Investors looking for funds should go beyond the one-, three- and five-year performance numbers, according to iBoss’s Chris Metcalfe, as these standard timeframes are “rarely representative of anything” and give no insight into how a fund will behave when the next real-world shock hits.

Instead, the chief investment officer is focused on managers with long, consistent records of running money through crises and on building portfolios that combine different styles to reduce reliance on a single approach.

“We’re just looking for managers who get most things right, most of the time,” he said. “And the longer the period you have to assess that, the better.”

iBoss places greater weight on two factors: how managers have responded in recent unpredictable months and how well they’ve navigated longer-term market cycles – Brexit, the euro crisis, the global financial crisis, Covid and the post-pandemic inflation regime.

That experience only counts, though, if the same person is still in charge. “You want the longest possible track record for the manager,” he said. “If the manager has changed, you have to start over again.”

But the job of choosing a fund doesn’t end there.

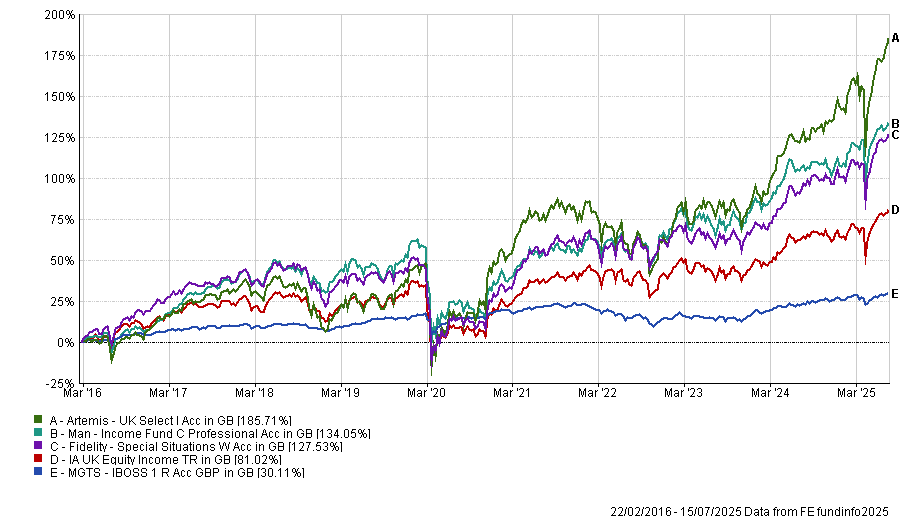

Even high-conviction managers come with performance swings, which is why iBoss rarely backs just one name in a given sector. In UK equities, for example, Metcalfe says Artemis’s Ed Leggett is “great”, but also prone to significant drawdowns. That’s why the CIO holds him in his portfolios alongside Fidelity’s Alex Wright and Man Group’s Henry Dixon.

All three have been awarded the FE fundinfo Alpha Manager title and have strong track records, but crucially their funds have different styles and risk profiles.

Performance of funds against sector over 10yrs

Source: FE Analytics

Legget, who co-runs the Artemis UK Select fund, focuses on identifying companies with conservative valuations relative to their peers, using a systematic process that combines financial and economic analysis with stock-specific insight. He also has the ability to take short positions where he sees overvaluation.

At the same time, Wright (Fidelity Special Situations) concentrates on out-of-favour stocks with recovery potential, often among small- and mid-cap companies – something Metcalfe sees as critical in the current environment.

Finally, Dixon brings a more disciplined valuation approach through Man UK Income, screening for both distressed companies trading below asset replacement cost and stable, cash-generative firms with strong dividend growth. The inclusion of corporate bonds, used selectively when they offer better value than equities, adds another layer of income generation.

“Dixon’s approach really complements the other two,” said Metcalfe. “He's very consistent and valuation-led, but with a clear focus on balance sheet strength and resilience – and that’s become even more important since Covid.”

This stylistic diversification at the manager level allows investors to stay the course and cut through individual underperformance. “You get all these guys firing at different times,” he said. “But the key is they’ve all proved themselves across cycles.”

Things get slightly more complicated when scouring sectors with few constituents, where comparisons are more difficult. In those cases, said Metcalfe, investors are left to look at the individual funds which have been there long enough to prove themselves and say: ‘Has this journey been something I could accept going forward?’

Once the funds are chosen and bought, turnover remains low in the overarching iBoss portfolio, but monitoring is frequent. “They don’t have to be going up all the time, but they have to be doing what we think they’ll do.”

This approach extends across asset classes – the fund selector recently increased his portfolios’ weighting to active managers to its highest level yet (as he told Trustnet) with both bonds and equities now predominantly run by active strategies.

As macro volatility intensifies and policy risks rise, that human element becomes even more important. “With the new trade policies worldwide, every aspect of the global economy is up for grabs,” said Metcalfe. “The value of data before November last year is much lower – everything has changed.”

In that kind of environment, “you want the longest possible track record for the manager” to show they can cope with the unexpected.