There has been a drastic fall in the number of fund managers who expect the economy to strengthen over the coming year, a respected survey has found, leading them to add to more defensive parts of the market.

While there has been a sharp economic rebound in recent months as many countries continue to open up from government-enforced lockdowns around the world last year and into the early part of 2021, the latest Bank of America Global Fund Manager Survey showed that many investors think this won’t continue for too much longer.

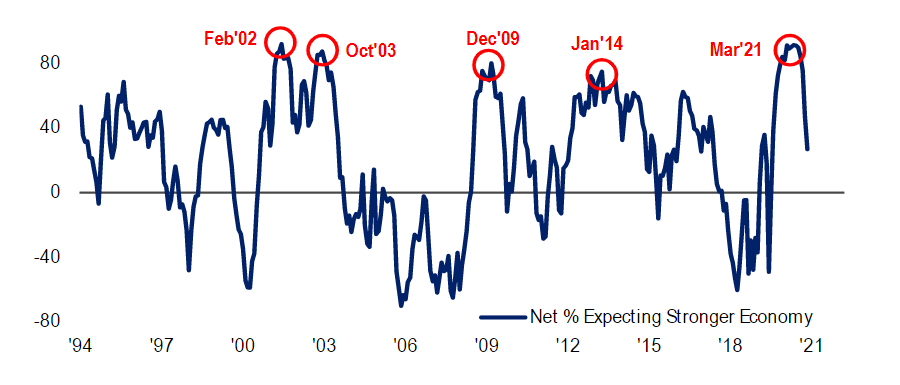

Percecntage of fund managers saying global economy will improve

Source: BofA Global Fund Manager Survey

“Global growth expectations have fallen drastically,” Bank of America said, after its August survey found that a balance of just 27% of fund managers expected the global economy to improve over the coming 12 months.

This is the lowest reading since April 2020 – the height of the Covid-19 crisis – and is down from a peak of 91% that was recorded in March this year.

In addition, the balance of asset allocators expecting the global economy to get “a little weaker” rose by nine percentage points to 28%, which is the highest since March 2020.

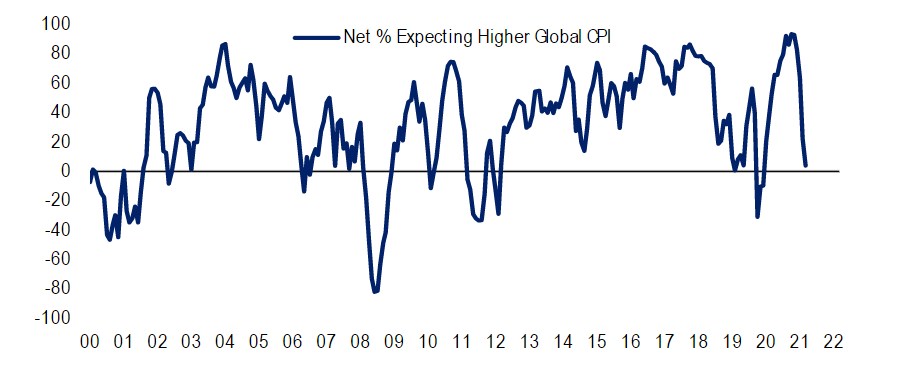

Net % of fund managers expecting higher inflation

Source: BofA Global Fund Manager Survey

At the same time, the number of fund managers who think global consumer prices inflation will be higher in 12 months has fallen off a cliff.

A net 4% of investors told Bank of America that they think inflation will be higher in a year’s time. This is down 18 percentage points on last month’s survey and a massive fall from the peak of a net 93% in April.

That said, expectations of higher short-term interest rates continue to grow this month. “Short-term rate expectations are still high and lag inflation expectations more than historically,” the bank’s analysts said.

But inflation continues to be the biggest ‘tail risk’ that fund managers are watching, with 22% of the survey’s respondents highlighting it as a worry. It was followed by a taper tantrum (20%), the Delta variant (19%), asset bubbles (17%) and Chinse policy (16%).

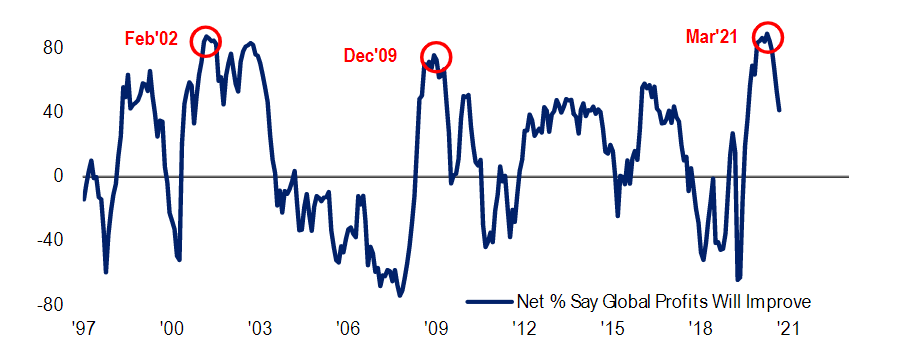

Net % of fund managers saying global profits will improve

Source: BofA Global Fund Manager Survey

The research continued: “Global profit expectations have fallen drastically, now at net 41% of investors, the lowest since July 2020 and down from the 89% peak in March 2021.”

