Funds investing in emerging market stocks have surged to the top of the performance tables this year, with those run by the likes of Jupiter, Artemis and M&G making gains far higher than once-dominant US equities.

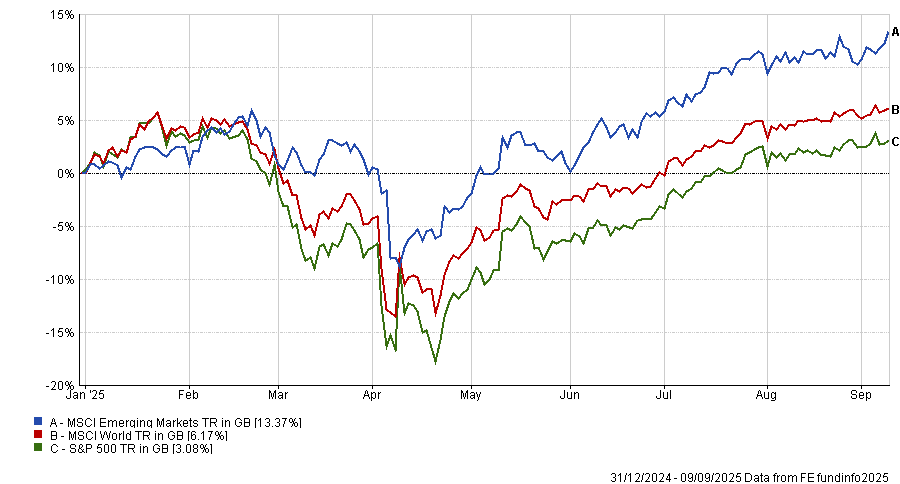

The MSCI Emerging Markets index has risen 13.4% in 2025 so far (in sterling terms), compared with a 6.2% gain for the developed markets-focused MSCI World. Developed markets have been derailed this year by US stocks, with the S&P 500 up just 3.1%.

Strategists at the BlackRock Investment Institute said emerging markets have had “a stellar year so far” in 2025 and put this down to three drivers: a weaker US dollar, a steady macro backdrop and mega forces.

Performance of MSCI Emerging Markets vs MSCI World in 2025 to date

Source: FE Analytics. Total return in sterling between 1 Jan and 10 Sep 2025

Emerging market currencies have strengthened in 2025, supported by a roughly 10% decline in the US dollar against major currencies, according to LSEG data. A weaker dollar tends to lift emerging market performance – including stocks – by lowering the cost of servicing dollar-denominated debt while increasing local-currency returns when converted back to dollars, BlackRock said.

On the supportive macro backdrop, the growth gap between emerging and developed markets is narrowing, but structural reforms in countries such as India, Vietnam and Brazil point to more resilient long-term growth, the firm added.

With inflation falling below pre-pandemic levels and rate cuts underway across several emerging markets, BlackRock thinks central banks may gain further room to ease policy once the US Federal Reserve begins to lower rates.

BlackRock’s current thinking is that mega forces, rather than macro factors, are the new drivers of returns but noted that their impact is uneven across emerging markets. It pointed to structural shifts such as supply chain realignment, technological innovation and the low-carbon transition as driving opportunities across emerging markets.

Countries like Mexico, Vietnam and Brazil are gaining from trade diversification, while Taiwan, South Korea and China are advancing in AI and semiconductors.

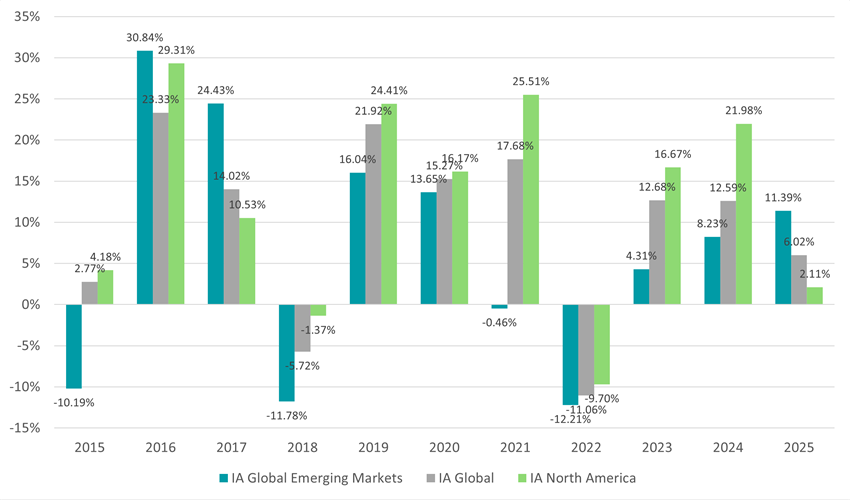

Performance of emerging market funds vs global funds by calendar year

Source: FE Analytics. Total return in sterling between 1 Jan and 10 Sep 2025

Against this backdrop, the average fund in the IA Global Emerging Markets sector has outperformed its IA Global peer, with an 11.4% return versus 6%. As the chart above shows, emerging market equities funds had underperformed global strategies for seven years in a row before 2025.

