The way people invest in the US is changing. Allocating to the region is no longer automatic but requires more careful thought than before due to political uncertainty, extreme concentration in a handful of mega-cap stocks and the dominance of the artificial intelligence theme.

Investors have been cutting their winners, introducing currency hedging or moving some exposure from pure growth strategies towards value, as discussed on Trustnet earlier this week. Below, three fund pickers reveal their new approach for the US, which focuses on small-caps, insurance and healthcare – or anything but tech.

Darius McDermott, managing director at Chelsea Financial Services, said one of the key lessons from 2025 was to be wary of cutting US exposure altogether, citing the rebound after the 'Liberation Day' sell-off.

“The US still represents the highest-quality equity market in the world and having no exposure at all would be a mistake for long-term investors,” he said.

However, while VT Chelsea’s managed funds have not been actively selling US holdings, they also “haven’t been directing new money into the market”. Instead, fresh capital has gone into emerging and frontier markets, such as India.

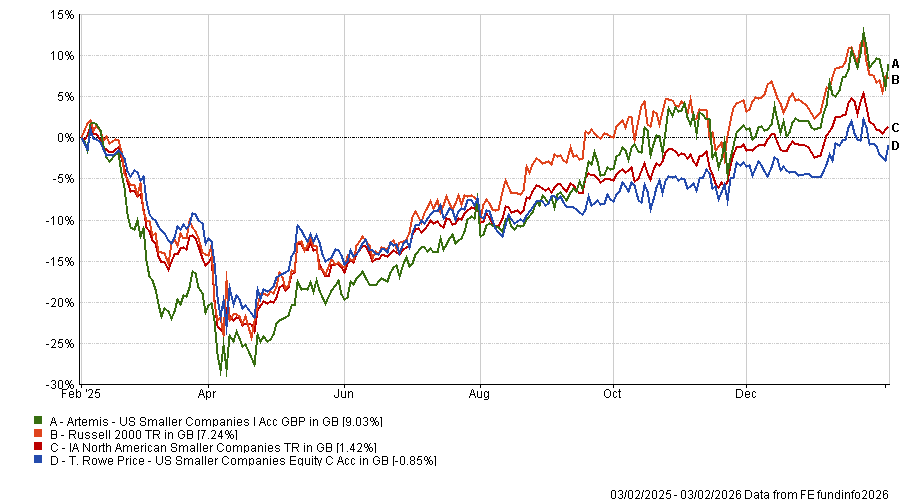

If allocating to the US today, McDermott said he would be more inclined to do so away from AI-driven hyperscalers and towards US small- and mid-caps, which he reckons are more attractively valued and more closely linked to domestic growth and company fundamentals. He highlighted T. Rowe Price US Smaller Companies and Artemis US Smaller Companies as options.

Both have limited weightings to the telecoms, media and technology sectors (11.6% and 3.6%, respectively) and focus more on basic materials (15.2% and 11.8%), financials (14.3% and 7%) and healthcare (both 16%). The Artemis fund has been in the top quartile of its peer group over the past one, three, five and 10 years.

Performance of funds against index and sector over 1yr

Source: FE Analytics

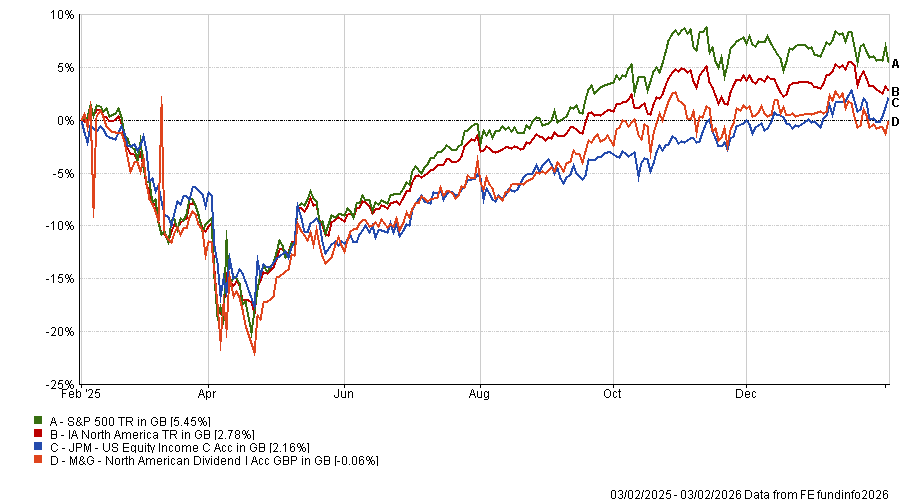

Alongside smaller companies, McDermott said he likes US equity income strategies with a value tilt, singling out JPM US Equity Income and M&G North American Dividend, which he said can provide a more balanced return profile by combining dividends with participation in long-term growth.

