The UK market has been rallying this year, but the recovery in UK equities has been powered by a handful of exceptional performers, rather than a broader resurgence, according to Nigel Yates, manager of the AXA Framlington UK Select Opportunities fund.

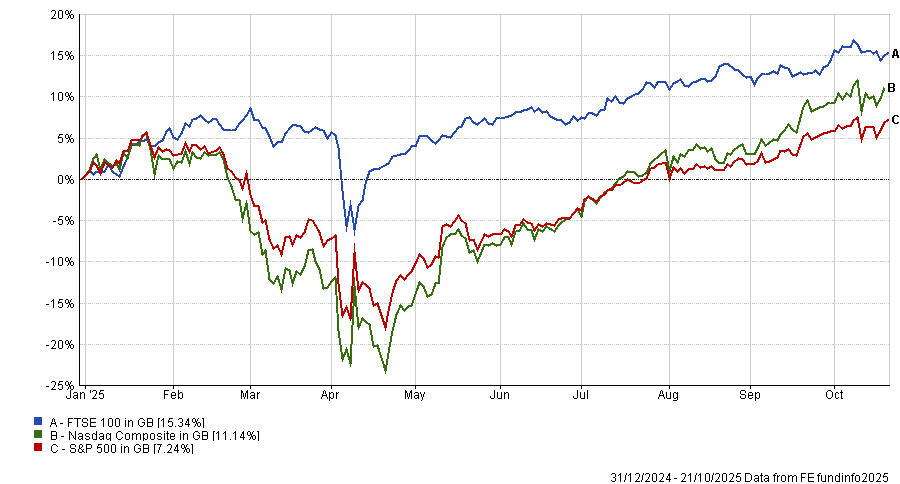

The FTSE 100 is up more than 15% in share price terms in 2025, outpacing the S&P 500 and Nasdaq Composite in sterling terms. Yates attributed this to investors trying to account for concentration risk in their portfolios and reduce their exposure to US tech.

Share price return of the FTSE 100 YTD

Source: FE Analytics. Share price in sterling

However, this strong share price growth betrays the fact that there “have actually been very few winners in the FTSE 100”.

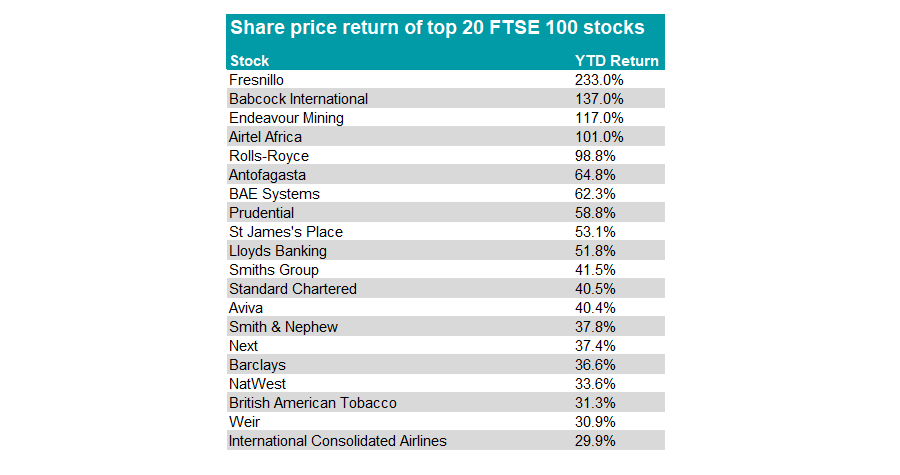

The market may be rallying, but it has been concentrated in a few key stocks in a handful of sectors, with the top five stocks gaining between 233% and 98.8% in share price terms, well beyond the 14% return of the FTSE 100.

“It’s been a good year, but it’s also been a very narrow one,” Yates said.

Russ Mould, investment director at AJ Bell, added that the top 10 companies alone are expected to pay out “53% of the forecasted total for 2025”, with the top 20 predicted to pay out nearly 70%.

Mould added: “This does serve to highlight how there is a degree of concentration risk within the index.”

Which sectors are leading the market?

AXA’s Yates pointed to the mining, defence and banking sectors as an example of the narrowness of the UK market, with half of the top 20 being in these sectors.

Over the year to date, gold miner Fresnillo led the market with a 233% share price gain, while Endeavour Mining and Antofagasta are up 117% and 64.8% respectively.

These companies have benefited enormously from the heightened interest in gold this year, as well as the constant demand for copper wires, Yates noted.

Meanwhile, four banks are in the top 20 for share price returns this year: Lloyds, Standard Chartered, Barclays and NatWest, with price performance ranging from 52.1% to 33.5%.

Banks have benefited from positive macro conditions such as higher-for-longer interest rates and good credit conditions.

Defence companies have thrived, with Babcock International (which joined the FTSE 100 in March) up 137%, the second-best performing stock on the market. Rolls-Royce (up 98.8%) and BAE Systems (62.3%) also appeared in the top 10 stocks.

Source: AJ Bell. Share price return as of 21 Oct

“If you’ve found yourself underweight any of those names or sectors, you’ve probably underperformed this year,” Yates said.

This presents some risks for investors, because if “anything changes in the narrative” that has been supporting these big winners, the UK’s rally could begin to wobble, Yates warned.

For example, Rolls-Royce, BAE Systems and Babcock were “all dreadful in October”, with share prices wobbling following the declaration of peace in Gaza, according to the AXA manager.

Where are the opportunities for investors?

The narrowness of this rally does not mean that there are not still “pockets of good value” available in areas that have been underperforming, Yates said.

Some “fantastic” stocks within the market have been treated very harshly, despite having many strong characteristics, because they have not been in these momentum-driven sectors.

For example, he pointed to quality compounding stocks such as RELX, London Stock Exchange Group(LSEG) and Experian, which have all underperformed this year, with LSEG shedding 23.5%.

These sorts have been bucketed together as “AI losers” because markets have developed the impression that the rise of Artificial Intelligence (AI) will be able to bypass the work of these more data-heavy UK tech stocks, according to the AXA manager.

“There is a feeling among investors that a lot of these companies are behind the times,” Yates noted.

However, he continued, these are the “highest quality stocks available to UK investors” with underappreciated room to grow, which have proved to have “enormous pricing power, fantastic returns and have solid compounding growth”. Many of them have large chunks of market share and wide franchises, which have enabled them to grow steadily.

Individual stocks such as LSEG look particularly well-positioned due to their partnerships with Microsoft and OpenAI, which should allow them to benefit from AI developments, according to Yates.

AJ Bell’s Mould added that investors should not underestimate the defensive companies in the UK market either.

For example, healthcare stocks such as Haleon and Hikma Pharmaceuticals are down in share-price terms this year but are expected to be substantial contributors to dividends and earnings over the next two years.

“Such a relatively dependable contribution could be valuable if growth proves hard to come by,” Mould concluded.