To find a fund that delivers returns far above the sector average, investors often must be willing to endure high volatility.

Out of the 79 funds in the Investment Association’s Global sector that have achieved top-quartile performance over the past five years, more than two-thirds of them exhibited the highest volatility of the entire peer group.

But the problem for investors is that high volatility is just as common in bottom-performing funds as it is in top-performing funds making it difficult to choose the winners.

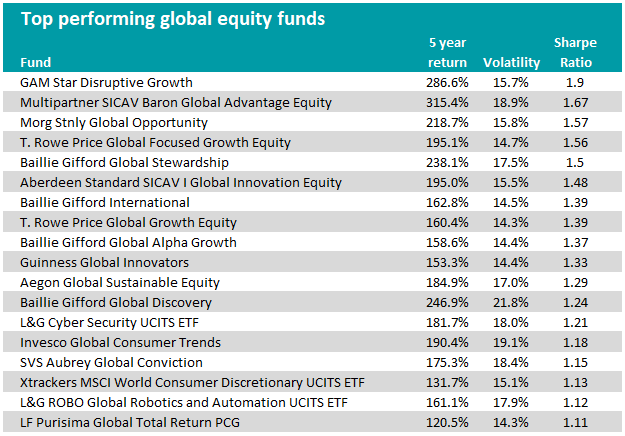

As such, Trustnet filtered down the global equity fund universe to single out those with top-quartile performance, bottom-quartile (high) volatility and top-quartile risk-adjusted returns (Sharpe Ratio).

The table below shows the 18 top-performing funds that met these filters over the past five years, rewarding investors for backing their higher risk approach.

The data in the table is run until last-month’s end, and the risk-free rate used was 1.24%, being the average Fed Funds rate for the past five years.

Source: FE Analytics

First in the table was the £582m GAM Star Disruptive Growth fund run by FE fundinfo Alpha Manager Mark Hawtin.

With a 286.6% return it was the second-highest performer in absolute terms, but with a Sharpe Ratio of 1.9 - it had the best measure of risk-adjusted returns of all the funds in the IA Global sector.

Hawtin’s strategy is focused on investing in growth stocks whose business models are being driven by new technologies.

Hawtin used to run a long-short strategy before this fund, so a careful attitude towards risk is key, despite its high volatility. Occasionally the fund will hold significant levels of cash in reserve – as high as 17% of assets under management – when valuations are stretched.

As a result, despite the volatile nature of the high growth stocks in the portfolio, volatility of the fund has been dampened over the past five years, although still remains high. It has an ongoing charges figure (OCF) of 1.07%.

Performance of the fund versus sector & benchmark over 5yrs

Source: FE Analytics

Elsewhere in the table, four Baillie Gifford-managed funds featured. The £2.1bn Baillie Gifford Global Discovery and the £811m Baillie Gifford Global Stewardship funds were in the top-10 best performing funds out of the entire peer group.

With the highest volatility of the table, Baillie Gifford Global Discovery is a predominantly a small-cap strategy run by FE fundinfo Alpha Manager Douglas Brodie, alongside Luke Ward and Svetlana Viteva.

It has been described by another manager as the “secret sauce” of Baillie Gifford because of its mandate to find immature businesses that can be decade-long holdings for the firm. It has an OCF of 0.76%.

The Baillie Gifford Global Stewardship fund is a multi-cap growth fund that integrates environmental, social and governance (ESG) risks into its approach. Run by Gary Robinson, Iain McCombie and Matthew Brett, the fund has the lowest OCF of those in the table of 0.53%.

The other two to feature were the £1.8bn Baillie Gifford International fund and the £4.6bn Baillie Gifford Global Alpha Growth fund. Both run by Malcolm MacColl, Spencer Adair and Helen Xiong, these funds both have an OCF of 0.59%.

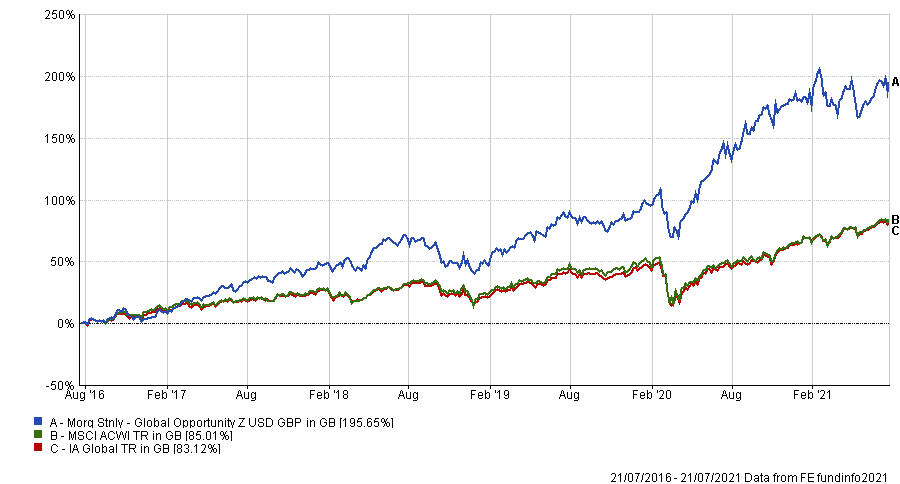

The £15.8bn Morgan Stanley Global Opportunity fund was the largest fund in the list. With a return of 218.7% and an annualised volatility of 15.8%, it exhibited the third highest Sharpe Ratio of those in the table of 1.57.

Managed by FE fundinfo Alpha Manager Kristian Heugh, the strategy is focused on investing predominantly in large-cap, high-quality companies that can use their competitive advantages to grow. It has an OCF of 0.9%.

Performance of the fund versus sector & benchmark over 5yrs

Source: FE Analytics

The £4bn T. Rowe Price Global Focused Growth Equity fund was another top-performer in the table, with returns of 195% and an annualised volatility of 14.7%.

Run by FE fundinfo Alpha Manager David J. Eiswert, this strategy is one of the few in the table that has an overweight tilt to UK equities relative to the MSCI All Country World Index. It has an OCF 0.84%

Three passive exchange-traded-funds (ETFs) also featured in the table: L&G Cyber Security UCITS ETF, L&G ROBO Global Robotics and Automation UCITS ETF and Xtrackers MSCI World Consumer Discretionary UCITS ETF.

Due to the nature of passive funds that track the performance of a particular basket of stocks, they are fully exposed to any wild swings in the share prices of the underlying companies.

Some other funds in the table were Aberdeen Standard SICAV I Global Innovation Equity, T. Rowe Price Global Growth Equity, Guinness Global Innovators, Aegon Global Sustainable Equity, Invesco Global Consumer Trends, and SVS Aubrey Global Conviction.