Strong returns in both 2020 and 2021 to date sees Premier Miton UK Smaller Companies benefit from a large jump in research on Trustnet, while Ballie Gifford’s funds remain popular despite a recent dip in performance.

Looking at the funds that have attracted the most pageviews on Trustnet over 2021 so far Baillie Gifford American – which was last year’s best performing fund out of the whole Investment Association universe – has been the most popular overall.

The £7.5bn fund has captured 2.15 per cent of Trustnet’s fund factsheet pageviews this year and replaced Fundsmith Equity as the most popular fund with our readers. Baillie Gifford American was the second most-viewed fund last year, a position now occupied by Fundsmith.

Below, you can see the 20 most-researched Investment Association funds this year, along with their total returns and quartile rankings for the same period.

Source: Trustnet

What’s interesting is how many of these funds are sitting in the bottom quartile of their sector over 2021. Many, however, were at the top of their sector in 2020 and their recent underperformance is down to the rotation in market leadership that has come with the global re-opening from the coronavirus pandemic.

The other thing to note is that most of the funds on the above list are running large portfolios – which means they have plenty of underlying investors and will naturally attract more pageviews.

In order to get more insight into changes in research trends, then, we can compare funds’ current share of overall Trustnet pageviews in 2021 with 2020, to see any moves in relative popularity.

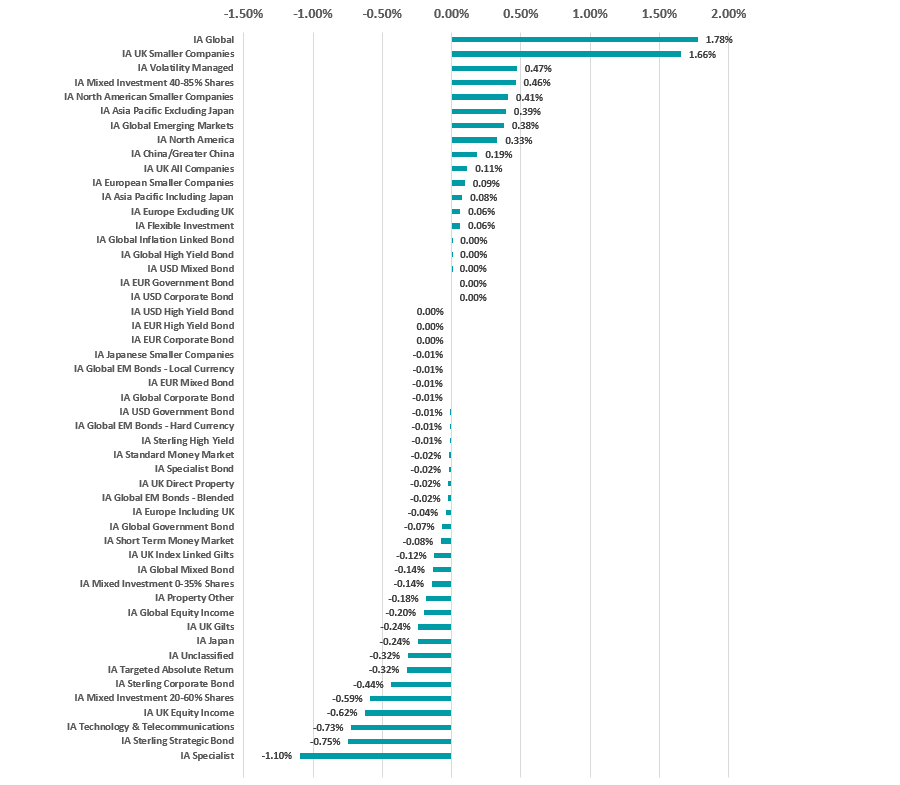

Starting at the sector level, the below chart shows the change in each sector’s research share on Trustnet.

Change in sector research share on Trustnet over 2021

Source: Trustnet

Most sectors have seen little change in their popularity in the first half of 2021 compared with 2020, although there has been a significant uptick in interest in IA Global and IA UK Smaller Companies funds.

Investors have been increasing their allocations to global equity funds for several years now and this trend has continued in 2021, with Investment Association (IA) data showing IA Global to be the best-selling sector in each month of the year so far.

IA UK Smaller Companies funds, on the other hand, have been somewhat out in the cold in recent years but have rallied hard in the re-opening trade. According to FE Analytics, the sector’s year-to-date average return is highest of any Investment Association peer group.

