Retail investors are growing increasingly anxious as signs of an economic slowdown across developed markets intensify, with some countries in danger of entering recession.

One of the key markers traditionally of recession fears is the price of gold. The yellow metal has reached new highs in recent weeks, reflecting a flight to safety. As such, the search for downside protection could be a top priority for investors.

To help navigate these more turbulent times, fund pickers have highlighted a range of funds and investment trusts they think could offer resilience and stability during a period of economic uncertainty.

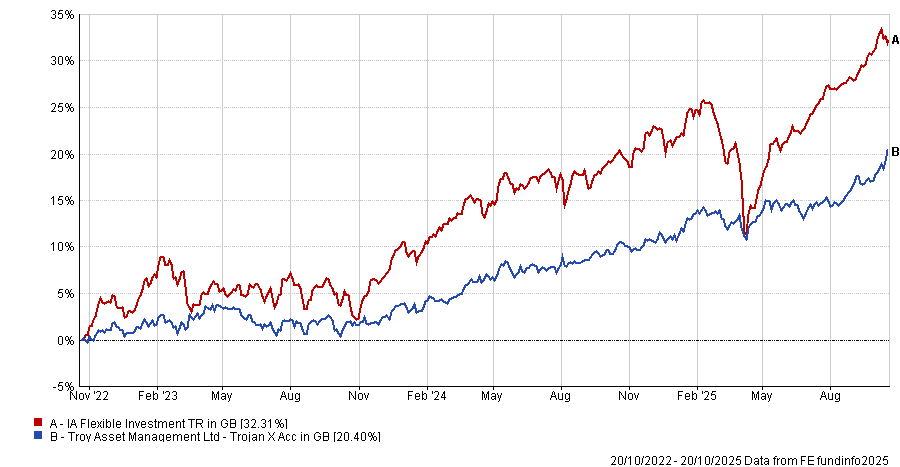

Dzmitry Lipski, head of funds research at interactive investor, picked the £5bn Trojan fund. It has been managed by Troy Asset Management founder and FE fundinfo Alpha Manager Sebastian Lyon since 2001 and deputy manager Charlotte Yonge since 2013.

“It is cautiously run, with a focus on downside protection and quality,” said Lipski.

The portfolio is defensively positioned, favouring short-dated fixed income across treasury inflation protected securities (TIPS), which make up around a quarter of the portfolio, alongside 10% in UK gilts and 8% in Japanese government bonds. The remainder is invested in equities and gold.

“Although, like many similar funds, it has struggled to outpace the UK’s high inflation rate over the past three to five years, the fund has a strong long-term track record of delivering real returns with low volatility,” Lipski said.

It has flitted between the third and fourth quartile for returns over one, three, five and 10 years, gaining 76.7% over the decade compared to the sector average of 92.6%.

Performance of the fund vs sector over 3yrs

Source: FE Analytics

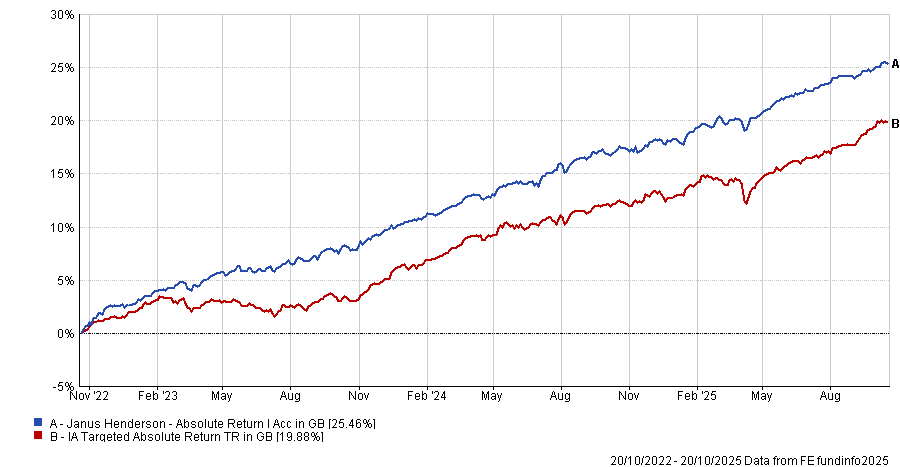

Lipski also pointed to Janus Henderson Absolute Return, which invests across equities, contracts for difference (CFDs), index futures and cash to control its net exposure to the equity market, which is currently around 14%.

