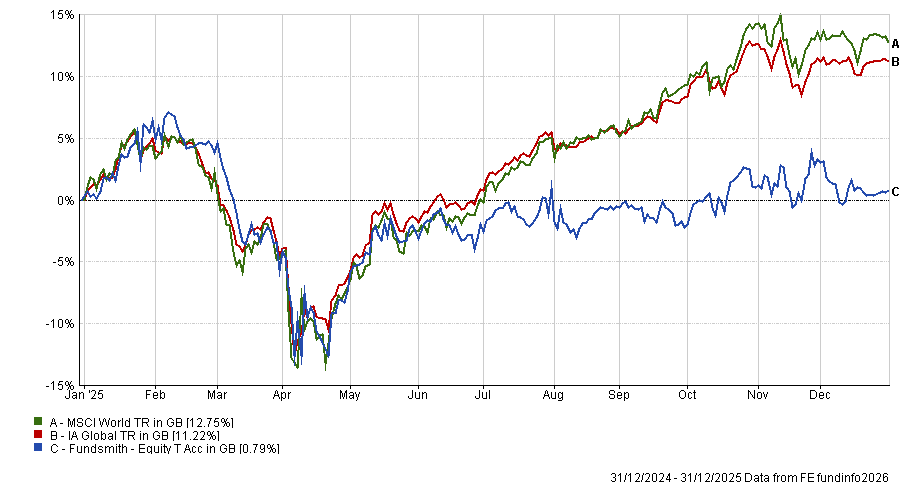

Last year was a tough one for FE fundinfo Alpha Manager Terry Smith’s enormously popular Fundsmith Equity, which languished in the fourth quartile of the IA Global sector for the first time in its 15-year history.

Performance of fund vs sector and MSCI World in 2025

Source: FE Analytics

Contributing most to the difficult year was Novo Nordisk, the Danish pharmaceutical giant, which Smith said had “managed to reaffirm my belief that you should never say ‘Things can’t get any worse’”. It was the biggest detractor to the fund in 2025, contributing a 3 percentage point loss overall.

“The company has parlayed a market-leading position in what is probably the most exciting drug development for about three decades [referring to its Wegovy weight-loss drug] into a secondary position and has failed to prevent illegal generic competition in its core US market.”

This development led Smith to reveal a mantra that he has used in his firm – to buy businesses that can be run by “idiots”, as it means the business is less reliant on the abilities of senior management.

“We have been made painfully aware that the range of businesses which can be run by an idiot is much more limited than we thought and hereafter we will aim to be more aware of the impact that poor management can have,” he said.

The veteran fund manager also acknowledged that engagement with struggling businesses “is less effective than selling the shares”.

However, with a new chief executive in place and “wholesale board changes”, he noted that its current valuation of 13x earnings suggests the market appears to be “expecting very little” from the stock.

“If we did not already own it, I suspect we would contemplate buying it as a good business which has been depressed by a ‘glitch’, albeit a rather large glitch,” he said.

In his annual letter to shareholders, the Fundsmith Equity manager also reiterated his more commonly associated mantra: buy good companies, don’t overpay and do nothing.

On this, he noted that the return on capital, gross margins and operating profit margins of his companies were “all high and steady”. Meanwhile, the portfolio’s weighted average free cash flow yield (the free cash flow generated as a percentage of the market value) ended the year at 3.7%, compared with 2.8% for the S&P 500 and 3.1% for the MSCI World.

“Our portfolio stocks have become a lot more lowly valued than the S&P as the free cash flow of many of the major stocks, which now dominate the index, has shrunk or disappeared in the face of massive capex spending on AI,” he said.

On doing nothing, he noted portfolio turnover stood at 12.7% for the year, costing less than 1 basis point. The firm sold its stakes in Brown-Forman and PepsiCo and purchased shares in Zoetis, EssilorLuxottica, Intuit and Wolters Kluwer. It was also given shares in Magnum Ice Cream, which was spun out from consumer brands giant Unilever.

