The average portfolio should have around 15% in gold to benefit from the significant upside still in the asset class, according to Ernst Knacke, head of research at Shard Capital.

Knacke’s team has remained bullish on the precious metal this year, with Shard’s portfolios holding anywhere from 15% to 20% in physical gold bullion or mining equities, depending on clients' risk tolerance.

This allocation is relatively high compared to conventional wisdom. Earlier this year, for example, Fidelity International suggested an allocation of 5% to 10% would be suitable for most investors.

However, Knacke is not alone in favouring a higher position in gold, with precious metal asset manager Sprott suggesting a 10% to 15% allocation within a diversified portfolio. Veteran US hedge fund manager Ray Dalio argued that a 15% allocation to the yellow metal made sense at the moment.

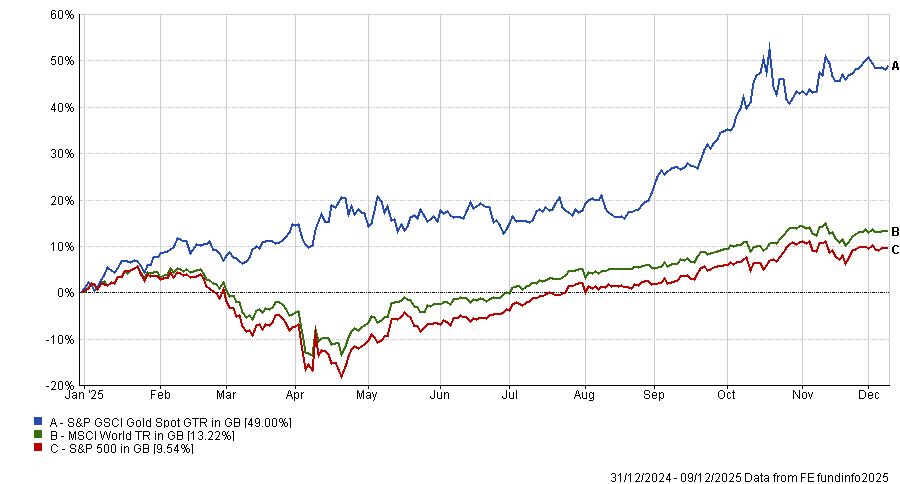

Gold bugs have been rewarded for their bullishness this year, as the price of gold surged to more than $4,200 per ounce while the S&P GSCI Gold Spot rocketed up by 49% in sterling terms. This outperformed both the S&P 500 and the MSCI World, as demonstrated by the chart below.

Total return of indices YTD

Source: FE Analytics. Total return in sterling.

As gold has soared, experts have been divided between those who remain bullish and those who have started to take profits.

Knacke has remained undeterred by concerns over valuation and said the “fair value of gold is whatever the market says it is”. Investors should consider $4,000 per ounce to be the “new floor” of the gold price, not the peak and the yellow metal could have much further to run, he suggested.

“We’re loaded up on gold, but if anything, signals are telling me I should be buying more of it,” he said.

Part of his continued bullishness is the decline of the dollar. The US currency has struggled this year, partially due to US president Donald Trump’s approach to fiscal policy, causing concerns over its status as the reserve currency.

Knacke said markets might have reached “peak dollar”, leaving central banks and investors struggling to find an alternative to fill the gap as a reserve asset. While he said this trend of de-dollarisation will take multiple years to occur, gold could be a big beneficiary.

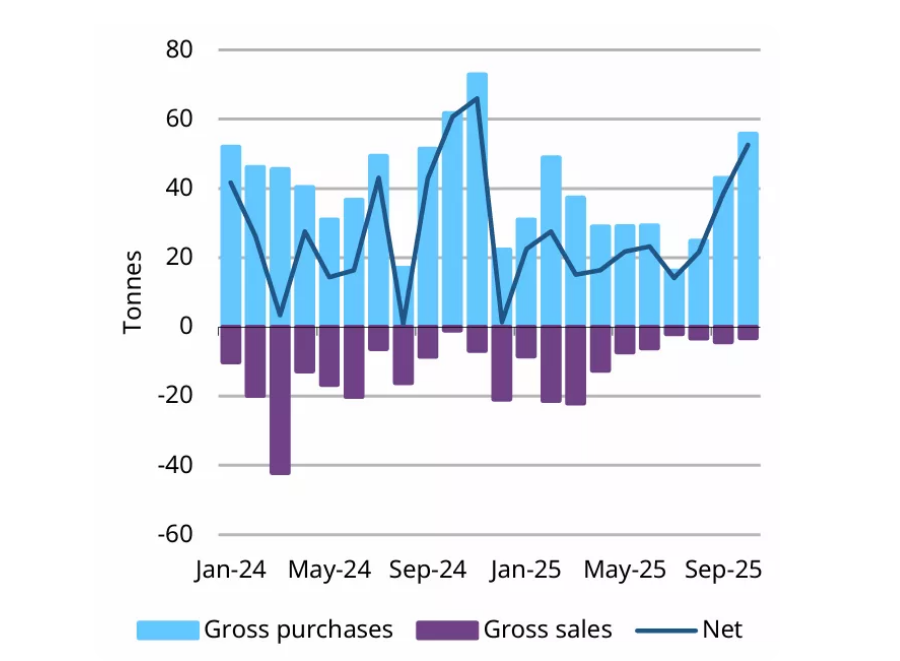

The evidence of this can be found in central banks' attempts to increase their gold exposure this year, rather than buying US treasuries, Knacke said.

Indeed, 53 tonnes of the precious metal were bought by central banks in October, according to data from the World Gold Council.

Monthly reported central banks' gold activity

Source: World Gold Council, IMF, Respective central banks. Data to 31 October

This trend of central banks buying gold could continue over the long term, Knacke said.

Governments have entered a “new fiscal age” in which they run increasingly high debts and deficits that they expect central banks to fund by buying more treasuries, leading to more inflation volatility.

Central banks searching for a reliable store of value will increasingly find themselves turning to gold, rather than relying on US treasuries, he said.

Additionally, higher market volatility on the back of elevated inflation means years such as 2022, when bonds “did not protect you in any way”, will become more common. This will backfire on investors who are overexposed to bonds and encourage them to seek other ways of protecting themselves from volatility, Knacke predicted.

“I think people will realise that to protect themselves from the uncertainty and volatility of their equity exposure, gold is as good, if not better, an alternative than bonds,” the strategist said.

As a result, gold should become much bigger parts of investors’ portfolios moving forward, which should be supportive of a further rally in the metal, he said.

“I’m not saying investors are suddenly going to hold 40% of their assets in gold, but I don't think a 15% exposure would be absurd.”

The fundamentals of the asset remain broadly supportive and the yellow metal should have enduring appeal for investors, Knacke continued.

Unlike a commodity such as oil, which is used up and needs to be repurchased, “every ounce of gold we’ve ever mined in the world still exists today, just in a different form”. This will continue to make it compelling for investors who want a stable, reliable long-term asset, according to the Shard Capital team.

“What I have confidence in is that, as a store of value, gold is the most attractive asset. It has been for the last 5,000 years and probably will still be for the next 5,000 years,” Knacke said.