European small-caps have shot past the S&P 500 since 2000 despite a lack of investor interest in Europe, according to JP Morgan Asset Management’s Jack Featherby.

“I think that can come as a shock to a lot of people, who seem to think that the only way to get growth is through access to North American mega-caps,” the manager said.

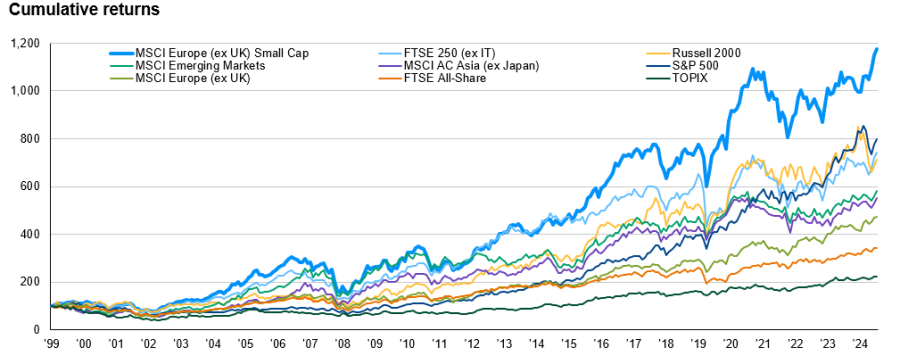

Over the past 25 years, the MSCI Europe Ex UK Small Cap Index has climbed more than 1,200%, outpacing most developed market indices.

Long-term performance of major equity markets

Source: JP Morgan Asset Management. All series are rebased to 100. Data from 31 Dec 1999 to 30 Jun 2025. Data in sterling.

Despite this “fantastic performance”, Featherby said the asset class has remained “largely forgotten” and represents less than 1-2% of the global index and investors' portfolios. As a result, investors have developed several misunderstandings about European small-caps and mistakenly concluded that “the US is the only game in town”.

European smaller companies have grown faster than both domestic large-caps and US large-caps by between 1 and 2 percentage points per year in dollar terms, he said. Part of this is because “it tends to be easier to add £1m to a small-cap” than it is for a US mega-cap company to sustain exceptional growth.

However, smaller companies in Europe also have several distinct advantages compared to other regions. The best European small-caps, he argued, are the ones that “stay small forever”.

These companies are in a sweet spot, he explained, because they dominate their respective markets but are not big enough to move up the market-capitalisation spectrum. As a result, Europe is full of “national champions” that fly under the radar.

“There’s a big asymmetry of returns in European small-caps. There are stocks on the market, such as Fortnox [a Swedish software company], which has surged 300% over the past 20 years, but it’s still a small-cap,” Featherby explained.

These kinds of high returns are not uncommon, he explained, and it is part of why the market has smashed the S&P 500 over the long term.

However, he also noted that the outlook for European small-caps is now better than it has been for several years and it could continue to outperform the S&P 500.

“We finally have a catalyst for small-caps' resurgence,” the JP Morgan Asset Management fund manager said.

