Being cautious in a period of volatility may feel like the right move but many investors are going about it in the wrong way, according to Han Goshawk Global Balanced manager Simon Edelsten.

Unclear outlooks for trade, tariffs and economics, among other factors, have clouded the forecast for many companies. However, the market has adopted a “wait and see” approach to tariffs, relying on companies' results to determine the impact tariffs will have, Edelsten argued.

While he said that taking a cautious attitude makes sense right now, this is the wrong approach: “I don’t think people are doing the work on tariffs”.

He said that because of this reactive approach, many investors are taken by surprise when companies acknowledge the impact of tariffs. He pointed to Japanese robot maker Yaskawa Electric, which tanked 10% in early July when it admitted that tariffs would lead to a decrease in sales.

“Fund managers should be making forecasts and doing sensitivity analysis on their companies” instead of waiting for companies to tell them what should already be obvious. “If you make large chunks of metal in Japan and Trump’s going to tax you 25%, surely an investor should be able to tell you might lose some orders,” he explained.

Part of this incorrect approach to cautious investing is because investors got “burned” during the initial market fall when reciprocal tariffs were first announced. As a result, many are opting to do nothing with their portfolios, in case they get proven wrong again.

“Lots of people sold shares at the wrong level, but then [Trump] backed off and they felt like a bit of an idiot,” Edelsten said.

Many other investors are not taking tariffs seriously enough and are “underestimating the impact they will have”. While bond yields rose in response to tariff concerns, the “equity market has been telling investors they don’t have anything to worry about”, Edelsten explained.

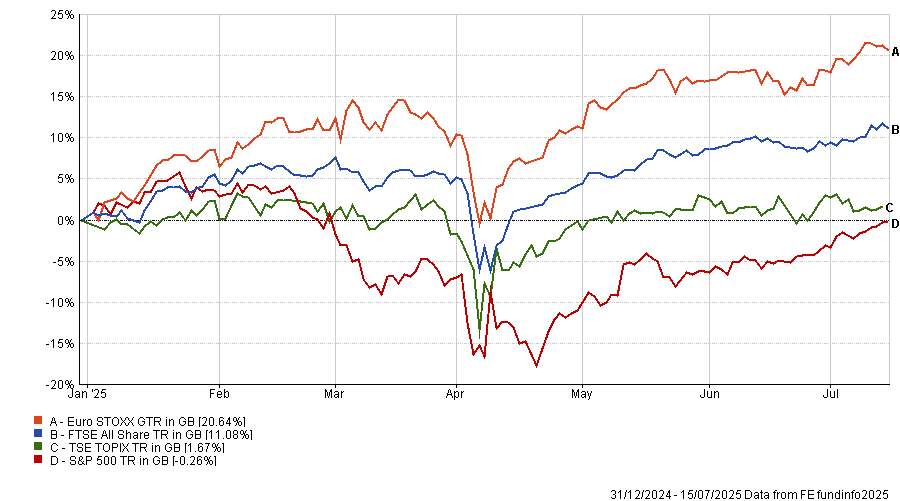

For example, most developed markets recovered quickly from Trump’s announcement earlier this month that the deadline for tariffs would be extended until 1 August, as seen in the chart below.

Performance of markets year to date

Source: FE Analytics. Total return in sterling.

Danni Hewson, head of financial analysis at AJ Bell, said, “Earlier this year, investors coined the term TACO (Trump always chickens out) trade, so it’s probably not surprising that markets didn’t react to the news that Trump’s tariff deadline has been shifted once again.”

News earlier this week that the White House has relaxed export controls on Nvidia’s chip sales to China has only further reinforced the TACO trade, according to Laith Khalaf, head of investment analysis at AJ Bell.

Khalaf added: “However, second-guessing the direction the US president will take on trade policy is a dangerous game and there is more than a little suspicion that markets are being quite complacent about the economic effects of tariffs.”

This reactive, wait-and-see approach is the wrong way to do cautious investing and is causing investors to dismiss many attractive opportunities, according to Edelsten.

A major example he argued is China.

“I think China is a great example of somewhere that’s handling tariffs well, that engaged early and worked out what they needed from America and what America needed from it,” Edelsten said.

In part, he explained this is because it is a less export-heavy economy than it used to be, with a greater focus on domestic consumption. This is helping to address some of the country’s structural issues and is making it far less reliant on international trade than it used to be.

As a result, some stocks in China are well-positioned to withstand tariffs, but are trading on extremely low valuations, which should make them very appealing to cautious investors.

“You can buy some of the biggest and best banks in China on a 6% yield, but at a very cheap valuation. But I don’t think people want to be associated with [China],” Edelsten said.

He added that there are areas of growth in the market that are still very appealing to a cautious investor, because they have little to do with Trump at all. For example, certain members of the artificial intelligence (AI) macro trend will help drive productivity, which will be the key measure of margins across various industries.

The proper way to be a cautious investor right now is not to “wait and see” in case Trump does soften his attitude, as many investors are doing, Edelsten explained. It’s to do the work and forecast which companies will do well if he does not.

“If you’re going to be in equities right now, put it in companies you’re delighted to own, even if tariffs cause bond yield to shoot up to 7% or there’s an inflation shot or whatever the next GDP stickler is,” he concluded.