Source: Trustnet

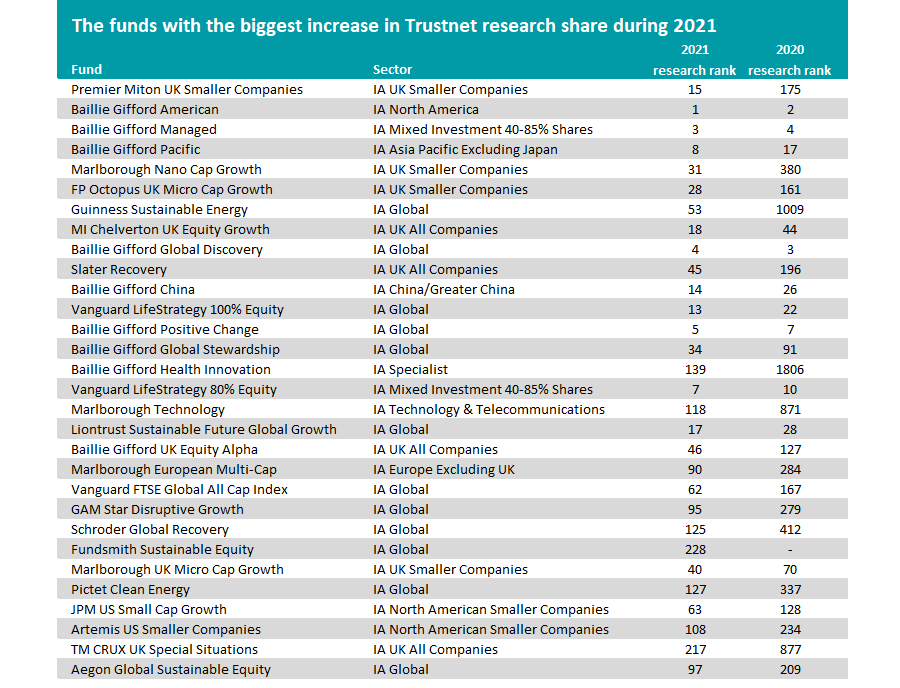

This outperformance of UK smaller companies funds is reflected in the table above, which shows the funds that have witnessed the biggest increase in interest from Trustnet users this year.

At the top is the £190m Premier Miton UK Smaller Companies fund, which is managed by Gervais Williams and Martin Turner.

It accounted for 0.13 per cent of all Trustnet factsheet views in 2020 but has increased this to 0.65 per cent in 2021 – the largest percentage change of any fund. This means it has jumped from being the 175th most popular fund to the 15th.

Premier Miton UK Smaller Companies made 77.33 per cent in 2020 (the highest return of any UK equity fund and one of the best overall in the Investment Association universe). Its run of strong performance has continued in 2021, with a gain of around 30 per cent also being one of the highest in the universe.

But it’s not the only UK smaller companies fund to be found on the above list. Marlborough Nano Cap Growth, FP Octopus UK Micro Cap Growth and Marlborough UK Micro Cap Growth are members of the same sector, while MI Chelverton UK Equity Growth resides in the IA UK All Companies sector but focuses on small-caps.

Baillie Gifford funds have also managed to increase their popularity among Trustnet users this year. Indeed, Baillie Gifford American, Baillie Gifford Managed and Baillie Gifford Pacific have seen a larger increase in research share than any other fund aside from Premier Miton UK Smaller Companies.

The Edinburgh-based fund house was incredibly successful in 2020 as its preferred quality-growth holdings – especially tech companies – surged amid masses of stimulus and trends such as working from home.

The group’s funds have handed back some of that performance in 2021 as market leadership rotated towards value and cyclical stocks; many of its funds are now in the third or fourth quartile, whereas most were firmly top quartile in 2020.

That said, Baillie Gifford has established a strong long-term track record and the outperformance of its funds has by no means been limited to just 2020. While some of the firm’s interest with Trustnet readers could be down to those weighing up whether to hold a recent buy that is no lagging behind others, there’s no doubt that plenty of Baillie Gifford’s pageviews are from longstanding investors who are holding their funds for the long run.

The rotation away from growth stocks and towards value is also reflected in the list by the significant increase in pageviews for funds such as Slater Recovery, Schroder Global Recovery and TM CRUX UK Special Situations.

Meanwhile, the Vanguard LifeStrategy range continues to grow in popularity. Vanguard LifeStrategy 100% Equity and Vanguard LifeStrategy 80% Equity have seen the strongest gains in pageviews, as investors increasingly embrace risk and bonds continue to struggle.