Investors who are worried they have missed the recovery trade may wish to look at the IT Private Equity sector, where it is still possible to find trusts on a 20 per cent discount, according to Vincent Ropers, manager of the TB Wise Multi-Asset Growth fund.

Ropers described TB Wise Multi-Asset Growth as “a true multi-asset fund”, due to its focus on investment trusts, which can make up 60 to 80 per cent of the portfolio. He said this separates it from many of its peers, which claim to be multi-asset vehicles, but are limited by their focus on open-ended funds.

“When you look under the bonnet, in effect they're limiting themselves to equities, fixed income, cash and a bit of property,” he said.

“But with investment trusts, it really opens the universe. We think the investment trust is the right structure to invest in property as well as other illiquid investments such as infrastructure, renewable energy and some other alternative strategies in more niche markets, for example asset-backed securities.”

One illiquid area of the investment trust market Ropers has had a high weighting to over the years, and one he is particularly excited about at the moment, is private equity.

The manager pointed out the massive rebound in world markets over the past year has not only been driven by a cyclical recovery, but the acceleration of multi-year megatrends in areas such as technology and healthcare.

Yet while it is easy to see how these themes have played out in global stock markets, Ropers said it is a different story in private equity.

“When we look at the managers that we like in private equity, we look at their portfolios and we see that a lot of them are actually exposed to the same themes, but without the hefty price tags that you pay in public markets,” he continued.

“That triggers our interest. And then in terms of the cyclical recovery, one of the advantages in the case of private equity is the lag in valuations. We can see that there is still a lot of upside embedded in the portfolios of those trusts, it's just not reflected yet in the net asset values because they haven't been updated yet.”

The manager added that not only do private equity trusts’ holdings look undervalued, but a handful of them appear to have been completely ignored by the markets and are trading on discounts around the 20 per cent mark.

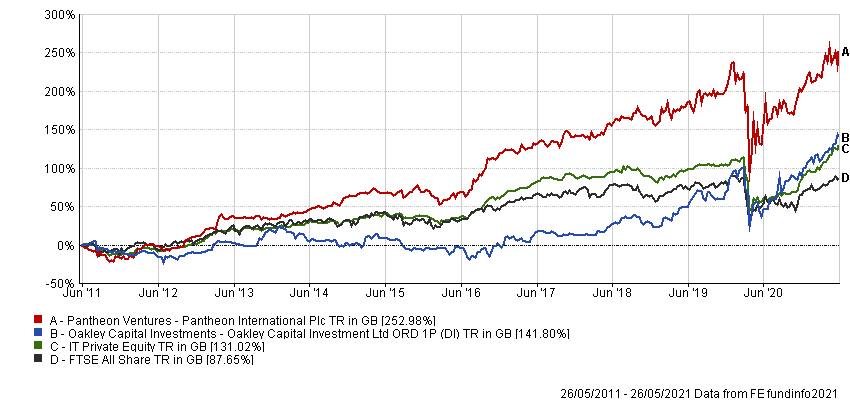

He holds Pantheon International, which made 252.98 per cent over the past decade and currently trades at a discount of 18.71 per cent; and Oakley Capital Investments, which made 141.8 per cent over this time and trades at a discount of 18.9 per cent.

Performance of trusts vs sector and index over 10yrs

Source: FE Analytics

But this is not to say this is the only area of the UK market where Ropers sees value. In a Trustnet article published in December 2020, Matthews said the UK was at a 30-year discount to other markets.

While the FTSE All Share is up 10.86 per cent in 2021 so far and 52.26 per cent since it bottomed out last March, it is still below its pre-crisis peak and Ropers pointed out its outperformance this year rarely registers as a blip over 10 years, especially compared with the main global index.

Performance of indices over 10yrs

Source: FE Analytics

And the manager said that foreign investors have started to take notice of the UK’s low valuations. He pointed to the experience of top-10 holding Odyssean, an investment trust that takes a private equity approach to investing in small caps, which saw two of its holdings receive takeover bids on the same day this week.

“I think that's probably six or seven bids it has received in its portfolio of 15 to 20 stocks over the past 12 or 18 months,” Ropers said.

“That just shows what kind of value can be realised when you've got managers that have the luxury of time and can invest that with their companies and try to push the management to realise their potential.

“But that [private equity-like approach] can really only be done in an investment trust, you couldn't do that in an open-ended format.”

Data from FE Analytics shows TB Wise Multi-Asset Growth has made 153.55 per cent over the past decade, compared with gains of 89.76 per cent from the IA Flexible Investment sector and 87.65 per cent from the FTSE All Share index.

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

The £73m fund has ongoing charges of 1.21 per cent.