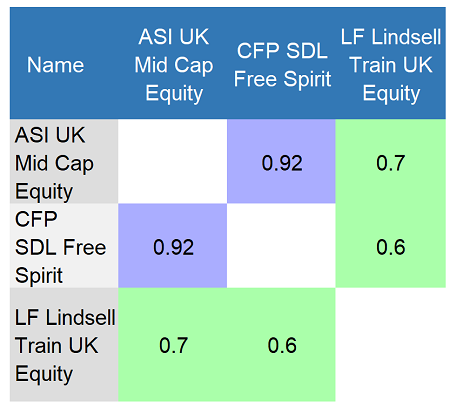

There are now just three funds in the IA UK All Companies sector with the maximum Crown Rating of five and a low correlation to at least one peer rated just as highly.

Correlation of top-rated funds

Source: FE Analytics

The last time Trustnet conducted this study, almost two years ago, it found there were nine funds in the sector with the maximum Crown Rating, an Alpha Manager at the helm and a correlation of 0.7 (where 1 = a perfect correlation and 0 = no correlation) or less with one of their highly rated peers.

However, the extreme volatility of 2020 has meant that even with a less stringent set of criteria – the requirement of an Alpha Manager has been removed – just three made the cut. Below are details of the three.

LF Lindsell Train UK Equity

LF Lindsell Train UK Equity is the only fund that has a correlation of 0.7 or less with more than one of its top-rated sector peers.

Its Alpha Manager Nick Train is famed for his long-term, buy-and-hold approach, investing in “truly exceptional businesses”, which he said are persistently undervalued by the market.

Square Mile Investment Consulting & Research said: “Such businesses tend to have high rates of return on capital and the reinvestment of profits into the business can compound into returns that can be impressive over the long term.

“Furthermore, these companies are likely to produce attractive levels of cash, with operations that do not continually require large amounts of funding.”

In the fund’s annual report to shareholders, Train apologised for its recent underperformance against the FTSE All Share – it made 11% in the year to 31 March, compared with 23% from the index. However, he pointed out that it held up much better in the preceding 12-month period, while his holdings have done much better than the market over the long term.

“It is an uncomfortable feeling when parts of the market we are not invested in are doing well,” he said, “or when longstanding and previously successful holdings are hit by profit-taking, or their shares simply tread water.

“All investors will experience periods like this and during them it is important to understand what is causing the underperformance and then to judge whether change is required.”

Despite this blip, LF Lindsell Train UK Equity’s long-term performance is exemplary. Data from FE Analytics shows it has made 258.1% over the 10 years to the start of September, compared with gains of 140.2% from its sector and 116% from the FTSE All Share. It has beaten the index in nine of the past 10 years.

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

The £6.5bn fund has ongoing charges of 0.65%.

CFP SDL Free Spirit

CFP SDL Free Spirit is an unconstrained, multi-cap version of manager Keith Ashworth-Lord’s better-known CFP SDL UK Buffettology fund.

Ashworth-Lord uses what he calls “Business Perspective Investing”, based on the strategy used by Berkshire Hathaway chairman Warren Buffett.

He previously told Trustnet: “When you are buying shares, you are not buying chips on a gaming table. Forget the noise of the stock market, forget what is going on with the economy, because it will all be a blip on a long-term chart. What you have really got to focus on is the businesses.”

Ashworth-Lord looks for what Buffett calls an economic moat – this means a company will have something special that stops competitors “putting their tanks on its lawn”, allowing it to consistently earn excess returns on the cost of capital, which will not be competed away.

“And the beautiful thing is that businesses that have this moat have certain tell-tale signs that we look for,” Ashworth-Lord said.

Among these tell-tale signs are strong balance sheets and cash flows, evidence of steady growth, and high margins that are stable or rising.

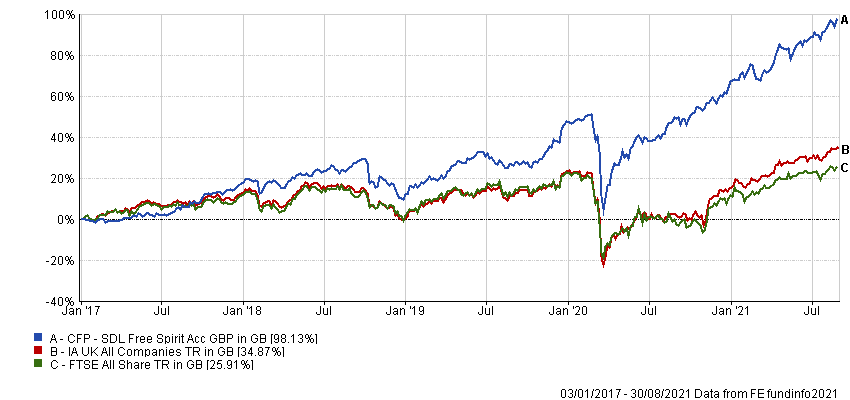

CFP SDL Free Spirit made 98.1% between launch in January 2017 and the start of September, compared with 35% from its sector and 25.9% from the FTSE All Share.

Performance of fund vs sector and index since launch

Source: FE Analytics

The £131m fund has ongoing charges of 1.16%.

ASI UK Mid Cap Equity

Last up is ASI UK Mid Cap Equity, managed by Abby Glennie, who buys medium-sized UK companies that can deliver fast growth over the long term. In particular, she aims to identify firms with sustainably growing business models, recurring revenues and high profitability, that are led by a strong management team.

To help her with this task, Glennie uses the “Matrix” screen developed by industry stalwart Harry Nimmo, with whom she has worked on the ASI UK Smaller Companies fund since 2003.

Until the merger between Standard Life and Aberdeen, ASI UK Mid Cap Equity had been focused on quality, undervalued companies. However, Glennie has added more sustainable growth companies, and is not afraid to pay a premium for them.

The team at FE Investments said: “The changes in the portfolio process, finalised in 2019, result in a low-risk approach mainly invested for the long term in high-quality companies which can operate through the cycle.

“We like this long-term process and believe the changes are here to stay and have improved the return profile of the fund. The team also utilises the independent environmental, social and governance (ESG) team for stock and sector assessments and works jointly with them when they engage with companies on improving ESG.”

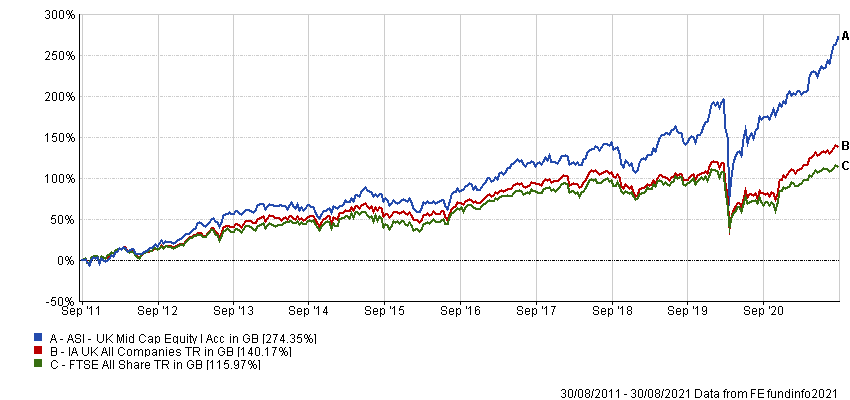

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

ASI UK Mid Cap Equity has made 274.4% over the decade to the start of September, the 11th best performance in the 198-strong IA UK All Companies sector. The £255m fund has ongoing charges of 0.85%.