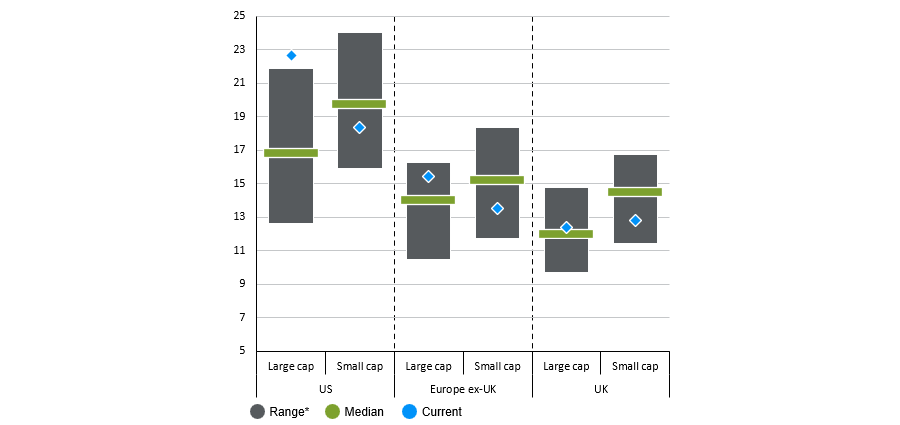

Part of this is valuation. Over the past few years European small-caps have slid to discounts of around 20% compared to their large-cap counterparts. This is because domestic smaller companies were punished by significant uncertainty, including surging geopolitical tensions, fluctuating interest rates and an energy crisis, Featherby explained.

As a result, there was a “flight to quality” in Europe, as investors poured into multinational businesses. This has caused large-caps to rerate upwards, causing them to become expensive relative to their history, while small-caps remain comparatively cheap, he said.

Regional large and small cap forward price-to-earnings ratios

Source: JP Morgan Asset Management. Forward P/E ratio is the price to 12-month forward earnings. All indices are MSCI. Range and median calculated from 2008.

This means that, even if headwinds re-emerge, many European small-caps have priced in potential volatility. For this reason, Featherby is “less worried” about recent developments, such as the vote of no confidence in France.

“The valuation gives me a bit of comfort. As far as I can tell, there’s no bubble in European small-caps that you need to worry about,” he said.

The compelling discounts of European small-caps are a great starting point, but many of these prior headwinds are now in the past. For example, the energy crisis is mostly behind investors and interest rates are now at a more moderate level.

On top of this, there have been some broadly supportive developments this year that he expects will be better for small-caps than their larger-cap counterparts. For example, he pointed to the German stimulus package, which pledged €500bn to infrastructure.

“When it comes to something like this, Germany won’t be spending money on American companies to build things; it will be giving the money to domestic companies to build at home,” Featherby argued.

This is going to benefit national champion small-caps far more than large-scale multinational entities, he explained.

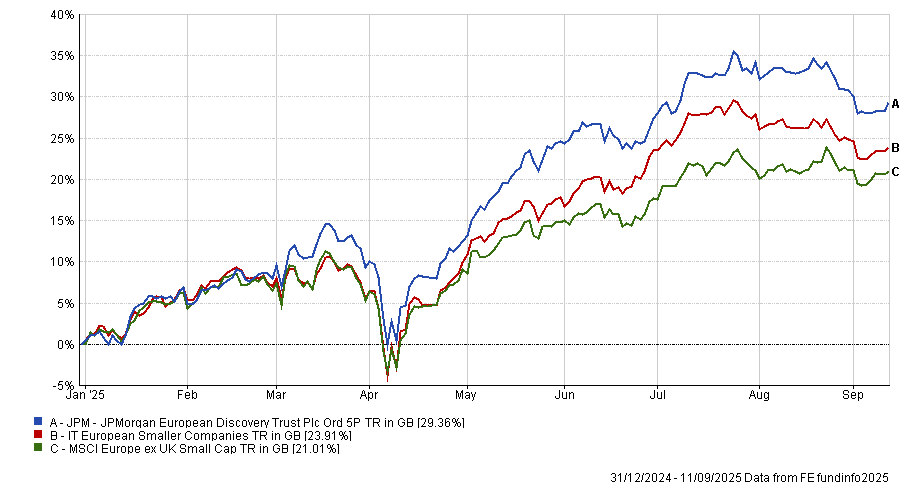

Featherby is one of the co-managers on the JPM European Discovery Trust, which has posted a top-quartile return in the IT European Smaller Companies sector year to date and firmly beaten the MSCI Europe Ex UK Small Cap index. It has even managed to outperform the S&P 500 (up 2.7%), so far this year.

Performance of trust vs sector and benchmark YTD

Source: FE Analytics