Amazon chief executive Andy Jassy made headlines recently with his message to employees: AI will gradually reduce its need for corporate staff.

It’s a sentiment echoing across the tech industry.

At Microsoft, a key holding in our Aegon Global Equity Income fund, a 3% workforce reduction this year reflects a similar pivot. Software engineers are reportedly among the most affected, with AI now generating an estimated 30% of the company’s code base.

These moves mark the early stages of a broader transformation in corporate America – the ability to do more with fewer people – which will have a profound impact on the broader stock market.

And the implications extend beyond the tech sector. Enter the banks.

Tempted by efficiency gains

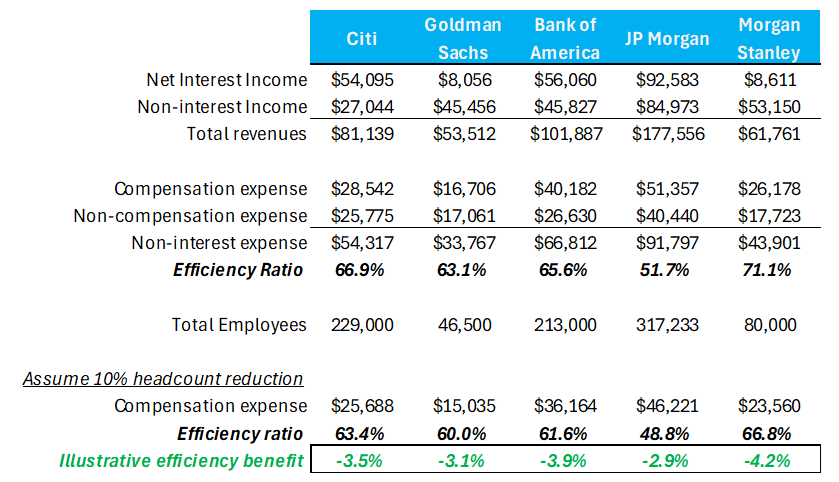

Banking is a human capital business. For the largest banks, compensation (employee costs) accounts for 50-60% of total operating expenses. But the model is evolving. Big banks are investing heavily in AI, and the productivity gains are visible.

Goldman Sachs CEO David Solomon illustrates this with an example from the firm's IPO advisory services: "An S1 filing document… 10 years ago, it would take a team of 5-6 people two weeks… Today, we can have something 95% of the way there in a few minutes."

At first glance, the conclusion seems obvious: banks should benefit at the margin by doing more with fewer people.

Source: Aegon AM

The value of the human touch

But not so fast. While AI can automate many entry- and mid-level tasks, banking remains fundamentally an advice-driven business - and advice is still a human domain.

Banks structure their organisation charts like pyramids for good reason. Junior roles form the foundation, feeding talent upward through experience and mentorship. JPMorgan, for example, talks about eliminating ‘no joy work’ – the repetitive, manual tasks that bog down junior staff.

But herein lies the tension. Those very tasks are where young bankers traditionally learn the ropes. Strip those away too quickly and you risk hollowing out the base of the talent pyramid, leaving firms without the next generation of skilled advisors.

David Solomon’s quote is telling. The 95% of work that AI can now handle will become commoditised – available to any firm with the right tools. The remaining 5% – the part that requires judgment, nuance and trust – is where the real value lies. And that value still resides in people.

A disciplined AI approach

Banks stand to benefit meaningfully from AI integration, but the most well-managed institutions are built for the long term. Top-tier management teams understand that banking returns tend to mean-revert over time.

That perspective is central to our conviction in JPMorgan, as we expect its AI investments to help drive steady growth in shareholder value over time.

CEO Jamie Dimon exemplifies this. JPMorgan targets a 17% return on tangible common equity (ROTCE) through the cycle, despite exceeding this target consistently since 2018. Wall Street frequently presses the bank to raise its guidance, but the target is grounded in long-term sustainability rather than recent performance.

This long-term mindset is backed by action. JPMorgan plans to invest $18bn in technology in 2025, focusing on employee productivity and scaling operations to absorb volume growth. The results are already visible. The bank’s technology backbone has supported a tripling of trading volumes since 2019. In payments, transaction volumes have risen 50% in recent years and AI models have helped reduce manual exceptions by more than half.

JPMorgan’s discipline on the 17% ROTCE target can be a source of frustration for some, who view it as overly conservative. Jamie Dimon is a ‘glass half empty’ leader for sure, but this attitude is borne from an appreciation for the competition that defines the banking industry. As in any mature industry, outperformance is fleeting unless it is reinvested.

Backing the right banks

This type of investment and forward-thinking approach to AI is not yet widespread across the banking sector. That’s why JPMorgan remains one of our top picks and we expect its AI investments position it well to compound equity value over time.

Cameron Shanks is an investment analyst at Aegon AM. The views expressed above should not be taken as investment advice.