Investors are making a mistake allocating money based on market capitalisation weightings when most sectors are on the verge of major disruption, according to Goldman Sachs Asset Management’s Alexis Deladerriere.

Most fund managers benchmark their performance against an index of stocks typically weighted by market capitalisation.

But Deladerriere argued that this approach reflects a flawed mindset. “It could have been alphabetical order,” he argued. “This market cap-weighted mindset is crazy in our view.

“It forces you to allocate to what has worked well, and you tend to under-allocate to what may be the stocks that benefit from mega trends, that may be the innovators or the disruptors of tomorrow.”

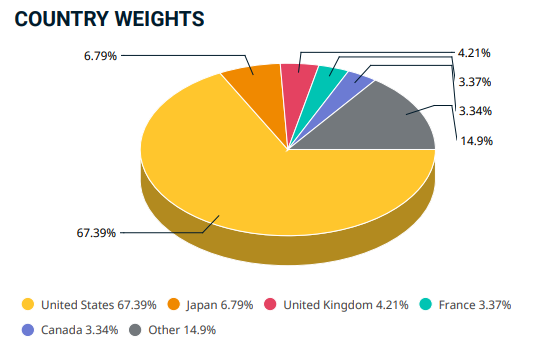

He also argued that benchmarks today are particularly skewed, highlighting how the MSCI World index has more than two-thirds of its assets allocated to the US.

“That doesn't really make sense from a fundamental point of view,” he said.

MSCI World Country weightings

Source: msci.com

Deladerriere also noted the US’s S&P 500 benchmark is “even more skewed than it has ever been”, with close to 25 per cent invested in just five companies.

“Just look at the market cap of the FAANGs,” he added. “It is the same as the market cap of the entire emerging markets. Six billion people. To us, that's a crazy framework for investing.”

The stock market is often described as ‘forward looking’. But Deladerriere, disputed this, saying it is “obviously backward looking”.

“You invest in yesterday's winners, not necessarily in tomorrow's winners,” he added.

This skew is made worse by the fact that the world is at a point of increased disruption in many sectors, in his view.

“Now more than ever you have these disruptions, which means that many stocks, many companies and many sectors are going to be left behind and won't be able to transform themselves over the next few years,” he explained.

“So you may end up on the wrong side of this disruption if you are invested in market-cap weighted benchmarks.”

As such, the team at Goldman Sachs Asset Management has identified key megatrends that are changing in the world and will keep on changing it for the next decade.

It singled out four in particular: the millennial consumer, tech advancement, the future of healthcare and environmental sustainability.

“We believe these are the four mega trends that will really change the world – where you are going to see tremendous innovation for the next decade or two,” Deladerriere said.

“These are the four big themes that we have identified, and we have created products and strategies that are aligned with that.

“All our products are well aligned with these mega trends. But beyond that, we want to create a dedicated product that is just fully exposed to these four mega trends.”

The $2.6bn GS Global Millennials Equity strategy is one such dedicated product, investing around the megatrend of the rise of the millennial consumer. It has been a top-quartile performer over the last five years.

Deladerriere, who is a lead manager for this strategy, emphasised that these are not just thematic funds.

He said that while they are thematic by nature, the team is extremely mindful of keeping a traditional investment approach, using bottom-up analysis and keeping a keen eye on valuations.

“We will be actively adding, trimming and selling out of positions if we believe we've realised the potential in the stock,” he explained.

“We’re not going to be in a position where we have big positions in super expensive stocks and we just own them by hoping that in the next 10 years they can change the world.

“It may happen, but we do not think it's good portfolio construction.”

The strategy has been a big beneficiary from Covid-19, he admitted: “This is because during the last 18 months, pretty much the entire world has become a millennial and does everything online, whether its shopping, banking, communicating or working.”

Some of the largest positions in the strategy are Amazon, Alphabet and Facebook. It also holds top-10 positions in payments giant Mastercard and semiconductor firm MediaTek.

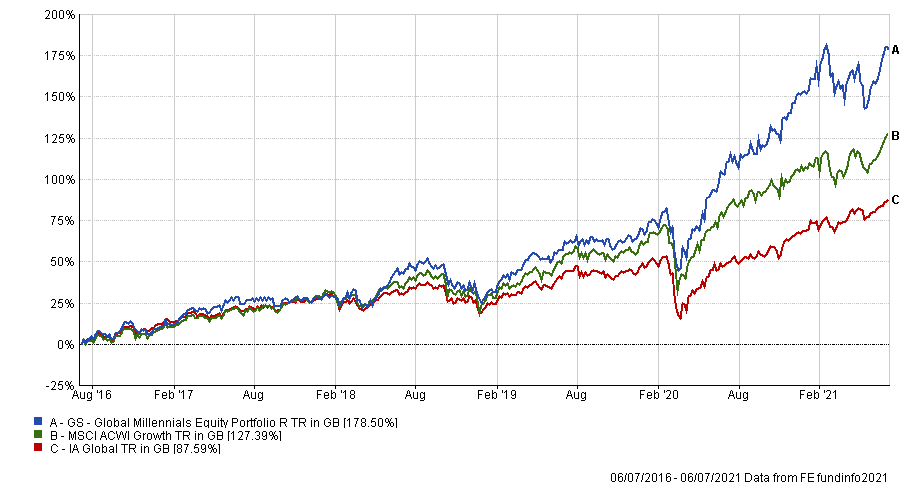

In the last five years, GS Global Millennials Equity has delivered a 178.50 per cent return in sterling terms. This is compared with 127.39 per cent from the MSCI Growth benchmark and 87.59 per cent from the IA Global sector average.

Performance of the fund over 5 yrs

Source: FE Analytics

It has an ongoing charges figure (OCF) of 1.02 per cent.