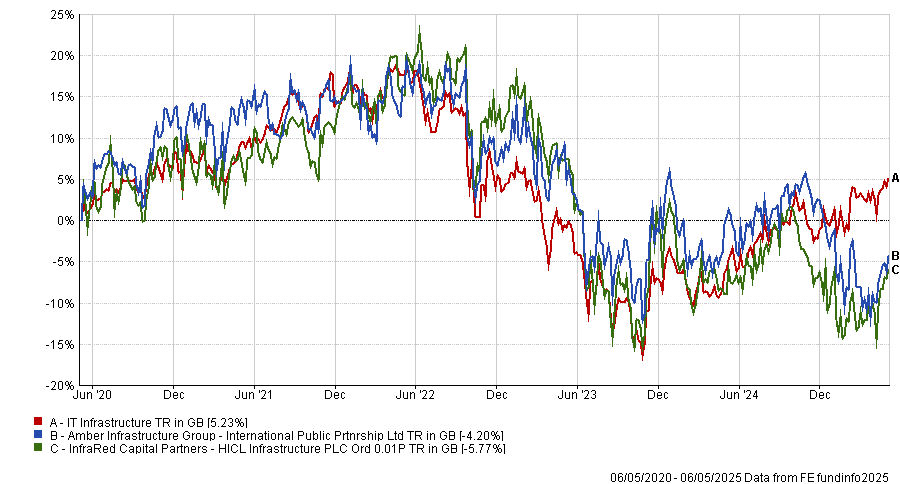

Performance of trusts vs sector over 5yrs

Source: FE Analytics

Ashley Thomas, analyst at Winterflood Securities, agreed that infrastructure is a sector to watch in falling rates as falling gilt yields cause lower discount rates, which in turn lead to higher valuations today.

“This discount rate effect would be more meaningful for longer life, lower risk ‘core’ economic infrastructure assets such as the water, energy, transport and accommodation investments held by one of our picks, HICL Infrastructure, where nearly 90% of portfolio revenues are contracted or regulated,” he added.

Winterflood estimates that a 1% reduction in HICL’s 8.1% discount rate would increase its NAV by around 11%, adding around 5% to the share price, given its stock currently trades at a 24% discount.

Renewable energy

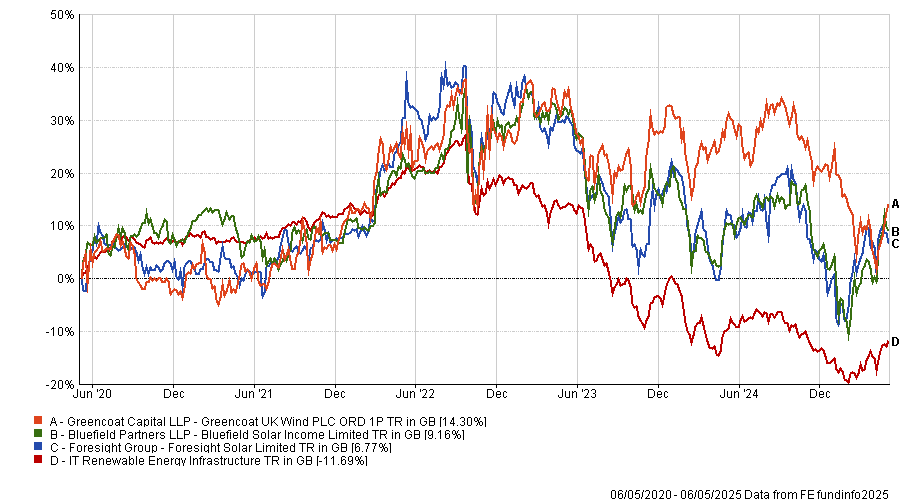

Rachel May, research analyst at Shore Capital, said: “The pure-play solar funds are currently trading on the widest discounts on record despite a growing number of disposals at values consistent with funds’ balance sheets, demonstrating the ongoing discount between public and private valuations.”

She chose Foresight Solar, which is trading on a 30% discount with a 10% yield, because of its holdings in solar assets located across the UK, Spain and Australia, with a development pipeline of Spanish battery energy storage systems and more solar projects.

