A keen emphasis on engagement and a preference for quality-growth companies is what drives the positive impact LF Montanaro Better World fund.

Headed up by experienced manager Charles Montanaro, the team looks for high quality growth companies that have strong ESG credentials and what they refer to as a ‘positive impact’ case.

“Currently, the sweet spot for such companies is in the developed world where the standards of governance are strong and companies are ahead of the curve when it comes to ESG reporting and regulation,” they said.

The fund looks for small -and medium-sized companies across a list of developed nations from around the world.

“We don’t target any country weightings,” they added. “We’re bottom-up investors so at times we may be overweight in countries that are producing quality growth businesses with solid impact cases.

“We look for companies that are not only high quality-growth companies, but also have a strong impact case through manufacturing a product or service that makes a positive impact on the world.”

With such a large universe of which to choose from, Montanaro then uses its unique screening process.

“We are spoilt for choice, but an initial internal proprietary screening process is key for firstly finding high quality companies.”

This encompasses 14 different criteria to rank companies on quality from ‘AAA’ to ‘D’.

“We’re interested in those at the ‘AAA’ end of the scale,” the team said.

“Small- and mid-cap investing is labour intensive, so you need a large team,” they also added. “By having a 12-person, multilingual, sector specialist Investment team benefits us massively.

“It enables us to have local knowledge on the ground and allows us to ‘kick the tyres’ when it comes to the generation of new ideas or maintaining investment cases for current holdings.”

Many funds that incorporate ESG into their process do so using an exclusion list, something that Montanaro has used for nearly two decades.

LF Montanaro Better World does not invest in fossil fuel companies, tobacco or alcohol producers and distributors, weapons manufacturers, gambling companies, adult entertainment and high interest rate lending companies.

But exclusion is now increasingly making way for a more inclusive, engagement approach, where companies are valued for their strengths and helped with their weaknesses.

This is reflected in the fund and all companies in the portfolio must fall into one of six impact themes that are aligned with the UN Sustainable Development goals.

Engagement is also a key cornerstone of the fund, something that is especially important if companies start to stray from the six impact themes.

“Engagement is a crucial part of our investment process,” said the team. “It forms a core part of how we seek to improve the ESG standards and impact of our companies.

“It's is conducted by way of visits of the company’s premises, meetings with management, conference calls and email. Engagement directly affects investment decision-making, either enhancing our confidence in an investment case or highlighting a concern that makes investing less compelling.

“In an ideal world we wish to reach a positive conclusion on every matter of engagement, but if there’s no positive resolution from the engagement and this ultimately affects the ESG or impact score of the company, then the Sustainability Committee will discuss whether it should be removed from the Approved List, resulting in a complete sale.”

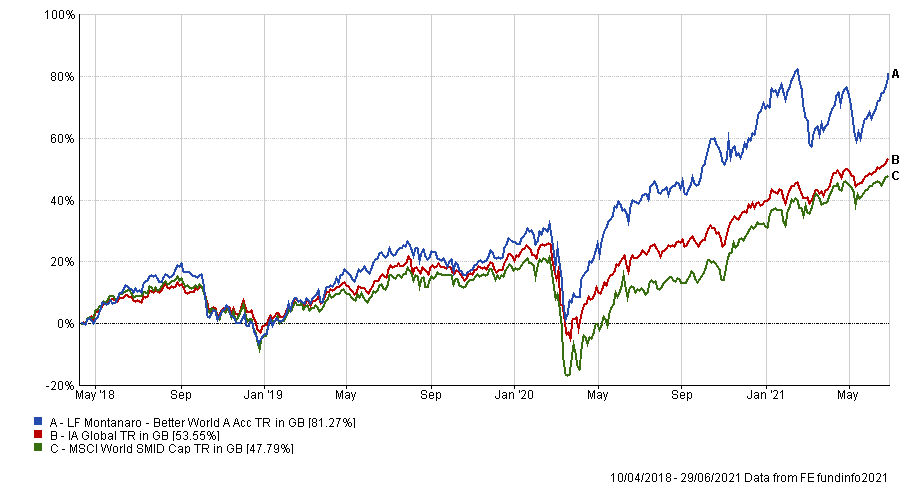

Performance of fund vs sector & benchmark over 5yrs

Source: FE Analytics

Over five years, LF Montanaro Better World has made a total return of 81.27 per cent, compared to 53.55 per cent for the average fund in the IA Global sector and 47.79 per cent for its MSCI World SMID Cap index.

Sitting within the broad IA Global sector, how does the fund compare with its peers?

“By concentrating on the bottom-end of the market-cap spectrum, we have little overlap with our peers, which means that investors can benefit from holding the fund alongside traditional, large-cap-focused impact funds.”

Another difference with peers, according to the team at Montanaro, comes from its “uncompromising” focus on quality-growth.

“This means that, irrespective of how strong the impact case or a company’s ESG credentials are, we will only invest in a business that is well-managed, with a strong balance sheet, a secure competitive advantage and attractive structural growth opportunities,” they explained.

“Once we find a company that ticks all of these boxes we hope to remain invested for the long term.”

With only 54 holdings (as of 31 May 2021) compared to more than 5,000 for the MSCI World SMID Cap index, the LF Montanaro Better World Fund is very different to the index and the active share of the Fund is above 98 per cent.

“We describe ourselves as benchmark agnostic,” they added. “The benchmark does not drive portfolio construction, which is a product of pure stock-picking within certain risk parameters.”

The £60.4m fund is managed by Charles Montanaro and Mark Rogers and has an ongoing charges figure (OCF) of 1 per cent.