Some 162 IA Global Emerging Markets funds are beating their global peers over 2025 so far, or 92% of the 176 in the sector. In 2024, only 26 emerging market funds outperformed the IA Global average.

Global emerging market funds are also beating the IA North America sector, with their average 11.4% return significantly ahead of the 2.1% made by the US peer group.

There are 166 IA Global Emerging Markets funds ahead of the IA North America average this year, compared with just one in 2024.

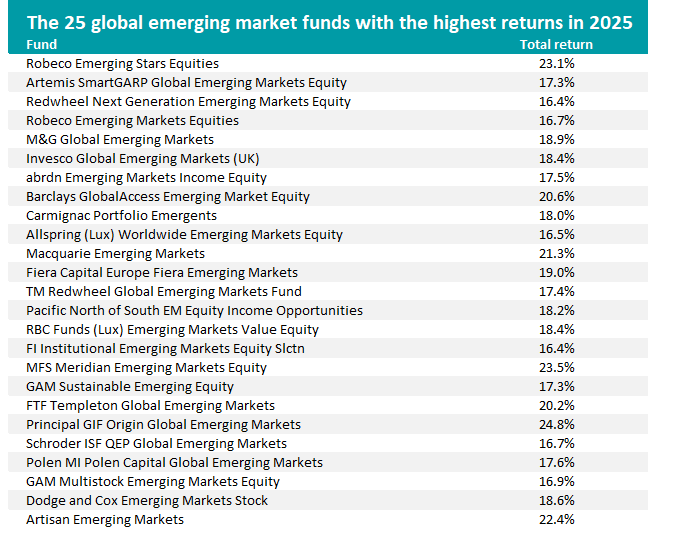

Source: FE Analytics. Total return in sterling between 1 Jan and 10 Sep 2025

Over this period, Principal GIF Origin Global Emerging Markets has been the best-performing member of the sector with a total return of 24.8%.

Managers Chris Carter, John Birkhold and Tarlock Randhawa ran the fund at boutique Origin Asset Management, which was acquired by Jupiter Asset Management at the start of 2025.

The fund is overweight China, Greece and Poland, all of which have made strong returns over the year to date and outpaced the wider emerging market universe.

With assets under management of £54m, it is one of the smaller members of the peer group. However, the table above does contain some larger and better-known funds, such as Artemis SmartGARP Global Emerging Markets Equity, Redwheel Next Generation Emerging Markets Equity, M&G Global Emerging Markets, Invesco Global Emerging Markets and abrdn Emerging Markets Income Equity.

While IA Global Emerging Markets is one of the best sectors to be invested in this year – ranked ninth of the 56 peer groups in the Investment Association universe – more focused ones have done even better.

IA Latin America is the best sector over the year to date with an average return of 24%, thanks to low stock valuations combined with better-than-expected economic data.

BlackRock GF Latin American has been 2025’s best performer here, up 28.6%, followed by abrdn Latin American Equity (27.5%), iShares MSCI EM Latin America UCITS ETF (26.5%) and Barings Latin America (25.4%).

China is also having a strong year, with the average IA China/Greater China member up 18.9%, good enough for second place. Invesco ChiNext 50 UCITS ETF (up 37.7%), Jupiter China (30.4%) and Jupiter China Equity (29.6%) are the leaders here.

IA Asia Pacific Excluding Japan trails a little behind the global emerging markets sector, with a 10.9% average return. This makes it the 11th-best Investment Association sector this year.

Top performers include Barclays GlobalAccess Asia Pacific (ex-Japan) (up 20.3%), Federated Hermes Asia ex-Japan Equity (19.3%) and HSBC MSCI AC Far East Exjapan UCITS ETF (19.1%).

However, BlackRock Investment Institute also said that “selectivity across countries and sectors remains key” when investing in emerging markets.

The data backs this up. FE Analytics shows that not all emerging markets have been good investments this year, as IA India/Indian Subcontinent is the worst peer group; the average Indian equity fund has made a 9.3% loss in 2025 so far.