Investment trust managers think a stock market bubble is the biggest risk for 2026, even as nearly half expect global markets to rise.

The annual manager poll by the Association of Investment Companies (AIC) found 48% of trust managers believe global stock markets would rise in 2026. But the biggest risk, cited by 33% of respondents, was a stock market bubble.

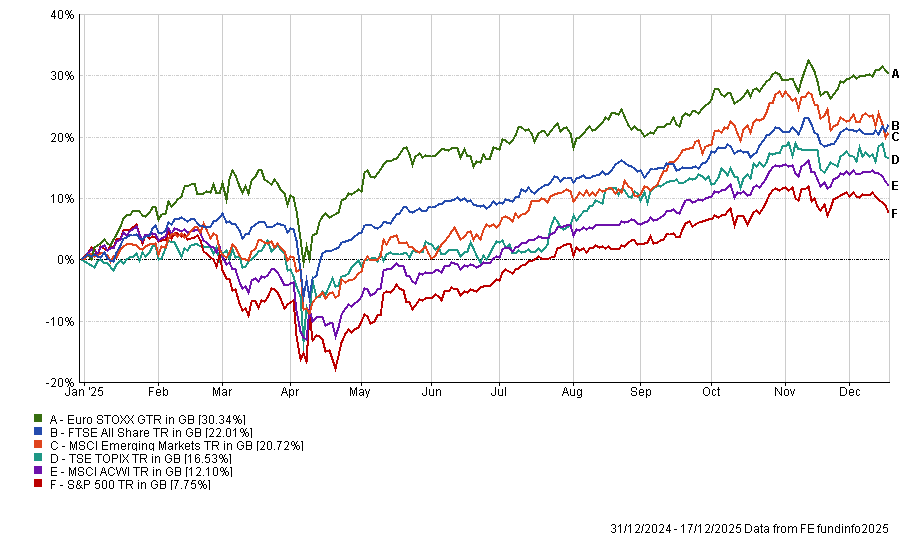

This comes after markets enjoyed another strong year, with the MSCI AC World index gaining 20.1% over 2025 so far and most other major indices posting double-digit gains (in sterling terms).

Performance of indices in 2025 YTD

Source: FE Analytics. Total return in sterling between 1 Jan and 17 Dec 2025

Nick Britton, research director at the AIC, said: “The high concentration of the US and global stock markets in a small number of names is certainly giving investment trust managers pause for thought.”

Martin Connaghan, senior investment director of Murray International Trust, noted global equity markets are experiencing elevated valuations, a slowing global economy and ever-increasing levels of government debt. These headwinds contrast with a solid earnings profile (although an arguably narrow one) and a potentially supportive monetary policy environment.

“One shouldn’t point to elevated multiples or market concentration and say that markets should correct, but at the same time, we must be mindful that when markets are concentrated and expectations are high, the margin for error is small and gravity can be a considerable force,” he said.

Felise Agranoff, portfolio manager of JPMorgan American Investment Trust, noted US equity valuations in particular remain high, leaving them more sensitive to disappointment.

“If earnings don’t keep pace or geopolitical tensions rise, we could see some further volatility,” he said. “Investors have enjoyed strong returns for years, so it’s natural to expect a few bumps along the way.”

Beyond valuation concerns, managers identified US trade policy – which saw imports from many trading partners hit with tariffs in 2025 – as a primary source of uncertainty. Tariffs were cited by multiple managers as a threat to global growth.

Omar Negyal, portfolio manager of JPMorgan Global Emerging Markets Income Trust, said: “The biggest challenge on the horizon remains US trade policy. Tariffs continue to unsettle global supply chains and could dent export-led growth in some markets.”

Jack Featherby, portfolio manager of JPMorgan European Discovery Trust, identified political uncertainty as the most immediate risk, “particularly around US trade and tariff policy, which has created ripple effects across global markets”.

Paul Green, co-portfolio manager of CT Global Managed Portfolio Trust, noted we are “yet to see the full impact of US tariffs on the global economy”.

Ollie Kenyon, senior director of RTW Investments, which manages RTW Biotech Opportunities, identified political and regulatory volatility as the most significant risk for 2026. He highlighted tariffs, drug pricing and US Food and Drug Administration policy as critical for stability in his particular sector.

The path of interest rates emerged as another area of concern, with several managers questioning whether central banks can deliver anticipated cuts. Sticky inflation could force monetary policy to remain tighter for longer than markets expect.

Columbia Threadneedle’s Green said: “Market expectations for interest rate cuts may be wide of the mark should inflation remain sticky above targets."

Jon Brachle, portfolio manager of JPMorgan US Smaller Companies Investment Trust, highlighted the challenge of persistent inflation and high borrowing costs. These pressures remain particularly acute for smaller US businesses, he said.

Featherby added that “renewed inflation could test central banks” next year.

Geopolitical tensions featured across multiple managers’ assessments, with the uncertainty spanning both international relations and domestic political developments.

Charles Jillings, co-portfolio manager of Utilico Emerging Markets Trust, said: “A material increase in geopolitical tension could result in a sudden increase in oil prices, which would result in short-term inflationary pressures and place financial stress on energy-importing economies.”

Negyal added that “geopolitics, elections and the path of the US dollar will all shape the year ahead” for emerging markets.

Concerns about underlying US economic strength emerged in the poll. Managers identified specific vulnerabilities despite relatively solid headline growth figures.

Green said: “Economic growth looks reasonable, but we note the reliance in the US on continued capital expenditure on AI-related buildout and that some parts of the economy appear to be in far weaker shape."

Murray International’s Connaghan pointed to "possible signs of labour market weakness in key regions" as part of the challenging backdrop.

Jillings focused on the knock-on effects of US weakness. A weaker US economy would reduce consumption, impacting export-driven economies and ultimately commodity-dependent countries through lower resource demand, he said.

The combination of economic uncertainties and high valuations has raised questions about whether corporate earnings can meet expectations. Two managers explicitly flagged earnings growth as vulnerable.

Green said “earnings growth assumptions are positive but could be derailed by weaker growth," while JP Morgan’s Agranoff warned that “if earnings don't keep pace” with current valuations, volatility could follow.