What’s more, this month is the first time since June 2020 that more fund managers forecast a decrease in profit margins rather than an increase. A balance of 7% think margins will decrease from here.

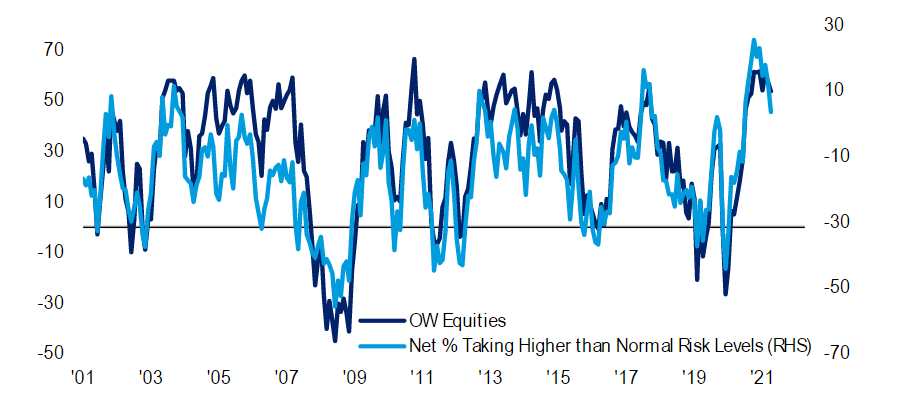

Net overweight to equities vs net % taking higher than normal risk

Source: BofA Global Fund Manager Survey

Given the peaks in economic growth, inflation and profit expectations, the allocation to equities has started to fall back.

“Global equity allocation had peaked in April at net 62% and is now at net 54%, but there is no appetite to rotate into bonds,” Bank of America explained.

The percentage of investors taking higher than usual levels of risk in their portfolios also fell. This peaked in February 2021, when a net 25% of fund managers said they were upping risk but has dropped to a balance of just 3% today.

“Risk levels have historically paralleled equity allocation,” the bank’s analysts explained. “Risk levels, as well as growth expectations rolling over, have contributed to the peaking of investor equity allocation.”

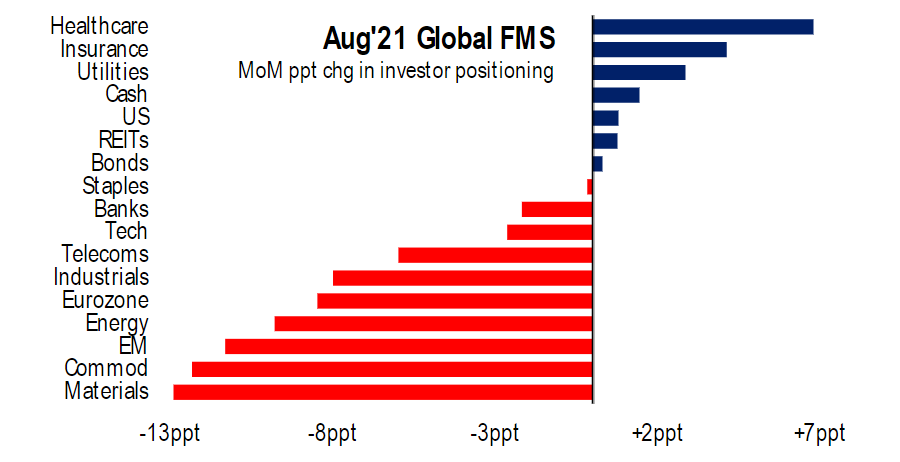

Month-on-month change in fund manager positioning

Source: BofA Global Fund Manager Survey

Relative to history, fund managers are overweight more cyclical assets such as banks, commodities, industrials and materials, while running underweights to areas of perceived safety like bonds and consumer staples.

However, as the chart above shows, asset allocators have turned to more defensive parts of the market in August, eying up areas that have a better chance of generating returns when growth is weaker.

“Investors have gotten slightly more defensive with an increase in healthcare, insurance, utilities and cash. They have also modestly trimmed their inflation exposure to materials, commodities, emerging markets and energy,” Bank of America said.

The Bank of America Global Fund Manager Survey polled 232 investors with combined assets under management of $702bn (£525bn) between 6 and 12 August.