Equity income funds – which spent last year in the doldrums – generated the highest returns last month as investors continued to rotate portfolios into value stocks.

Although the coronavirus pandemic continues to dominate headlines, March saw more progress in risk assets with the MSCI AC World index posting a 4 per cent total return over the course of the month.

These gains were led by the US, with the S&P 500 rising 5.7 per cent (in sterling terms). Confidence in the world’s largest economy has been bolstered by a strong vaccine roll-out and massive levels of fiscal stimulus from the administration of president Joe Biden.

Beneath the surface, however, the rotation away from growth stocks, which have led the market for more than a decade, towards value stocks, which until recently were being shunned by investors, remained in place. The MSCI ACWI Value index gained 6.4 per cent in March while MSCI ACWI Growth was up just 1.6 per cent.

But while equities had a decent month, bonds continue to show weakness as investors eye up the prospect of stronger economic growth and inflation, which they fear might prompt central banks to tighten policy faster than expected.

The Bloomberg Barclays Global Treasury index fell 0.9 per cent last month. Much of the action took place in the US, as the yield on 10-year Treasuries rose from 1.41 per cent to 1.72 per cent over the course of the month; 10-year gilts yields were more muted and went from 0.82 per cent to 0.84 per cent.

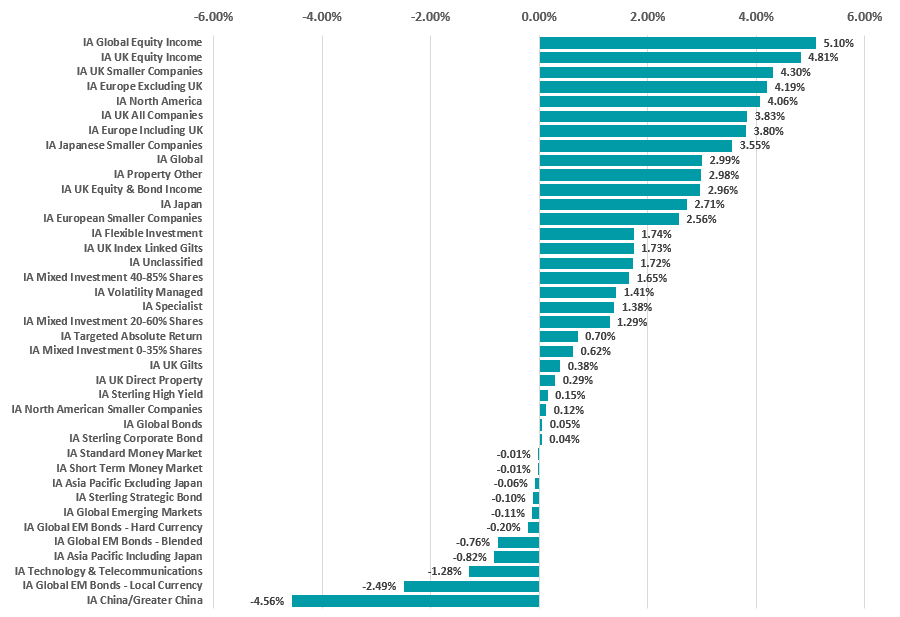

Performance of Investment Association sectors – Mar 2021

Source: FinXL

The chart above shows how all this played out in the average returns of the various Investment Association sectors last month.

IA Global Equity Income came in first place with its average member making a 5.10 per cent total return. The sector’s strongest funds in March were Overstone Global Equity Income (up 7.34 per cent), Guinness Global Equity Income (up 7.30 per cent), Sarasin Global Higher Dividend (up 7.24 per cent), TB Evenlode Global Income (up 7.04 per cent) and Vanguard Global Equity Income (up 6.80 per cent).

Close behind, however, was the IA UK Equity Income with an average total return of 4.81 per cent, with Jupiter Income Trust, TM RWC UK Equity Income and Barclays UK Equity Income at the top of the table here.

Other UK sectors like IA UK Smaller Companies, IA UK All Companies and IA UK Equity & Bond Income also made some of the month’s highest average returns, reflecting the progress in the country’s vaccine programme and the move into move value/cyclical areas of the market.

At the bottom of the rankings are various emerging market equities and debt sectors, as sentiment towards them is dented when investors worry about rate increases, and IA Technology & Telecommunications, which suffered in the pull-back from growth stocks.