The £1.2bn fund has been managed by FE fundinfo Alpha Managers Ben Wallace and Luke Newman since 2009 and has delivered top-quartile returns over one, three, five and 10 years.

“Arguably, the task of protecting capital while confined to the realm of equities only is challenging compared with more flexible asset allocation strategies but this fund has consistently delivered,” Lipski said, noting it has made returns “a little above” the Bank of England’s base rate with “remarkably low volatility”.

Performance of the fund vs sector over 3yrs

Source: FE Analytics

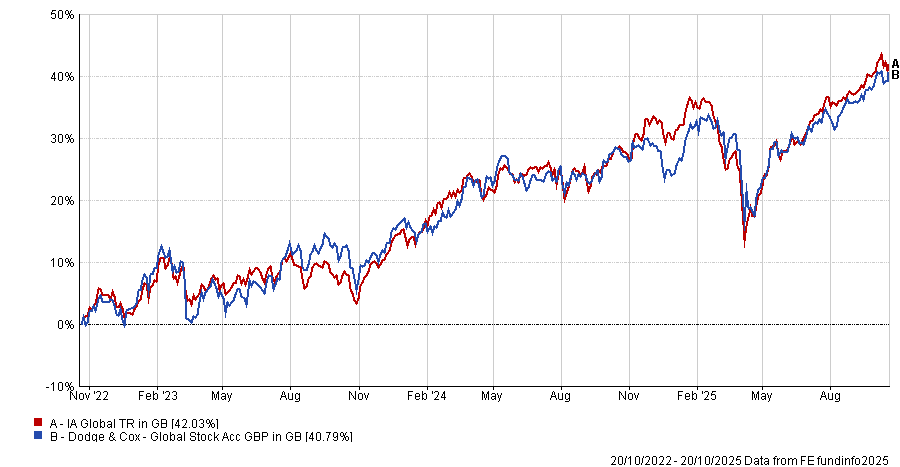

Elsewhere, Tom Stevenson, investment director at Fidelity International, suggested nervous investors could look towards Dodge & Cox Worldwide Global Stock.

“The investment approach of this global, value-focused fund is to perform detailed, original research and build a portfolio based on the conviction that comes from that work,” Stevenson said.

Although focused on identifying value opportunities, the fund is also pragmatic, Stevenson explained, meaning it will own a growth stock if it can buy it at a cheap price alongside more traditional contrarian value stocks.

Top holdings include financials, healthcare and tech, such as Charles Schwab, CVS Health Corporation and Alphabet.

Performance of the fund vs sector over 3yrs

Source: FE Analytics

More broadly, Stevenson noted it is important for investors to consider how to mitigate concentration risk in the S&P 500 index, which has long been dominated by the Magnificent Seven technology-focused stocks.

A prudent way to mitigate this risk while retaining exposure to the US market is to pick an equal weighted index tracker like iShares S&P 500 Equal Weighted ETF, he said.

