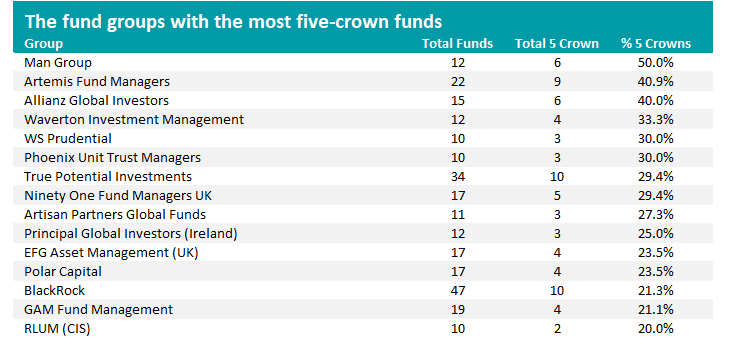

Man Group, Artemis Fund Managers and Allianz Global Investors are currently the fund houses with the highest proportion of their line-up holding the top FE fundinfo Crown Rating, following the latest rebalance of the independent rating.

Man Group holds a five-crown rating for six of its 12 funds (50%), including Man Income, Man Japan Core Alpha and Man Sterling Corporate Bond. Previously, just three of the group’s funds had a top rating.

Meanwhile, Artemis has nine of its 22 funds (40.9%) with five crowns, among them Artemis Global Income, Artemis SmartGARP UK Equity and Artemis Monthly Distribution.

Six of Allianz Global Investors’ 15 funds (40%) own the top FE fundinfo Crown Rating, such as Allianz Best Styles Global AC Equity, Allianz Emerging Markets Equity and Allianz RiskMaster Growth Multi Asset.

Source: FE fundinfo. Groups with more than 10 eligible funds only.

Some of the best-known funds in the industry continue to hold the lowest crown rating after performance failed to return to its previous highs.

The £15.8bn Fundsmith Equity fund – the biggest active IA Global fund – remains on a one-crown rating after several years of underperformance. Manager Terry Smith recent said index concentration, the rise of index funds and dollar weakness were the main reasons for the fund’s lacklustre returns.

Smith’s £423m Fundsmith Stewardship fund also holds one crown.

Similarly, all four funds managed by Lindsell Train – Lindsell Train Global Equity, Lindsell Train Japanese Equity, WS Lindsell Train North American Equity and WS Lindsell Train UK Equity – have just one crown each. Lindsell Train Global Equity previously held two crowns but lost one in the rebalance.

Like Fundsmith, Lindsell Train’s funds were among the best of their peer groups in the 15-year bull market that followed the 2008 financial crisis but have underperformed of late as higher interest rates hampered their quality-growth approach.

Outside of fund groups, trends can be seen in the funds that have won five crowns having previously only held one or two.

Charles Younes, deputy chief investment officer at FE Investments, pointed to Cohen & Steers Diversified Real Assets and Brookfield Real Assets Securities. Real assets have been favoured as investors sought out tangible, inflation-resistant investments that can act as a safe haven amid rising geopolitical uncertainty.

At the same time, funds such as Muzinich Emerging Markets Short Duration and Barclays GlobalAccess Emerging Markets Debt have gained five crowns. Younes said this is another example of an asset class being used as a hedge for the softening US dollar, rising inflation concerns and heightened geopolitical tensions.

“The January 2026 rebalance shows a market that’s evolving and becoming more diverse. Real assets and emerging market debt funds are climbing to the top, proving that managers can successfully navigate the challenges of a softening US dollar,” he added.

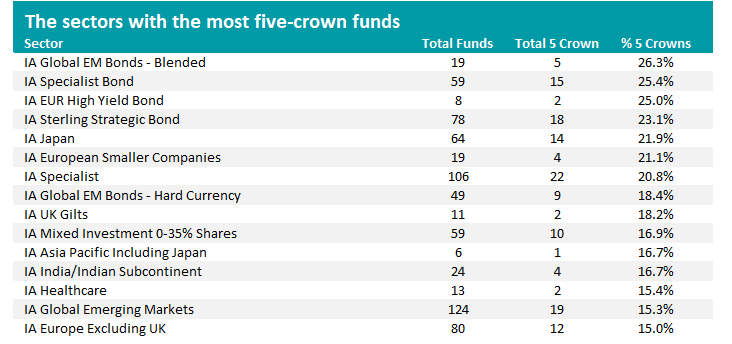

Source: FE fundinfo

When it comes to sectors, IA Global EM Bonds – Blended has the highest share of five-crown funds: five of its 19 eligible members, or 26.3%, hold the top rating.

Fixed income sectors IA Specialist Bond, IA EUR High Yield Bond and IA Sterling Strategic Bond round out the top four, while equity peer groups like IA Japan, IA Global Emerging Markets and IA Europe Excluding UK have more than 15% of funds with five crowns.

However, there are 17 sectors – including IA China/Greater China, IA Financials and Financial Innovation, IA Latin America, IA UK Direct Property and IA UK Index Linked Gilts – where not a single fund has a five-crown rating.

FE fundinfo’s Crown Ratings are designed to help investors identify funds that have consistently outperformed their peers. The ratings are based on an independent, purely quantitative and backwards-looking assessment of how a fund has navigated the market – focused on alpha, volatility and consistency – over the past three years, rather than a forecast of future performance.

The top 10% of funds receive five crowns, the 15% get four crowns and the remaining three quartiles are for three-, two- and one-crown funds.