China’s stock market has long been a puzzle for global investors, caught between macro headwinds and bursts of explosive growth – and 2025 has been no exception.

Over the past year, aggressive government stimulus and persistent external pressures, including ongoing tensions around Trump-era tariffs, have fuelled volatility as investors weighed short-term policy boosts against deeper structural concerns.

While volatility can be seen as a red flag, recent returns across the IA China/Greater China sector suggest it may have been a necessary ingredient for success.

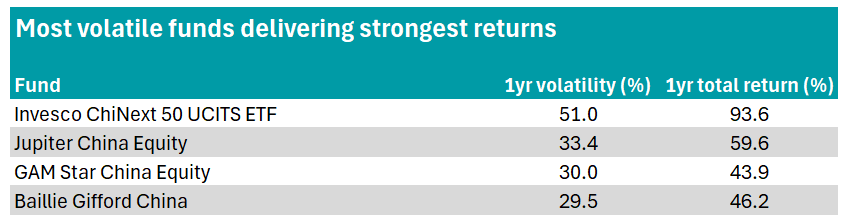

Building on previous findings, Trustnet analysis comparing volatility and total returns found that some of the most volatile funds in the sector delivered the strongest performance over the 12 months ending August 2025.

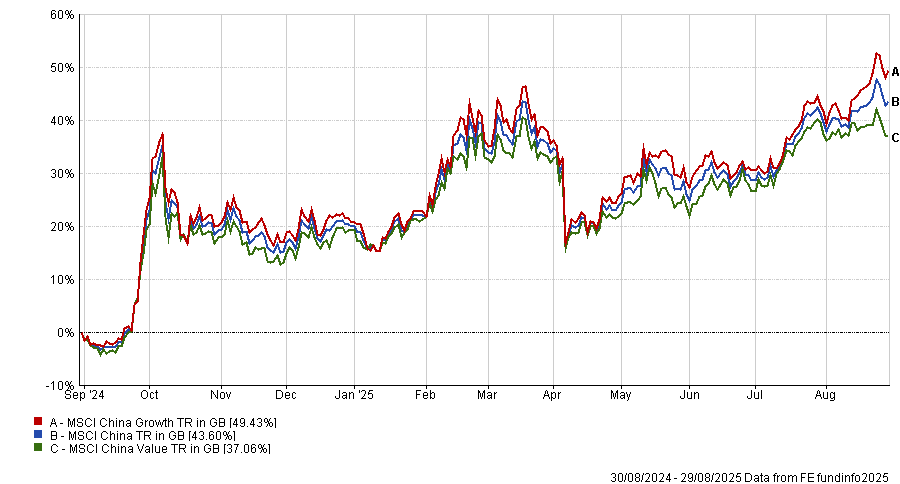

During the same period, the MSCI China index gained more than 40% in sterling terms, with growth companies outperforming their value counterparts.

Performance of MSCI China, MSCI China Growth and MSCI China Value indexes over year ending August 2025

Source: FE Analytics

Dan Coatsworth, investment analyst at AJ Bell, said: “When Chinese retail investors are feeling bullish, they have shown a tendency to place bets on more risky areas of the market in the hope of making it big.

“We have seen elements of this behaviour in 2025 as investors bid up a range of stocks – the more the market has gone up, the greater their appetite to chase certain stocks.”

As noted by Xiadong Bao, portfolio manager in international equities at Edmond de Rothschild Asset Management, most of the best-performing funds across the sector over the past 12 months are tech-centric and biased to small- and mid-caps, which are also typically more volatile.

“These are subject to more positive inflows from domestic mutual funds and retail investors,” he explained. “While the large-cap tech names are strapped in the quick-commerce subsidy war and have underperformed.”

Source: FE Analytics

As shown in the table above, Invesco ChiNext 50 UCITS ETF, in particular, delivered supersized gains for investors this year, making a 93.6% total return over the assessed period against 51% volatility.

The ETF is a “poster child for high-growth Chinese stocks”, according to Freddie Gabbertas, investment manager and emerging markets and Asia lead at Arbuthnot Latham, who remarked that it was therefore “no surprise” to see the fund top the performance list.

“The ETF’s top 10 holdings have an average price-to-earnings ratio of 58x – far above the broader China equity market’s average of 13x – highlighting the extent to which the rally has been driven by highly valued growth stocks,” he said.

These top holdings include global manufacturer of optic modules and subsystems Eoptolink Technology and Chinese battery manufacturer Contemporary Amperex Technology.

Baillie Gifford China is another strong performer this year, logging a 46.2% total return, although it has not been for the risk-averse, with 29.5% volatility.

The fund, which has been co-managed by Sophie Earnshaw since 2014 and Linda Lin since 2024, has further demonstrated its volatility over three, five and 10 years, managing a 2.4% gain, 14.7% loss and 151.9% gain respectively.