Performance of funds against index and sector over 1yr

Source: FE Analytics

JPM US Equity Income is income-orientated but analysts have noted how income is a residual the investment philosophy of of managers’ Andrew Brandon and David Silberman, with capital growth the primary focus. The strategy aims to soften some of the sharper moves in the wider market and produce a yield in excess of the index by favouring sensible blue-chip stocks.

M&G North American Dividend follows a dividend-growth approach, based on the belief that companies that grow dividends can add value and beat the market over the long run.

To mitigate a purely defensive bias, the portfolio is divided into three buckets: quality companies with reliable growth, asset-backed cyclical businesses and 'rapid growth' companies driven by structural themes. If a company cuts its dividend, the team treats this as a failure of capital discipline and will look to sell the holding over time.

Ben Yearsley, director at Fairview Investing, framed his approach to the US market explicitly around diversification away from mega-cap technology, saying that “it’s never wrong to take a profit”.

Many investors switched some of their market-cap trackers last year to equal-weight trackers, which he said was “a perfectly acceptable approach even though it didn’t work out last year”. Rather than relying solely on indices, Yearsley tends to use smaller or mid-cap companies or more of a value style.

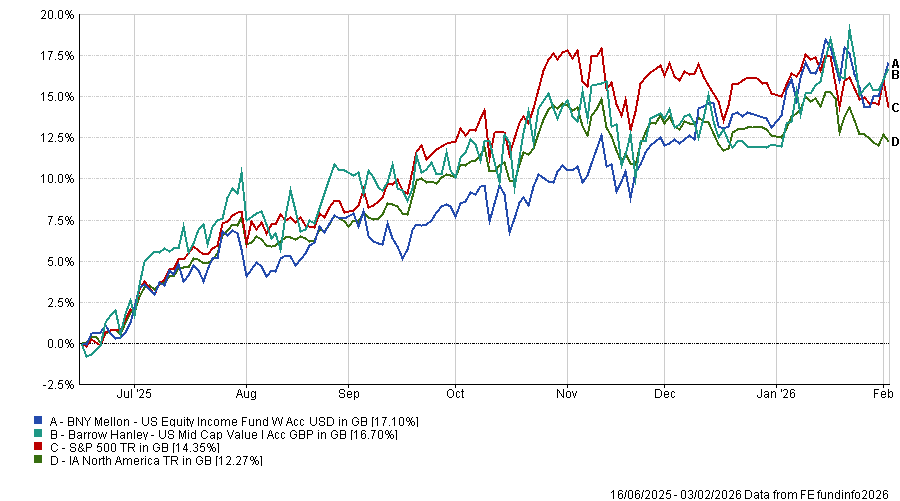

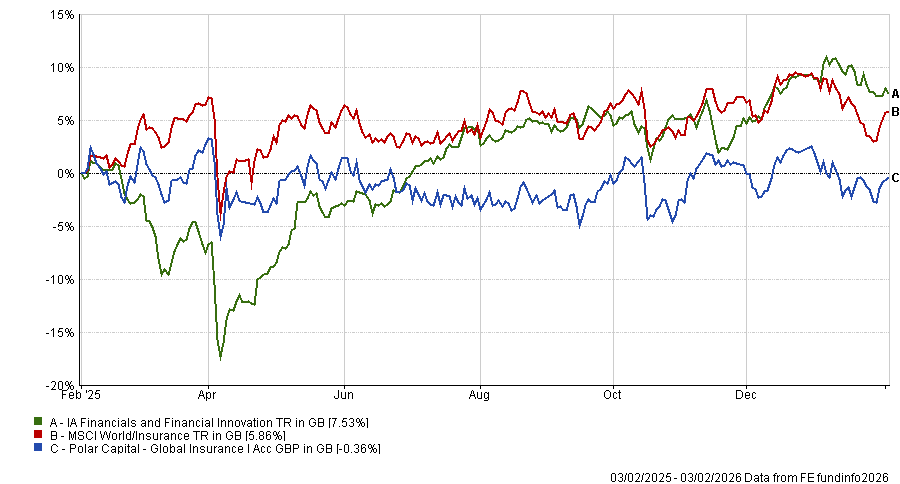

His picks in the space were Barrow Hanley Mid Cap Value and BNY US Equity Income, but he also pointed to more specialist sector funds that “have had a rougher time”, such as Polar Capital Global Insurance, which he said is about 70% US invested.

