Late last week, Canadian semiconductor company Alphawave endured a difficult initial public offering (IPO) as its value fell by more than £600m on its stock market float.

This disappointing debut came soon after a similar fate for Deliveroo, leading AJ Bell investment director Russ Mould to ask whether this could harm the capital’s ability to attract these type of companies in future.

However, he outlined that a more likely explanation is that high valuations and a difficult environment for tech-enabled stocks have led to the underwhelming offerings.

Mould said: “Alphawave shares were down by 20 per cent on the first day of conditional dealings and the cynics will be queueing up to say it is no shock given its lofty price tag.

“This is a great shame, though, and no cause for celebration. Alphawave has a business model which investors understand and know can work well, thanks to the ARM Holdings’ time as a FTSE 100 firm, so London still seems like a good choice for the listing.”

This comes amidst a broader tech stock sell-off and only weeks after food delivery firm Deliveroo fell by 30 per cent on its debut. Its shares were issued at 390p and immediately fell to 271p before recovering slightly.

So does this affect London’s ambitions to attract young fast-growing companies for future offerings?

“This will inevitably be used as a stick with which to beat the London Stock Exchange and the London market more widely, amid accusations that the UK investment community doesn’t ‘get’ technology or like entrepreneurs – when nothing could be further from the truth,” said Mould.

While Deliveroo came under fire for its record of heavy losses and uncertainty about whether online food delivery will continue to thrive in a post-Covid world, Alphawave seemingly went into this in a strong position.

The global semiconductor market is booming and the company’s business model is primed to capitalise on the demand for silicon chips over the long term.

Ahead of the IPO, Hargreaves Lansdown senior investment and markets analyst Susannah Streeter said: ‘’With IPOs timing is everything and Alphawave launches onto the market on a tide of demand for semiconductors, with shortages of chips disrupting production of cars and electronic goods across the world.”

However, even prior to the Deliveroo IPO, the demand for tech stocks had waned as inflation concerns put investors off ‘growth’ names amidst rising bond yields.

Mould added: “As it turns out, through sheer bad luck, Alphawave [came] to market in a volatile week.

“Global markets are suffering their first stumble for some time, owing to unrest in the Middle East, fears of inflation and ongoing concerns over what could be an uneven global recovery in light of India’s ongoing woes and outbreaks of Covid in Taiwan.”

Indeed, other favourites like Tesla, the ARK family of investment funds, SPACs and IPOs have all started to slide.

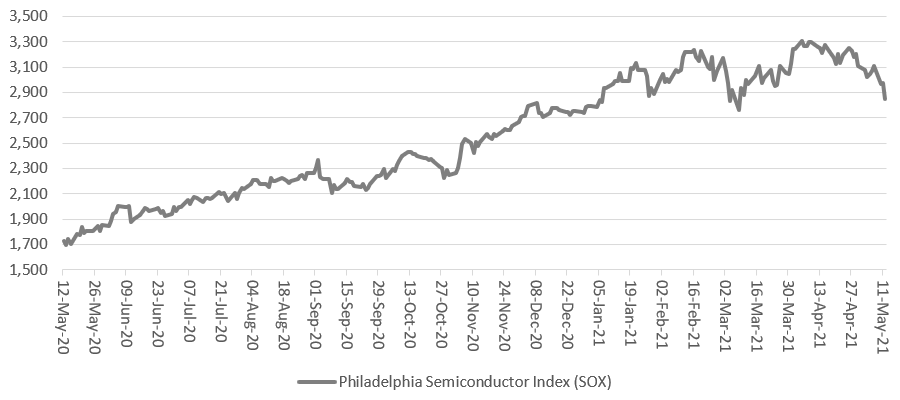

Mould noted that the Philadelphia Semiconductor index has lost 14 per cent of its value since it peaked on 5 April, despite that silicon chips are still in short supply.

Performance of Philadelphia Semiconductor index over 1yr

Source: Refinitiv

Additionally, Mould suggested that Alphawave came with a lofty valuation and that given market conditions, perhaps its advisers asked for too much. The 410p offer price put a £3.1bn price tag on the company.

“Granted, Alphawave is growing very quickly but such a valuation prices in a lot of future growth already and does so at a time, again, when investors may be able to buy plenty of cyclical, immediate growth cheaply,” he added.

“They may not feel such a need to pay premium valuations for long-term secular growth well out into the future.”

This can be illustrated by the performance of two US-traded tracker funds, the iShares Russell 2000 Value ETF and the Invesco QQQ Trust.

The iShares fund tracks a basket of 1,500 ‘value’ stocks across financials, industrials, consumer discretionaries and real estate – with just 5 per cent in technology - whereas the Invesco fund tracks the performance of the tech-focused Nasdaq 100 index and holds Apple, Microsoft, Amazon, Tesla and Facebook.

Performance of funds since 2020 March sell-off

Source: FE Analytics

Since March last year, the iShares Russell 2000 Value ETF has made a total return of 93.21 per cent, starting to outpace its growth counterpart in November. The Invesco QQQ Trust has made 55.62 per cent.

Mould finished: “The company’s advisers should have been aware of this trend and pitched the Alphawave IPO valuation accordingly, although it is possible that they tried and management elected not to listen.

“Valuing IPOs is a fine art and there is no right or wrong answer. The aim is to ultimately set a price that satisfies sellers and buyers and provides a good base for a healthy market once trading healthy, while a third interested party, the advisers, will also want to ensure they bag their fees.”