Praveen Kumar has been ousted as manager of the Baillie Gifford Shin Nippon trust after an internal review, the board of the trust has announced.

Deputy manager Brian Lum has been promoted to lead portfolio manager while Kumar will be leaving Baillie Gifford as a result, a spokesperson for the firm confirmed.

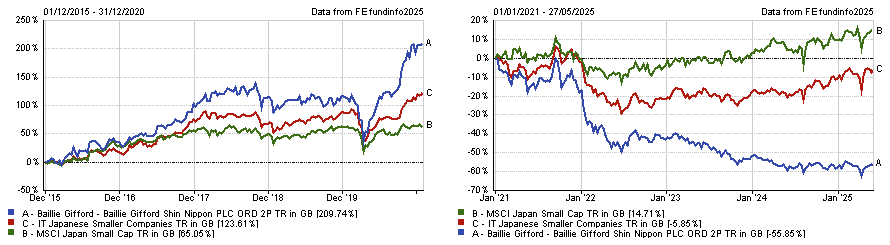

It follows an internal review to address a challenging five years for the £310m trust, in which its performance has suffered. The share price has fallen by more than a third (37.4%) in the past five years and currently sits on a double-digit discount to its net asset value (NAV) of 12.9%.

Lum, who has been at Baillie Gifford 18 years, will be flanked by Jared Anderson, who has eight years of experience at the firm and also co-manages the Baillie Gifford Japanese fund.

No changes are anticipated to the company's investment objective or policy, nor to the investment process applied by the Japanese team, a statement from the firm read.

Chair Jamie Skinner said these portfolio management changes “are one of several measures Baillie Gifford has implemented over the past year”.

Kumar took over as lead manager of the trust in December 2015. Between 2015 and 2020 his performance was “exceptionally strong” according to Chris Salih, head of multi-asset and investment trust research at FundCalibre, who attributed the underperformance to multiple factors.

Performance of fund against index and sector over multiple timeframes

Source: FE Analytics

The yen fell 25% versus the US dollar in the past five years, which has been good for exporters (such as large AI companies, electric vehicles, semiconductor related businesses and renewables), but detrimental to the high-growth small-caps the trust focuses on. Having been hammered in the reflationary rally, many of these companies have seen little change in sentiment, Salih noted.

“Returns have been challenged, but this is to be expected to a certain degree given the trust’s inherently volatile nature, compounded by broader headwinds facing Japanese smaller companies,” he said.