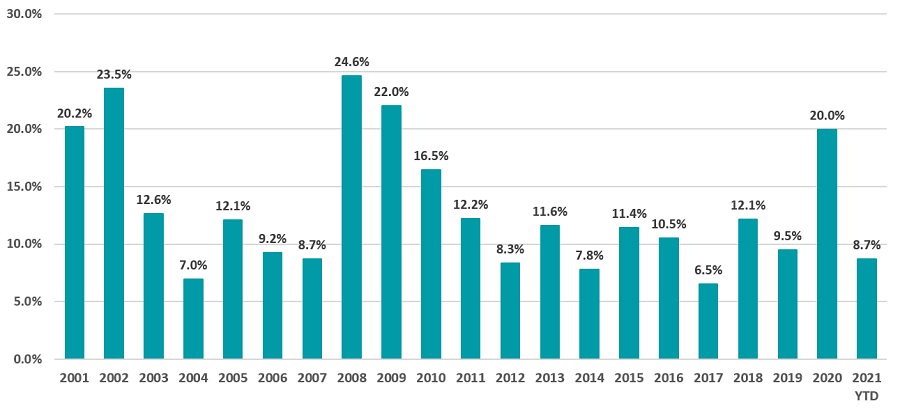

Volatility in 2021 is well below its long-term average, with a figure of 8.7 per cent for the MSCI ACWI index to the end of April compared with 13.3 per cent over 20 years.

Average volatility of MSCI ACWI index over 20 years

Source: FE Analytics

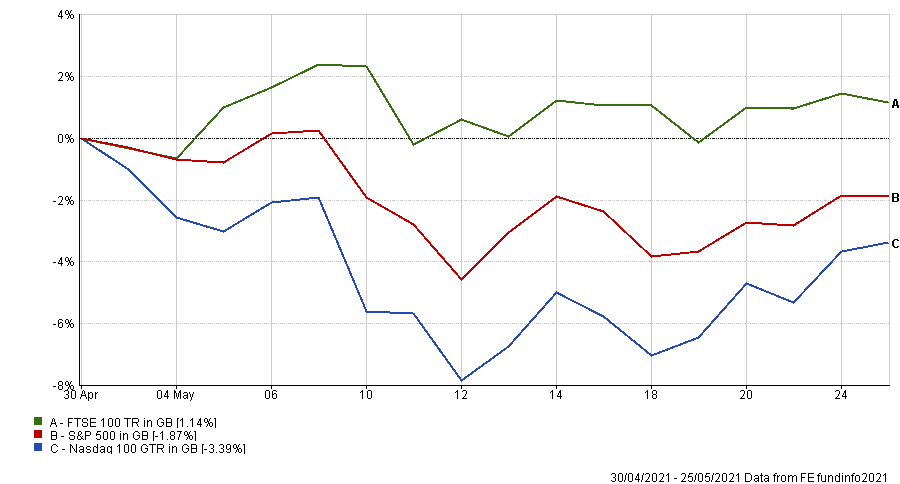

Since then, markets have become choppier, with investors panicking about higher-than-expected inflation figures in particular.

Nasdaq 100 and S&P 500 vs FTSE 100 in May

Source: FE Analytics

Yet independent commentator Adrian Lowcock pointed out volatility is a normal part of markets, and its absence can make investors too relaxed.

“It is always better to approach volatility with investing as something that you should expect and therefore it is best to be prepared for it,” he said.

“Volatility in markets is fairly common and indeed having calm markets is a rare thing. It can lull you into a false sense of security and lead investors to underestimate the risks.

“I think there is the potential for greater volatility in markets over the reminder of 2021.”

The main triggers for volatility spikes at the moment are coronavirus flare-ups and inflation concerns.

On the former, Lowcock said: “The optimism of the lockdown and expectations of a strong economic recovery are the default and have been the main reason markets have been fairly tempered while participants wait for lockdowns to ease. This means there is a greater opportunity for disappointment if the strength of recovery doesn’t meet expectations.”

He added that if the vaccines are not as effective as hoped against new strains of the coronavirus, this could also put the recovery in jeopardy.

“The latter is likely to lead to a sell-off in cyclical and value stocks and indeed even if the pandemic doesn’t return, just the fear of it could cause volatility in markets,” Lowcock said.

“Finally, add in the unknown events: while all eyes have been on the pandemic there is the potential for something to come out of left field.”

The re-opening of the economy is in itself another potential source of volatility, according to Ryan Hughes, head of active portfolios at AJ Bell.

“The global economy feels like it’s at an interesting inflection point, with investors trying to understand the implications of many countries coming out of lockdown.

“As a result, seeing volatility pick up in the midst of this should be expected, as the path that central banks and governments have to tread to successfully navigate this reopening is tricky.”

He added that the main concern here is rising inflation and whether it is transitory or structural, “with the former being the preferred outcome but the latter not being able to be properly discounted”.

“If it is structural, then the likelihood is that central banks will need to raise interest rates sooner than originally expected, which of course would be bad news for bonds and certain parts of the equity market too.

“Until this question is firmly answered by investors, we should expect volatility to remain elevated.”

FundCalibre’s managing director Darius McDermott notes central banks are responsible for low levels of volatility in markets since the financial crisis, thanks to trillions of dollars of quantitative easing (QE), persistently low interest rates and soothing words “every time things get a bit scary”.

“But now, for the first time in a long time, the market is concerned about inflation,” McDermott said.

“The Fed has remained incredibly dovish in the face of ever-strengthening data, but markets are afraid that it is going to have to quickly reverse course and raise interest rates to try and stop inflation getting out of control – hence the increased volatility recently (although it’s still only around the ‘average’ of the data set),” McDermott said.

This is the first time that tapering has been considered since the response to the coronavirus outbreak. However, the Bank of England appears to be some way behind the Fed in this regard.

It has projected inflation at around 2.5 per cent in 2021, above its annual 2 per cent target.

“However, their forecast is that inflation will then return to 2 per cent in 2022 and 2023,” according to Teodor Dilov, fund analyst at interactive investor.

“Considering all that, pricing pressures are likely to continue throughout 2021, but once consumption settles down and energy and materials prices stabilise, we could expect normalisation of inflation levels.”

Yet just the perception that central banks are considering tightening has been enough to rock markets in the past.

“We have seen the volatility that this can bring numerous times over the last eight years and I would expect this time to be no different,” said GDIM investment manager Tom Sparke.

According to Sparke, the second half of this year is likely to contain some considerable volatility as the recovery loses momentum.

“It is likely that we will see the year-on-year inflation numbers drop off as the base effects move out of the measured period, hopefully persuading investors not to worry too much about imminent rampant price rises,” Sparke said.

“However, not long after, we will also see a drop-down in growth figures as the second quarter is likely to have been the peak of the return to activity and the lower Q3 data may seem disappointing in comparison.”

Overall, the commentators anticipated a more volatile second half of the year.

“The short answer, I think, is yes – there will be more volatility later in the year, particularly over the summer months,” McDermott summarised.