The dominance of tech over the past decade or so has meant it has become synonymous with growth investing, with the mega caps in the US and China offering a short-cut to outperformance over this time.

Yet there is one key determinant of excess returns in which it has lagged behind other sectors – earnings acceleration.

This is according to the Revisiting Earnings Acceleration as a Source of Diversifying Excess Returns report, authored by American Century Investments.

Richard Adams, senior investment director at American Century, noted there has been little academic work on this subject, and the papers that have been published have focused on the US market. The American Century report expanded this globally, measuring earnings acceleration as the difference in the compound annual growth rate of reported EPS (earnings per share) figures between the previous two years and the next three.

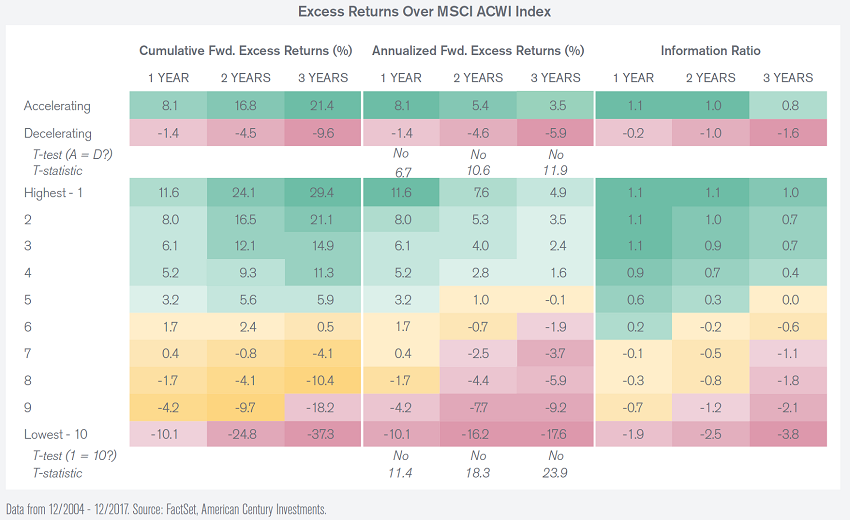

It found a strong correlation between earnings acceleration and outperformance, with the faster the acceleration, the higher the returns.

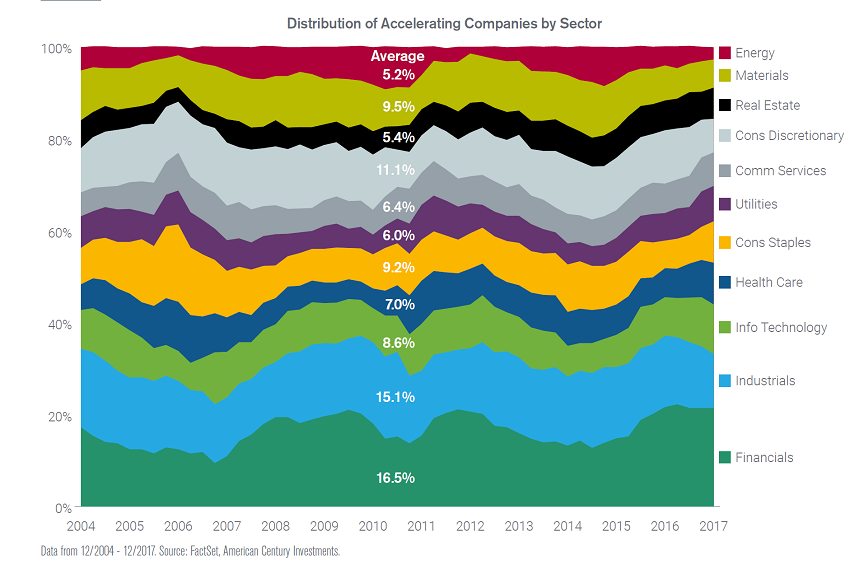

This may sound obvious, but what was surprising was the relatively small role played by tech. Over the timeframe of the study, going back to 2004, it accounted for just 8.6% of the companies that accelerated earnings, a figure that remained relatively stable over this time. This put it behind financials at 16.5% and industrials at 15.1%.