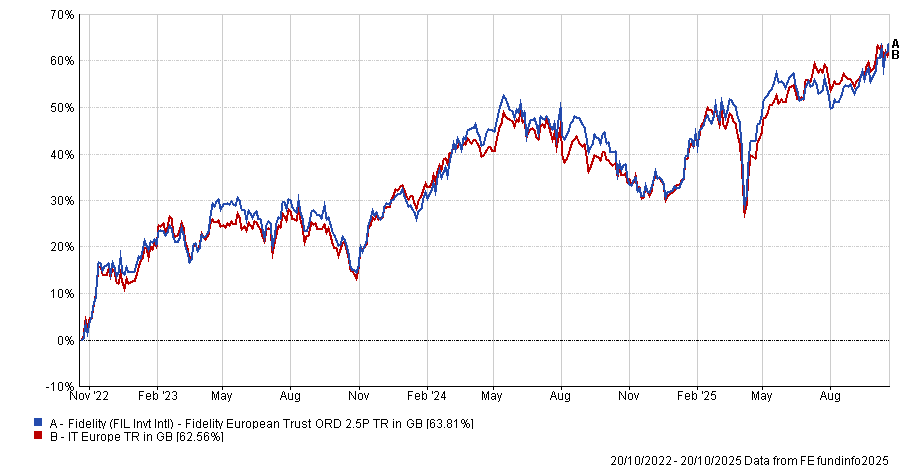

Meanwhile, Matt Ennion, head of fund research at Quilter Cheviot, looked to investment trusts and suggested the Fidelity European Trust, which is managed by Alpha Manager Sam Morse and Marcel Stozel. It is in the first quartile for returns over three, five and 10 years, gaining 228.9% over the decade.

The management team has a “laser focus on downside protection” and aims to run the portfolio on a beta lower than one, “which means the fund has a very defensive profile that should hold up well relative to the broader European market in a recessionary environment”, Ennion noted.

Performance of the trust vs sector over 3yrs

Source: FE Analytics

Also looking at investment trusts, Ashley Thomas, infrastructure and renewables research analyst at Winterflood, suggested HICL Infrastructure and International Public Partnerships.

The HICL Infrastructure trust comprises more than 100 infrastructure assets across critical sectors such as water, electricity and health. Thomas noted the revenue base is “secure” with 63% of revenues contracted, 23% regulated and just 14% demand driven.

It currently trades on a discount of 21.5% to net asset value (NAV) and offers a 6.9% dividend yield.

Meanwhile, International Public Partnerships derives 50% of its revenue base from regulated assets, 38% from public-private partnerships and 12% from demand based operating businesses.

It has a slightly narrower discount of 20.1% and offers a higher dividend yield of 8.5%.

“While both offer a degree of inflation protection, they would benefit from a reduction in real yields that could occur from a lower growth environment – a 1% reduction in discount rates would result in an around 10% increase in the HICL net asset value and around 8% for International Public Partnerships,” Thomas said.

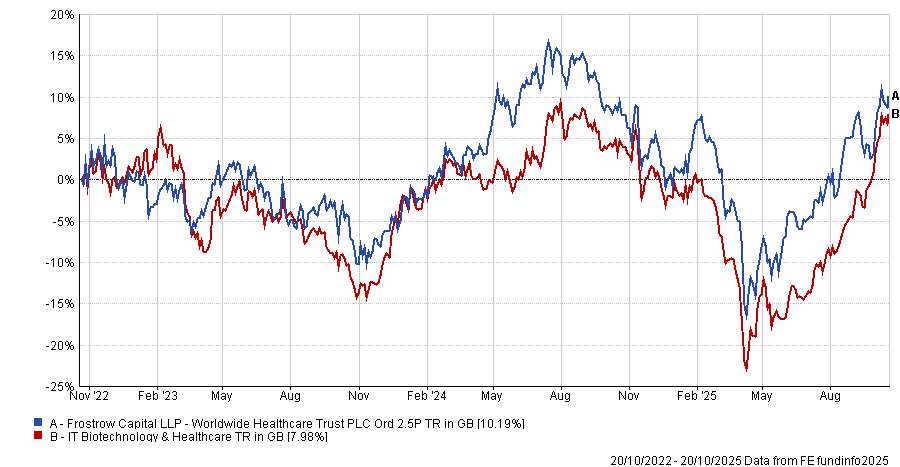

Thomas’ colleague Shavar Halberstadt, equity research analyst at Winterflood, highlighted the Worldwide Healthcare investment trust, which offers investors exposure to both healthcare and biotech.

“While healthcare is generally considered a helpful defensive option in an economic slowdown, biotech tends to outperform in the market during recessions,” he said.

