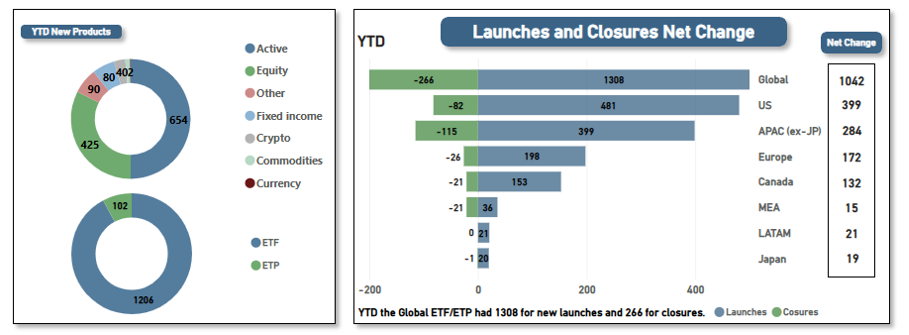

A significant milestone has been reached for exchange-traded funds (ETFs), with 1,308 new ETF products launched globally as of the end of June 2025, according to independent research and consultancy firm ETFGI.

After accounting for 266 closures, there was a net increase of 1,042 ETFs, overtaking 2024’s previous record of 878 new listings at the midpoint of the year.

As shown in the chart below, most new ETFs (654) are active while 425 are equity-focused and 80 are fixed income ETFs.

New products and new launches and closures in H1 2025

Source: ETFGI, ETF issuers and exchanges

The US launched 481 new ETFs, while the Asia Pacific region excluding Japan issued 399 and Europe 198.

The Asia Pacific region ex Japan was also responsible for the highest number of closures at 115, followed by 82 and 26 closures for the US and Europe respectively.

New launches according to region in the first half of each year

Source: ETFGI, ETF issuers and exchanges

iShares led the way with 42 listings, followed by Global X (36) and First Trust (27).

ETFGI also found that assets invested in the global ETF industry reached a new all-time high just shy of $17trn at the end of June, with assets growing 14.5% year-to-date (YTD) from $14.9trn at the end of 2024.

YTD net inflows also broke records at $897.7bn, surpassing the $730.2bn recorded in 2024.

Top 25 new launches globally in the first half of 2025 ranked by AUM as of end of June

Source: ETFGI, ETF issuers and exchanges