Growth and value investment strategies should not be seen as mutually exclusive as portfolios can be a blend of both, according to Jack Caffrey, co-manager of JPM American Investment Trust.

Speaking at the Association of Investment Companies’ (AIC) 2025 Investment Showcase, Caffrey – who leads the value side of the portfolio – argued that investors can find value in traditionally growth-oriented sectors such as technology, and growth opportunities in areas typically seen as value plays.

“Some people say there are distinct growth sectors and value sectors and we disagree with that assessment,” he said. “Blending value and growth together [allows for] tremendous flexibility.”

The JPMorgan American portfolio is currently made up of 20 value stocks and 20 growth stocks, with a 55% weighting toward growth and 45% to value.

As an example of the portfolio’s flexibility around the two, Caffrey pointed to trust holding Morgan Stanley. Up until a year ago, it was part of the growth sleeve of the portfolio, now it has moved to the value.

“There was a sense that capital markets were slowing, sentiment was changing and credibility became a concern, which meant the growth team no longer wanted to hold the stock,” Caffrey explained.

“But I wanted it. I wanted the upside of an eventual recovery of an equity-underwriting cycle, helped by that increase in valuations in the aggregate.”

Meanwhile, the growth team were excited by a former value holding, travel website Booking.com, which they incorporated into their portfolio because of its “ample supplies of data”, a useful asset to deploy artificial intelligence (AI).

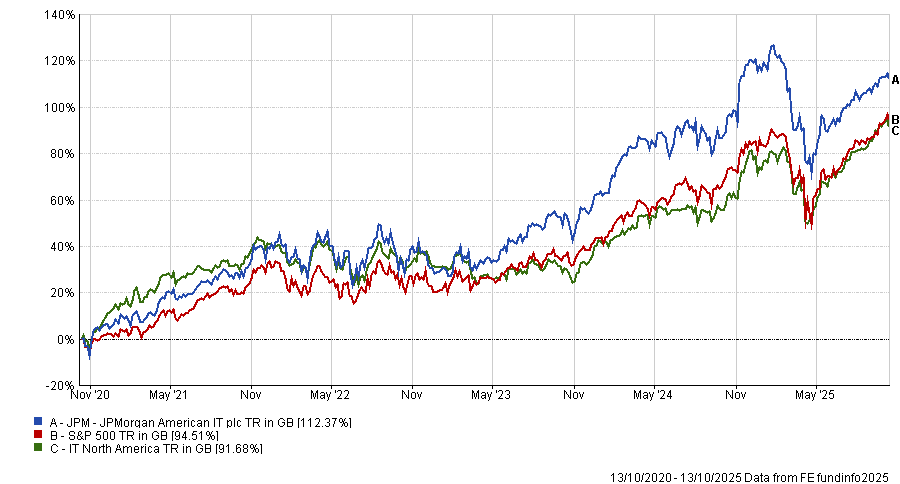

Performance of the trust vs sector and benchmark over 5yrs

Source: FE Analytics

However, Caffrey acknowledged that flexibility between growth and value can be challenging to achieve in a market increasingly dominated by a handful of mega-cap growth stocks, many of which are banking on AI to deliver on lofty promised returns.

“I would be remiss not to acknowledge that there is a concentration issue going on within the S&P 500, with the top 15 names making up 45% of the market,” Caffrey said.

He noted that 13 of these names are growth stocks, with Berkshire Hathaway and ExxonMobil being the only two value stocks.

This concentration, he said, has distorted the performance of the S&P 500 and made it more difficult to find underappreciated value opportunities.

Although the trust’s top holdings are dominated by the Magnificent Seven, the portfolio is underweight technology compared to the benchmark.

Caffrey said: “I would hate to think the market will remain dominated by a small number of bigger stocks and that we live in a world that is not the S&P 500, but the Magnificent Seven and the Forgotten 493.”

He was not alone in raising concerns about the dominance of the Magnificent Seven and the risks tied to AI-driven valuations. Other managers at the AIC event echoed similar warnings, pointing to stretched valuations and structural vulnerabilities in the US market.

James Harries, co-manager of the STS Global Income & Growth trust, said that president Donald Trump’s populist, inflationary policies, the recession of globalisation and AI-driven valuations mean the US market faces a “triple vulnerability”.

While the latter has created a wealth effect for AI stockholders, the returns from AI spending remain “indeterminate”.

“If this trend reverses, that would have a significant impact on returns and the US market,” Harries warned. “And that is an important point in terms of differentiation, because we all know the Magnificent Seven have been magnificent investments but their spending is increasing their capital intensity.”

In addition, the monetisation of AI is not yet clear, it does not benefit from network effects and the companies that have dominated the previous decade are all competing to find a place for themselves in the same space, Harries said.

“The Magnificent Seven were previously individual monopolies and fabulous businesses because they were basically without competition and didn’t require any capital – yet neither of those things holds true anymore.”

He added that the US appears “quite late cycle” in its economic expansion and that elevated valuations combined with slowing growth could pose longer-term risks for investors.

“This isn’t a particularly brilliant combination when you build in this vulnerability as a result of the AI spend,” Harries said.