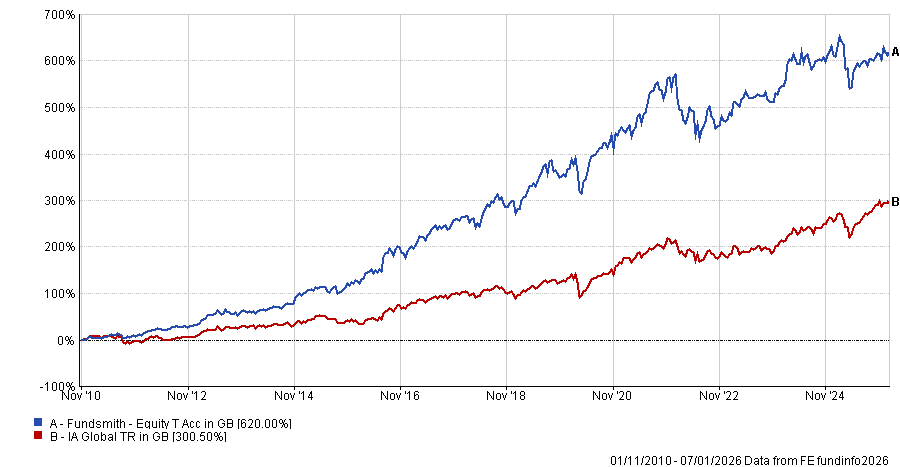

While this has worked over the long term, with the £16.2bn fund the third-best performer in the IA Global sector since its launch in 2010 (up 612.9%), last year it failed to keep pace with its rivals or the MSCI World index.

Performance of fund vs sector over 10yrs

Source: FE Analytics

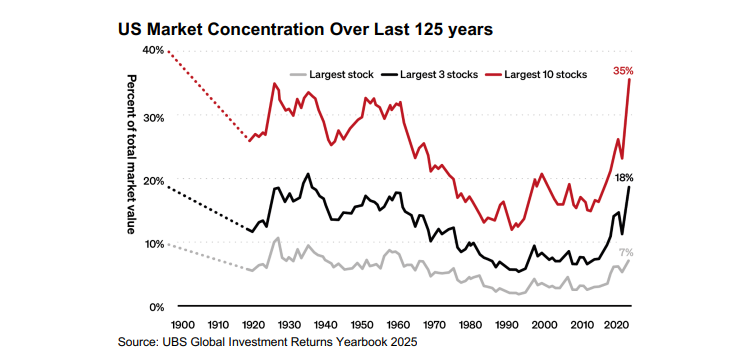

There are three key reasons for this, he explained: index concentration, the rise of index funds and dollar weakness.

On the first point, Smith noted that the ‘Magnificent Seven’ names of Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla now equate to 39% of the S&P 500 index, up from 34% in 2024. Additionally, despite issues for some of these stocks last year, they contributed 50% of the returns in the index.

“It was difficult to even perform in line with the index in recent years if you did not own most of these stocks in their market weightings and we would not do so even if we became convinced that they were all good companies of the sort we seek to invest in, which we are not,” he said.

“It would, in our view, represent too much of a portfolio risk to own them all, just as we would not own all five of the drinks companies we have in our investible universe even if we thought that prospects for the sector were good.”

The last time the index was this concentrated was in 1930, a period followed by the great depression and the Second World War. It took 24 years for the market to reach its previous high.

“Although this is regarded as prehistoric by most investors today, it is wise to remember that the S&P (not the NASDAQ) did not regain its 2000 high until 2007 and then promptly lost it again in the Credit Crisis until 2013,” Smith noted.

Next, he turned to the rise of passives, which also boosted the returns of the mega-cap US tech giants. In 2023, the proportion of fund-owned US equities held in index-tracking funds passed 50% for the first time.

“John Bogle, the pioneer of index investing who founded Vanguard, the index fund manager, was asked at the 2017 Berkshire Hathaway annual meeting if there was a level of assets in index funds which would distort markets and he agreed that there was, although he had no method of determining that level. We may already have reached it,” Smith said.

He warned that this is “laying the foundations of a major investment disaster” as was the case in the early 2000s dot-com bubble or in Japan in the late 1980s.

This time around, “the dominance of index funds now makes the rise of these large stocks a self-fulfilling prophecy,” he noted, suggesting that the scale and length that the bull run can continue for is unknowable.

“I have no clue how or when it will end except to say badly.”

His final point was about the US dollar, which fell against the pound from $1.25 to $1.35 by the year’s end. This affects the sterling value of the fund as most of its companies are listed in the US.

In his view, there are two solutions to the above issues. Smith could start buying stocks in the largest companies that dominate the index and/or become a momentum investor, trading shares performing well regardless of the underlying fundamentals.

“We are not going to do either. If you want an index fund, you can buy one with much lower costs than we or any other active investment manager apply. Nor are we momentum investors, and there are better exponents of this investment strategy than us,” he said.

“Whilst we are going to stick to our investment strategy, we will of course seek to do it better.”