Sustainable funds still have the potential to maintain good returns and even outperform, according to alpha manager veteran Mike Fox, although sentiment surrounding them has soured.

Fox, who is head of equities at Royal London Asset Management (RLAM), co-manages the firm’s UK equity, global equity and mixed-asset sustainable suite. He has spent most of his career incorporating ESG-focused themes into his investment approach.

“The sustainability space is definitely going through a consolidation phase after a number of strong years,” he acknowledged.

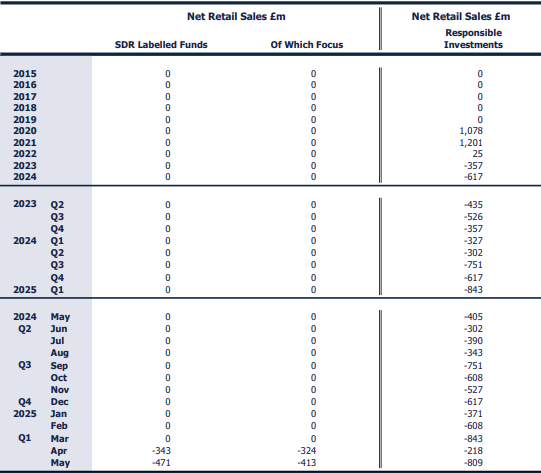

The meteoric rise of the sustainable (or ESG) investing movement dramatically slowed at the beginning of 2022 in the face of warfare, economic instability and the ‘anti-ESG’ backlash that originated in the US. This has led to consistent outflows, as displayed by the Investment Association below.

Responsible investment funds – net retail sales

Source: Investment Association

Despite the change in sentiment from investors, Fox argued that it’s a different story in the corporate world.

“Of course, you can find some examples proving otherwise, but most companies are still pro-sustainability,” he said. “Ultimately, corporates have to justify themselves to their employee and customer bases – and the view is that being good at sustainability is helpful in both recruiting better talent and creating better, more value-add products.”

With practically every industry housing companies prioritising their ESG-related commitments, sustainability-focused fund managers have choice when it comes to building their portfolios.

“We research a wide range of companies and score them on their sustainability credentials across the mixture of products and services they have,” Fox explained.

RLAM then looks to invest in the top 50% of companies with credible ESG credentials.

The asset manager’s suite of sustainable funds are largely keeping up with the pack.

“We can look at the range and can say that anybody who has bought one of them over the last few years has had a good experience from it,” Fox said.

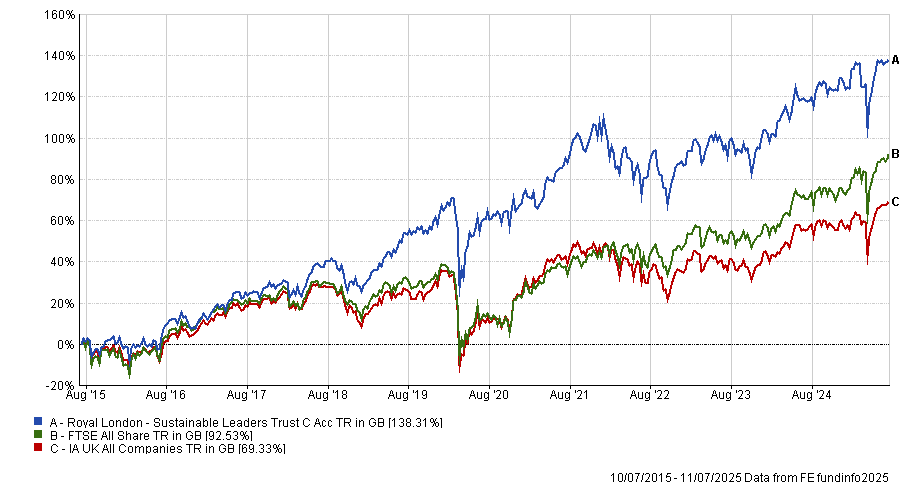

The £2.8bn Royal London Sustainable Leaders Trust is the fourth best-performing fund in its sector at the 10-year mark, delivering a total return of 140.3%. Between one to five years, the fund bounces between the third and second quartile, but has not fallen into the fourth.