It has “reaped the rewards from clever stock picking”, according to Coatsworth. “Its biggest holding is Chinese tech firm Tencent, whose shares have continued to push higher.”

Tencent recently reported strong earnings growth and has shown the benefits of deploying artificial intelligence (AI) in its business, thus providing the kind of narrative that Chinese retail investors have been looking for, he noted.

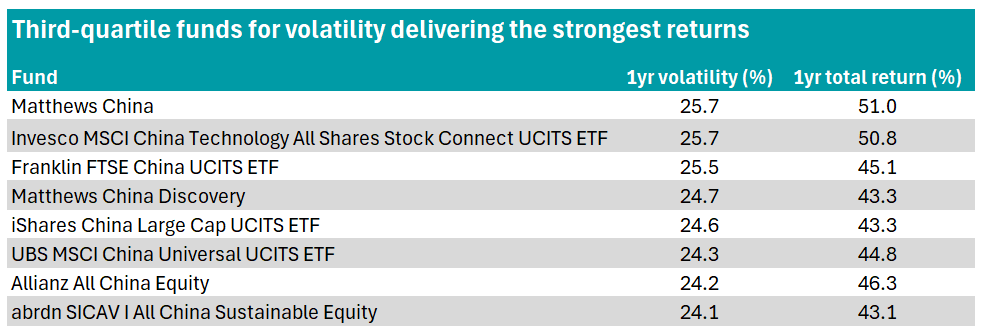

However, while the most volatile funds dominated the top of the performance table, investors did not necessarily have to take on the highest levels of risk to see strong returns.

In fact, several funds in the third quartile for volatility also delivered top-quartile performance, with returns spanning 43%-51%.

Source: FE Analytics

With 25.7% volatility, Matthews China managed a 51% total return over the assessed 12-month period. The $20.4m fund is also one of the most consistent, remaining in the first or second quartile for total returns over one, three, five and 10 years – managing a 136.1% gain over the decade.

The fund is managed by Andrew Mattock, alongside deputy managers Winne Chwang and Sherwood Zhang, with top holdings stretching across tech firms and financials, including China Life Insurance Company and online shopping platform Meituan.

Meanwhile, Matthews China Discovery – also managed by Mattock and Chwang – had a slightly lower volatility (24.7%) and return (43.3%) over the assessed 12-month period, which nonetheless marks a strong improvement. It languished in the fourth quartile among peers for total returns over three years and five years, losing 8.4% and 15.7% respectively.

The $109.8m fund invests around two-thirds of its net assets in small companies located in China, defining such companies as those with a market capitalisation under $5bn or the largest company in the MSCI China Small Cap index.

Its comparatively weaker longer-term performance compared to Matthews China is likely driven by this heightened small-cap exposure.

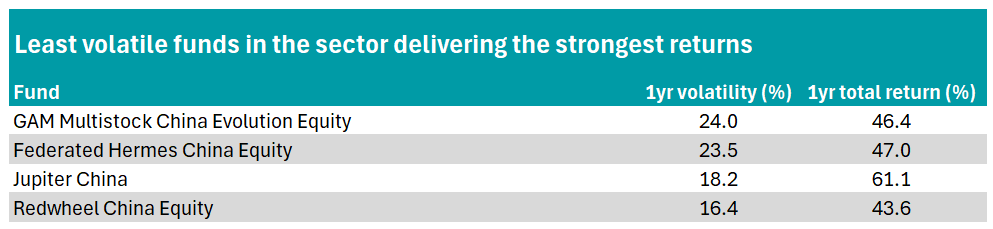

There were also strong performing funds to be found among the least volatile in IA China/Greater China.

Source: FE Analytics

The biggest return by one of the least volatile funds was delivered by Redwheel China Equity, with 16.4% volatility and a 43.6% total return – beating Matthews China Discovery.

However, despite the strong 12-month performance, the $18.5m fund made an 8.5% loss over three years and a 6.2% loss over five years.

Similar to other funds in the sector, its holdings are dominated by familiar large-cap names such as Tencent and Alibaba, alongside innovative tech-driven companies like electric car manufacturer NIO.

Jupiter China made the best returns of the least volatile funds in the sector over the assessed 12-month period, with 18.2% volatility in exchange for a 61.1% return.

The £96.1m fund also beat the sector and index over one, three and five years, although is in the fourth quartile for total returns over 10 years at 49.8%.

The fund aims to achieve long-term capital growth through investing principally in companies in China but it may also invest in companies operating in other countries which, in manager Ross Teverson’s opinion, conduct a material proportion of their business in China or derive a material proportion of their earnings from activities in China.

As such, its top holdings include British multinational bank Standard Chartered and Singapore-based online travel agency Trip.com.