Performance of funds against index and sector over 1yr

Source: FE Analytics

The fund focuses on non-life insurance businesses around the world with a preference for medium-sized companies. The strategy many struggle during sustained falling markets when stocks are sold off indiscriminately, but the team has delivered returns in line with its stated objectives on an annualised basis.

Performance of funds against index and sector over 1yr Source: FE Analytics

Source: FE Analytics

Andrius Makin, associate portfolio director at Killik, focused on more specialist ways of accessing the US rather than revisiting broad market positioning.

His firm predominantly uses index funds to allocate to the US, but he agreed with McDermott and Yearsley that adventurous investors could look at small- and mid-cap companies, which are forecast to deliver double-digit earnings growth and should benefit from the One Big Beautiful Bill Act, he said. He also added that on price/earnings terms, small- and mid-caps trade at 26% and 34% discounts to large-caps, respectively.

That said, “smaller companies do leave you more exposed if economic conditions tighten, so in our MPS we have increased exposure only marginally”.

Instead, Makin is looking at specialist biotech funds, which are predominantly invested in the US and offer useful diversification. Large pharmaceutical companies face a 'patent cliff', with many sitting on large cash piles that could drive more M&A, including in UK-listed biotech trusts.

Although biotech has been under pressure since the post-Covid highs, the portfolio director remained positive on the sector given accelerating earnings growth and the possibility of increased acquisition activity, alongside new programmes to accelerate approvals.

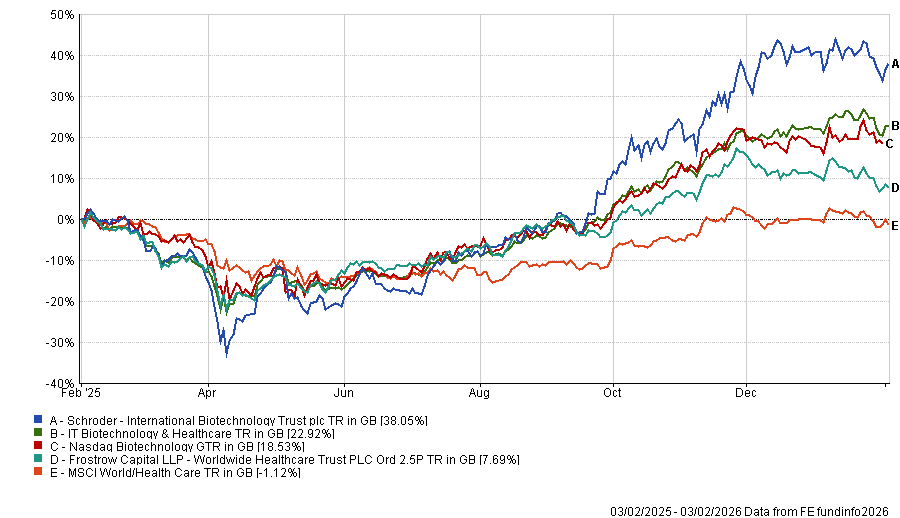

To access the area he turned to investment trusts: the International Biotechnology (81.2% US exposure) and the Worldwide Healthcare (74.2% in the US) trusts.

Both have achieved a maximum FE fundinfo Crown rating of five but differ in size (£316.1m versus £1.4bn, respectively) and risk level (with a respective FE fundinfo risk score of 275 and 165).

Worldwide Healthcare manager Trevor Polischuk has recently been quoted on Trustnet saying: “The confluence of this environment – the innovation, whether it be politics, lowering interest rates, M&A, valuation… – I've never seen it all align like this, and after four years of healthcare underperformance, I think the setup is phenomenal. This is the most bullish I’ve ever been on healthcare in my career.”

Performance of funds against index and sector over 1yr

Source: FE Analytics

Making warned he would however “be mindful of position sizing given that I expect biotech would lag healthcare and the wider market if we see any deterioration in economic conditions”.