It has a high proportion of long-dated, inflation-linked revenues (88% of revenues are contracted for the current year), which provides good visibility over future cashflows, and the dividend is expected to be more than fully covered.

Performance of trusts vs sector over 5yrs

Source: FE Analytics

Markuz Jaffe, analyst at Peel Hunt, likes Greencoat UK Wind, as a pure play on UK onshore and offshore wind assets with a strong track record of cash generation. Its dividends are explicitly linked to UK inflation and form part of the trust’s total return profile.

“As a result of its geographic focus, Greencoat UK Wind is clearly exposed to sterling base rates through the combination of changing gilt yields driving underlying asset valuations, investors’ dividend yield expectations influencing the share price and any potential reductions in financing costs,” he explained.

Winterflood’s Thomas pointed to Bluefield Solar Income as another that could benefit from lower long-term gilt yields and therefore discount rates. He predicted that a reduction of 1% in the discount rate would increase NAV by around 12%, adding around 18% to the share price given the 21% discount.

Property

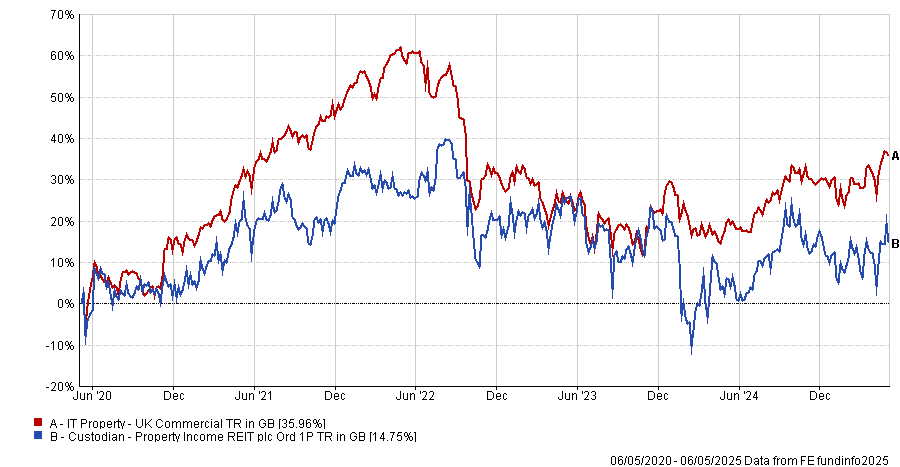

Emma Bird, head of investment trusts research at Winterflood Securities, said property investment trust discounts have closely tracked UK gilt yields, widening as yields rise and narrowing as they fall. Falling rates should improve sentiment, support asset valuations and help reduce current discounts, she argued.

Performance of trust vs sector over 5yrs

Source: FE Analytics

Bird went for Custodian Property Income REIT as her pick in this space, as it has 18% of its borrowings subject to a variable rate linked to the sterling overnight index average rate (SONIA).

A cut in the Bank of England base rate should correspond with a reduction in SONIA, reducing debt costs for funds with unhedged floating rate debt using it as a reference rate. This should mean higher earnings for trusts like Custodian Property Income REIT as SONIA falls.

Private equity

Deutsche Numis’ Ord said portfolios of ‘jam tomorrow’ stocks that were hit hard when rates rose but could rally when they start to come down again, giving the Private Equity and Growth Capital sectors as examples.

She likes Seraphim Space Investment Trust in the current climate: “Perhaps more significant than the change in interest rates is a focus on defence spending, which will be positive for a number of portfolio companies which provide services such as satellite constellations with near-real-time imagery, satellite communication antenna and logistics and waste management.”

Peel Hunt’s Jaffe went for HarbourVest Global Private Equity, which offers global exposure to private companies through a fund-of-funds structure.

It currently trades on a wider-than-average discount of 43% but Peel Hunt thinks this could narrow as interest rates come down and the trust’s initiatives to maximise returns (a doubling of the allocation to its distribution pool, a simplified investment structure and the introduction of a continuation vote) start to take effect.