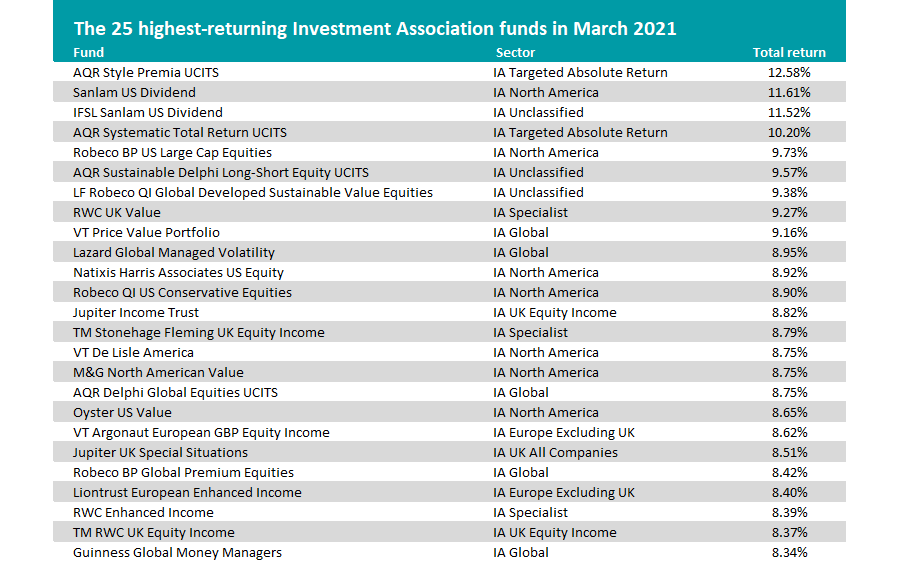

Source: FinXL

The best performing individual fund of March 2021, however, resides in the IA Targeted Absolute Return sector: AQR Style Premia UCITS, which made a total return of 12.58 per cent.

The $638m fund offers exposure to fundamental investment styles – value, momentum, carry and defensive – through a long/short portfolio that invests across stocks/industries, equity indices, bonds, interest rates and currencies.

Quantitative asset management house AQR Capital Management has several other funds that generated some of last month’s highest returns – such as AQR Systematic Total Return UCITS and AQR Sustainable Delphi Long-Short Equity UCITS.

Many of the other funds on the above table make clear how much the rotation into value stocks is impacting fund performance.

Many of the funds topping the performance tables last month are from the IA North America sector, but the names are very different to quality-growth strategies like Baillie Gifford American that dominated in 2020.

Sanlam US Dividend, VT De Lisle America, M&G North American Value and Oyster US Value, for example, all focus on value investing and have seen a recent boost to performance.

This isn’t limited to US funds either: RWC UK Value, VT Price Value Portfolio, Jupiter Income Trust, Jupiter UK Special Situations and TM RWC UK Equity Income are some of the other best performing funds that use a value approach.

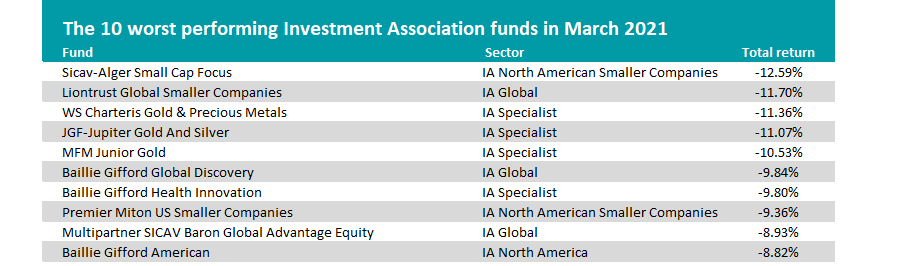

Source: FinXL

A look at the bottom of March’s performance rankings shows that gold funds had a tough month, as investors turned their backs on the yellow metal despite concerns over inflation.

Baillie Gifford’s funds – which were the best performers in several sectors in 2020 – has three funds in the bottom 10. The group is known for its long-term growth approach, which has rewarded investors for many years but might find the move to value more challenging.

Ben Yearsley, investment consultant at Fairview Investing, said: “After their stellar performance over the last few years there was always going to be a point when they underperformed.

“As many Baillie Gifford funds went up together it isn’t really a surprise seeing them fall together. What is more of a surprise is the sharpness of the falls when NASDAQ and the S&P both eked out gains in March.”

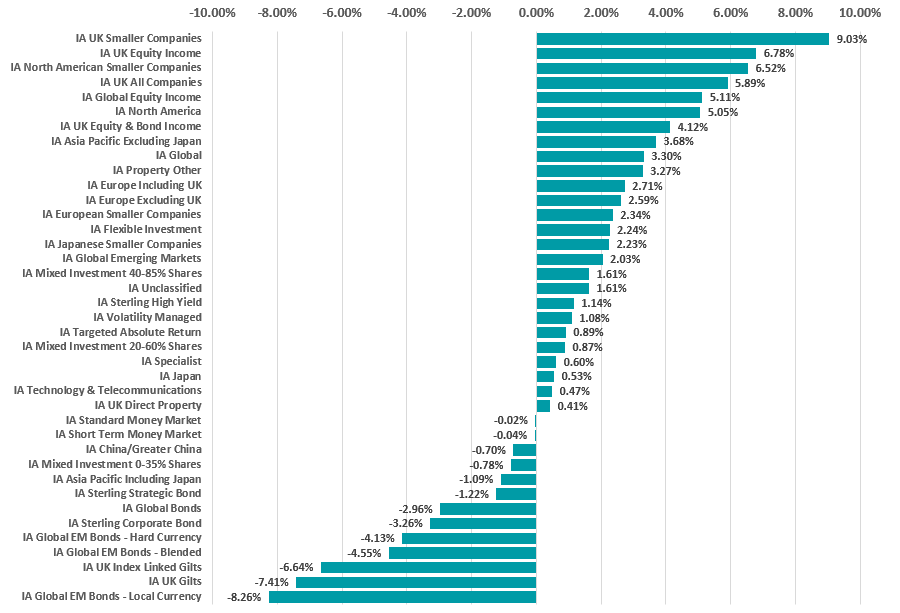

How does all this mean 2021 is shaping up so far? Below shows the year-to-date performance of the Investment Association sectors as well as the best and worst funds.

Performance of Investment Association sectors – 2021 to date

Source: FinXL