He acknowledged that the £1.4bn trust’s medium-term performance has suffered from negative sentiment towards small and mid-cap biotech names and its China exposure but said “this tide has now turned”, with the fund delivering a NAV total return of more than 18% over the past six months compared to 6% for the MSCI World Health Care index.

Performance of the trust vs sector over 3yrs

Source: FE Analytics

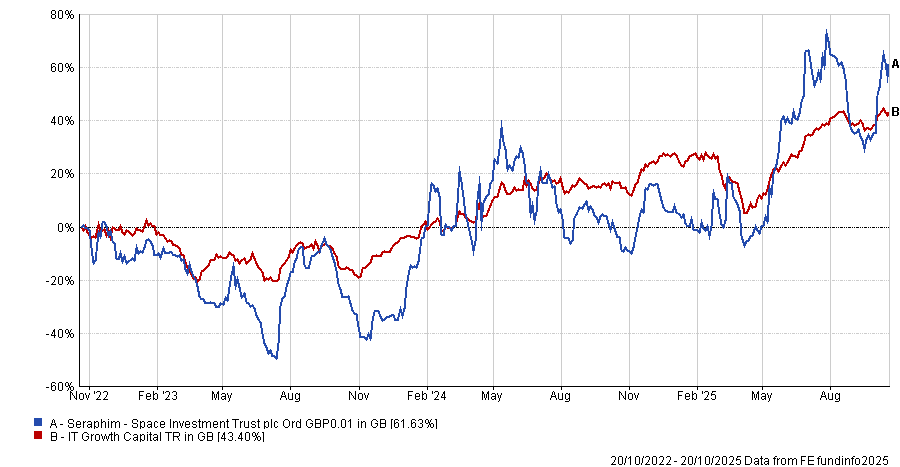

Seraphim Space was also selected by Halberstadt. It is trading on a 27.8% discount to NAV. With recent strong performance driven by an uptick in global defence and space spending, Halberstadt said it will be “relatively immune to a recession, as the trust’s portfolio companies largely contract with government, militaries and space agencies, with limited to no consumer exposure”.

Moreover, a significant economic slowdown is likely to drive further interest rate reductions, which will support the valuation of the fund’s growth-stage private holdings, he added.

Performance of the trust vs sector over 3yrs

Source: FE Analytics

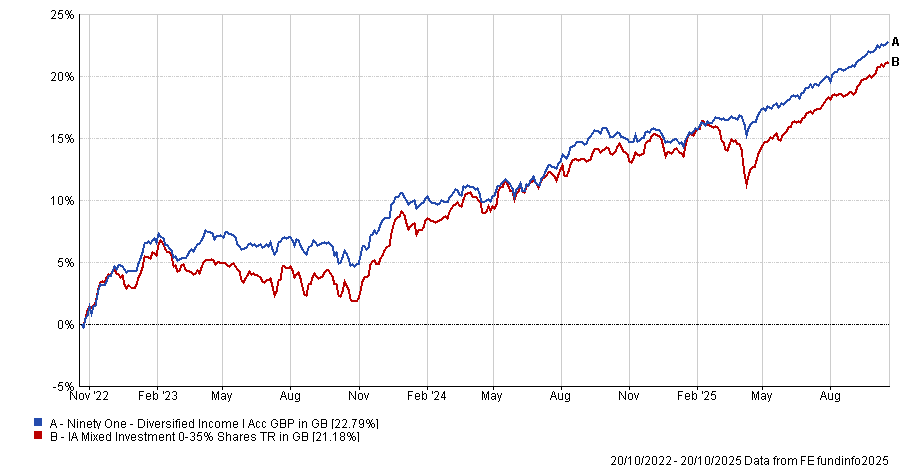

Finally, Hal Cook, senior investment analyst at Hargreaves Lansdown, turned to a historically defensive asset class: bonds.

He suggested the Ninety One Diversified Income fund, which has been managed by the “very experienced” John Stopford since 2012.

“With most of the fund invested in bonds, if interest rates were to fall it is possible that those bonds will either not lose much value, or even increase in value from today’s prices,” he said.

Performance of the fund vs sector over 3yrs

Source: FE Analytics