Yet Adams said this was not as surprising as it sounded.

“If you think about a business like Microsoft, a couple of years ago it was growing its cloud business at 100%,” he said.

“At that point, it would be very difficult for that business to fit into the acceleration portfolio. This is why we don't see a lot of mega cap tech in there.

“[For example,] Apple is a company we haven’t owned for almost a decade. It is no criticism of these companies at all, but they've already attained very high growth rates, and the prospect of accelerating from there is really quite limited.”

Adams noted earnings acceleration is a source of outperformance that is often overlooked by investors, even those that use a growth strategy. He said that this is partly because it seems so obvious, it is usually assumed to be a key component of growth investing – but this is not the case.

“The real focus for most traditional growth investors is on the level of growth,” he explained. “What we find is that very few investors focus on earnings acceleration as the starting point of the research process. It's normally just a characteristic that's nice to see.

“We think it's a little bit like the word ‘quality’. It's been somewhat debased, so it doesn’t explicitly mean quality, because it gets too widely used. The same is true for earnings acceleration.”

Remaining on the subject of quality growth, Adams said its dominance of growth investing in the UK is one reason why earnings acceleration is particularly underappreciated in the domestic market.

Quality growth managers focus on metrics such as return on invested capital and cash flows, and search for economic moats that allow businesses to sustain their competitive advantages. Yet Adams said that these tend to only be visible in companies that are already well established.

“We're not going to exclude those quality names,” he continued, “but the difference here is we're looking for companies that have their acceleration ahead of them.”

Adams accepted that as powerful as it is, you can’t rely on earnings acceleration alone when picking stocks – he said it is also necessary to incorporate real-word considerations into the process.

As a result, the management team behind the American Century Concentrated Global Growth Equity fund also looked at the sustainability of the earnings acceleration, the difference between the estimate of a company’s earnings and the market’s, and valuation.

An example of a stock that ticked all the boxes is ServiceNow, which provides back-office services for businesses, such as cloud computing, IT support and “the infrastructure that a lot of the largest companies in the world are operating on”.

“We actually use it here at American Century,” Adams said. “That's a business that's really seeing very high penetration across the largest businesses and is cross-selling a lot of its services.

“As we're moving more towards a hybrid and virtual working environment, there is more demand for those sorts of platforms that facilitate connectivity across the IT infrastructure.”

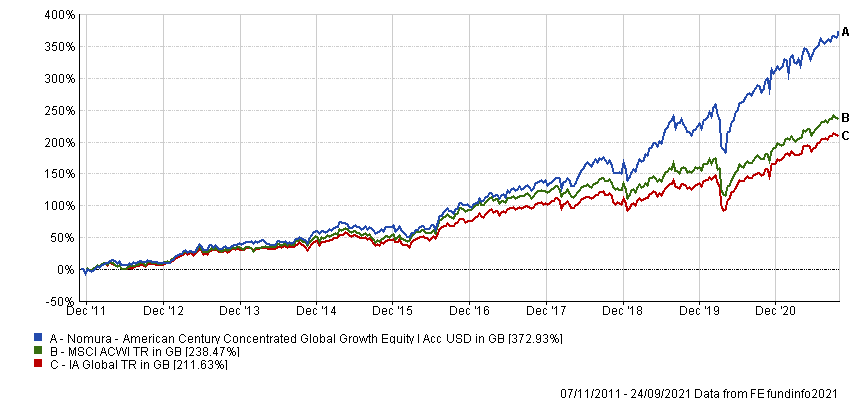

Data from FE Analytics shows American Century Concentrated Global Growth Equity has made 372.9% since launch in November 2011, compared with 238.5% from the MSCI AC World index and 211.6% from the IA Global sector.

Performance of fund since launch vs sector and index

Source: FE Analytics

The $192m fund has ongoing charges of 0.87%.