Trust performance vs the sector and benchmark over 10yrs

Source: FE Analytics

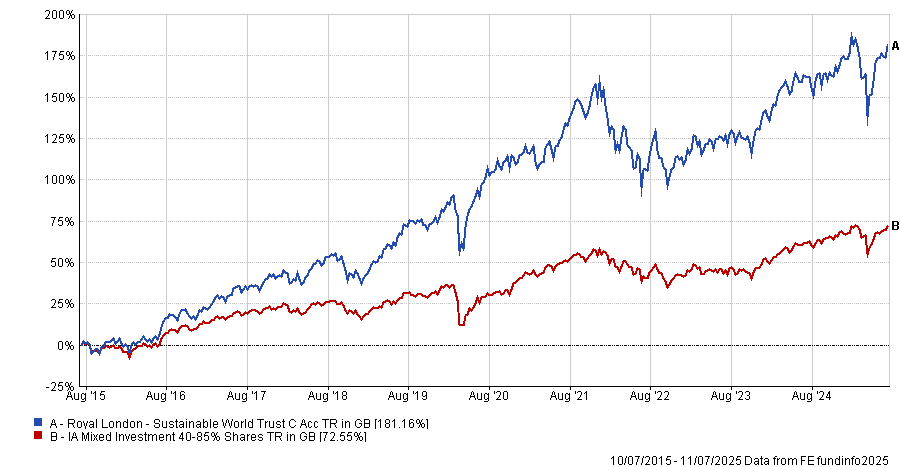

The Royal London Sustainable World Trust features in the second or first quartile for total returns against its peers over one, three, five and 10 years. At 10 years, the trust is the top performing in the IA Mixed Asset 40-85% Shares sector.

Managed by Fox, George Crowdy, Sebastien Beguelin and Daphne Tsang, the £3.4bn trust invests in companies making a positive contribution to one or more sustainability themes: clean, healthy, safe and inclusive.

Trust performance vs the sector over 10yrs

Source FE Analytics

The key to sustainable funds performing well during a period of increased scrutiny and scepticism is to adapt and ensure they have exposures to a broader range of industries, said Fox.

“A lot of the old areas to invest in can still be successful – technology’s not going anywhere,” he said. “But the sources of alpha in the market have largely evolved.”

In the 2010s, a sustainable fund could target innovative and growing companies, not worry too much about the price paid for them and deliver a good performance, Fox noted.

He also holds the view that maintaining a more equal regional split is attractive, citing Asian financials, European industrials and UK domestics as ways in which to “make good money”.

Nowadays, he said, financials have come “roaring back”.

“It’s a sector that has worked really hard to improve its sustainability credentials and has always played a critical role in society through the provision of finance and financial products – plus, it is hugely benefited by the changes in the interest rate environment,” Fox said.

Royal London Sustainable World Trust’s top 10 holdings include Broadcom, Standard Chartered and Microsoft, whereas Royal London Sustainable Leaders Trust has a top 10 including London Stock Exchange Group, HSBC and Prudential.

In contrast, companies in and around the pharmaceutical sector – like Thermo Fisher – have disappointed.

“They really had a huge benefit through the Covid period, which I think they and we underestimated as to how long it was going to take to wash through,” Fox said.

“If we had our time again, some of those names would have been reduced a lot quicker.”

So, when reviewing the performance of RLAM’s own sustainable funds, Fox has concluded that the issue isn’t that funds targeting sustainable themes can’t deliver, but rather that sustainability is “in a cyclical downturn in a structural uptrend”.

“The underlying premise from a corporate perspective and an investor perspective is still good,” he said.

Sustainable funds are more likely to underperform in a world of wars and rising oil prices but, as proven during the years of the Covid-19 pandemic, there are periods where a sustainable fund will outpace the rest of the market.

“When thinking about which scenario is going to be more dominant over time, we can observe that peace tends to be more prevalent than war, and that innovation tends to trump legacy,” said Fox.

“Sustainability has become underappreciated as a long-term style of investing. It doesn’t offend me too much – it was underappreciated for the first 15 years or so of me doing it.

“For now, we’re just heads down and grinding out good returns for our existing investors. We’ll be here to serve new ones when the mentality toward this space improves.”