Many fixed income managers are missing out on attractive opportunities by sticking entirely to what they know, according to Martin Coucke, co-manager of the Schroder Strategic Bond fund.

“I think a lot of investors are biased towards one certain asset class that has worked well in the past, or towards the one they started in. So they don’t expand their investment universe,” he said.

Managers based in the US tend to favour US assets while the same is true for investors in Europe and the UK, he argued. For some this might be an issue of resources, but many large asset managers also do this, he claimed, suggesting it’s also an issue of internal bias.

Coucke thinks this is causing many fixed-income investors to miss crucial opportunities, resulting in major losses for clients.

To avoid this and differentiate themselves from competitors, the Schroders fund aims to “follow the money” by investing in idiosyncratic opportunities wherever they appear.

“If there’s value in the US bonds, you’ll see us investing in the US. If there is value in Asian bonds, you’ll see us in Asia,” Coucke said.

This strategy has proven successful with the Schroder Strategic Bond fund ranking in the top quartile in the IA Sterling Strategic Bond sector over the past one, three, five and 10 years.

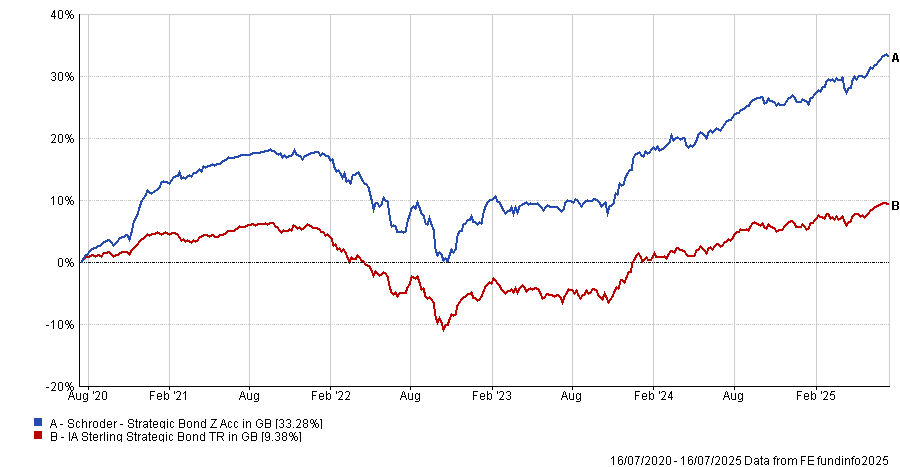

Its five-year total return of 33.3% is the second-best result in the sector during this period, beating the average peer by 24 percentage points, as seen in the chart below.

Performance of Schroder Strategic Bond vs the sector

Source: FE Analytics

Below, the co-manager explains why the fund aims to be a one-stop shop for investors' fixed income allocations, why the best and worst calls were both in 2022, and why European satellites were an interesting opportunity.

What is Schroder Strategic Bond’s philosophy?

It’s a one-stop shop: a go-anywhere fund for customers in the UK. We aim to do everything on the customers behalf, from asset allocation to duration management and security selection.

We want to be on top of the competition and, to do that, we look for pure idiosyncratic opportunities. If we don’t like US investment-grade credit, but if we see some interesting names in the asset class, we’ll do the work to buy it.

We do not have a specific performance objective because if you’re just outperforming the benchmark without beating your peers, you will not get very far.

What were your best calls in recent years?

At the end of 2022, people were saying we’d have a soft landing or a recession, which would have been quite good for duration. However, we review our macro assumptions with our large credit team every month, so while this was going on we concluded that no landing could be possible and inflation would remain stickier.

Having this in mind meant we didn’t increase duration; we kept it stable around 4-4.5 years. We couldn’t put any conviction on duration, because we couldn’t see any major economic weakness. That worked out well for us.

We also had around 45% of the portfolio in high yield at the end of 2022 due to amazing valuations and we believed growth would remain strong. These high-yield bonds performed well in 2023 and we gradually started reallocating some profits as valuations became more expensive rather than rushing for the exit.

As a result, we didn’t really lose any money, which is the number one rule of what you should be doing as an active manager.

And your worst?

If I’m being fully transparent, I think a lot of our mistakes were in early 2022.

By the end of 2021 we had a duration of about 2.8, but we increased quite sharply after the invasion of Ukraine, thinking it would generate a growth crisis, but we were wrong on that.

Our real estate risk also got completely crushed in 2022 when the market wrongfully assumed real estate companies could not withstand higher interest rates, which caused it to be one of the worst-performing parts of the market that year.

While it wasn’t to the extent that we materialised major losses, we would have ideally had less duration and less real estate exposure in 2022.

Where are you finding the most attractive opportunities?

It’s tough because I think it’s fair to say the credit market is expensive; anyone who is telling you different is lying to you.

We’re looking for idiosyncratic opportunities because there’s always mispricing in credit, but it’s probably not time to be overextended.

That said, at the start of the year, we found interesting opportunities in European satellites. They were under massive pressure last year and were out of fashion, but we felt they would come back as Europe continued to try and build its independence from the US.

I wouldn’t say they were too big to fail or anything because they were quite small, but these companies would need to exist and so we bought some very cheap bonds on the back of it.

The other place you always find interesting opportunities is real estate, because the dispersion is quite meaningful. In the US I think there’s much less opportunity and is expensive, but the dispersion in European real estate is a bit better.

What do you do outside of fund management?

I used to do quite a lot of tennis, but I’ve sort of replaced that with paddle now.

And I’ve always been a big Formula One fan, but I think that’s because it and asset management are really very similar and have a lot of the same skills. So I do quite a lot of go-karting as well.