Michael Crawford, manager of the TB Chawton Global Equity Income fund, questions how much investment managers can accurately predict the future path of a company.

“It's not possible to predict as much as most people think,” he said. “That's why we tend to focus a bit more on areas and companies which are well established have almost sort of won their battle within their industry and we regard that degree of predictability as more favourable.

“This is in contrast to many of the narratives you hear at the moment about companies where it has a great story - but you don't actually know whether they're going to make it or not.”

Indeed, TB Chawton Global Equity Income’s largest positions are in some of the most well-known global brands in in the world, spread across different industries.

These include global consumer goods firm Procter & Gamble, semiconductor foundry giant Taiwan Semiconductor Manufacturing Company and pharmaceutical, medical device and consumer health multinational Johnson & Johnson.

This is because one crucial aspect of Crawford’s investment philosophy is finding established companies with a history of high returns on capital as well as a mechanism of ‘alignment’ within them.

He said: “We are looking for companies that can achieve high and sustainable returns on top of current capital invested.”

These companies will have a historic record of sustained higher returns, as well as a “chain of alignment”.

“We also really want to see some mechanism within the company - or the management of that company - being aligned with our interests and our investors interests, and by that, I mean focused on the long term,” he explained.

“I think the most effective ways that’s achieved is through having a significant shareholder - which might be a family, the founder himself or herself - who acts as a sort of agent to ensure that long-termism is maintained.

“Obviously, there are many companies where the founding family has moved on and, in those cases, and in other cases, it is actually a function of the culture. This is where a culture develops within the company which causes that long-termism to persist.”

One example of a company Crawford highlighted that has both an influential shareholder and a great culture is Swedish industrial firm Atlas Copco.

Share price performance of Atlas Copco over 5 yrs

Source: Google Finance

“They have a very long history of great longevity,” he said.

“Since about just after the Second World War, they've had a significant shareholder called investor AB. They are extremely long term.”

Investor AB has board representation at Atlas Copco and is controlled by the Wallenberg family through their Foundation Asset Management company FAM.

Crawford praised Atlas Copco’s “extremely distinct culture”, which he said is very focused on decentralisation.

“They believe that the most successful organisational structure is the one where as much power as possible is devolved to individual operating units operating at a low level,” he explained.

One outcome from this was the company’s decision to invest heavily into vacuum technology for the semiconductor industry where a lot of the manufacturing process is done in a vacuum chamber.

“They realised that this was going to become a very important part of the semiconductor industry because as you make smaller and smaller semiconductors, you need to have a very clean environment,” Crawford said.

“What it shows is that this culture generates this ability to sort of almost become future proof as they see new ideas and new opportunities.

“If you had a central management, the head office is not going to see all that, and they might miss that.”

Crawford added: “We’re looking for this chain of alignment from the investor all the way into the company and its employees.

“The more that can be so that everyone is facing in the same direction, I think the better.”

From the perspective of a global equity income investor, Crawford believes there is a trade-off between growth and income.

“I think capital growth leads income growth,” he said. “There’s sometimes a threshold where the level of income or the yield becomes a warning sign as much as a positive factor.

“Companies that are paying high yield -particularly if they're in industries which are more cyclical - I think often are on perhaps on the way down, they've reached maturity and they're starting to either be disrupted or more competition is coming in.

“With the companies that I'd say are the backbone of this fund are very stable, long lived companies like Nestle which have been around for 100 years and have a stable demand that in my view, is not particularly at risk from disruption or anything like that.”

When it comes to valuation of these companies, much like famed value investor Warren Buffett, Crawford looks for margin of safety to ensure that there is protection if his analysis is not correct.

However, he said: “I do think that that concept has been moved on now by particularly by James Anderson at Baillie Gifford into this concept of margin of potential.

“What can this company actually achieve if things go as you expect? What is the upside? We think about it in both those ways.”

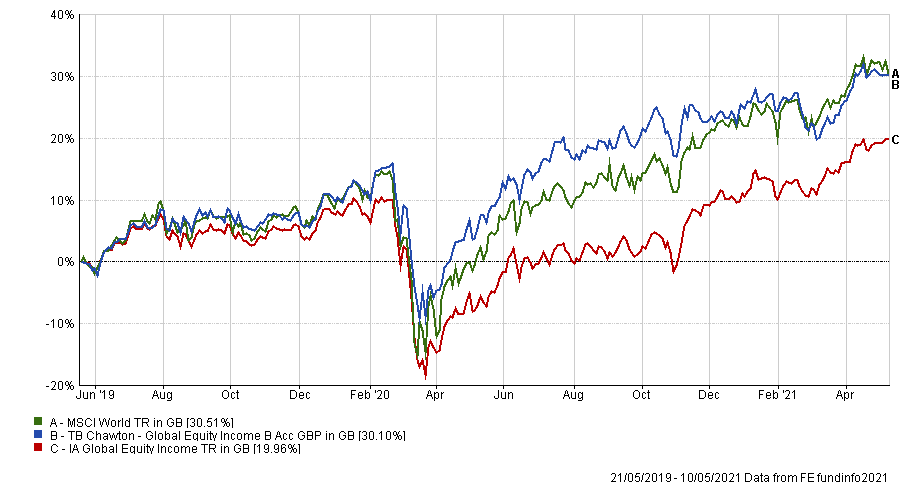

TB Chawton Global Equity Income has made 30.10 per cent since launch in May 2019, compared with gains of 19.96 per cent from its IA Global Equity Income sector and 30.51 per cent from the MSCI World index.

Performance of the fund since launch

Source: FE Analytics

The £12m fund is yielding 1.7 per cent and has ongoing charges of 1.15 per cent.